SC DoR PT-401O 2018 free printable template

Show details

1350

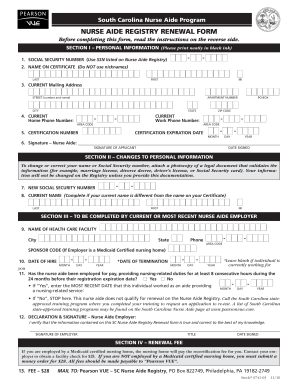

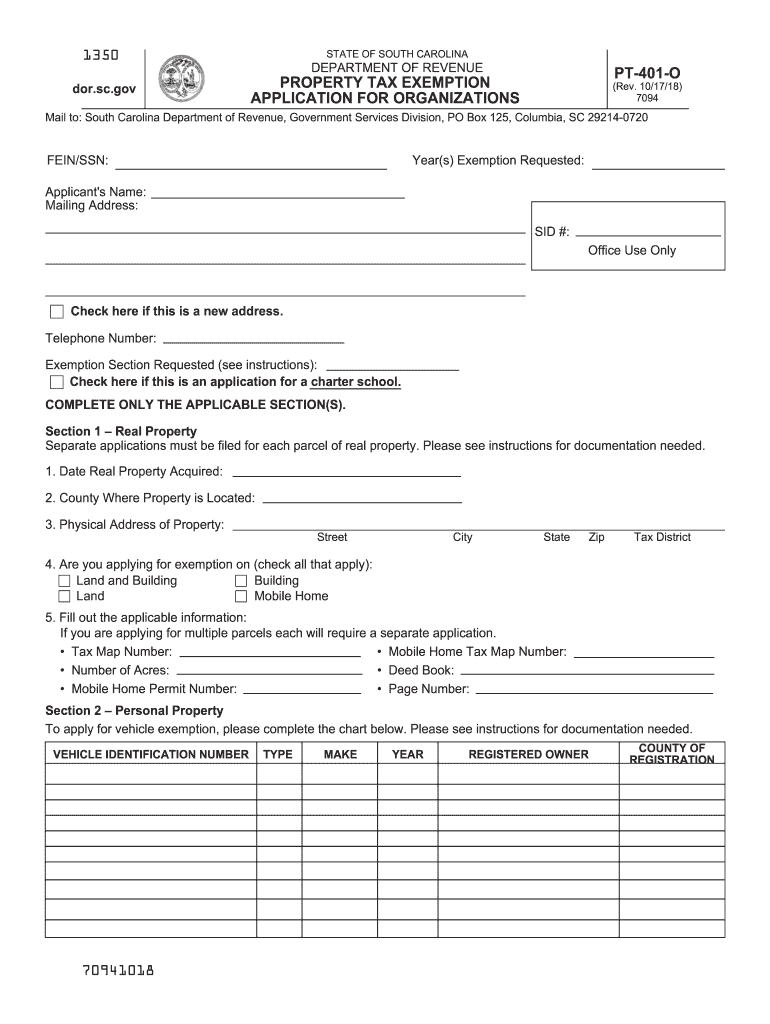

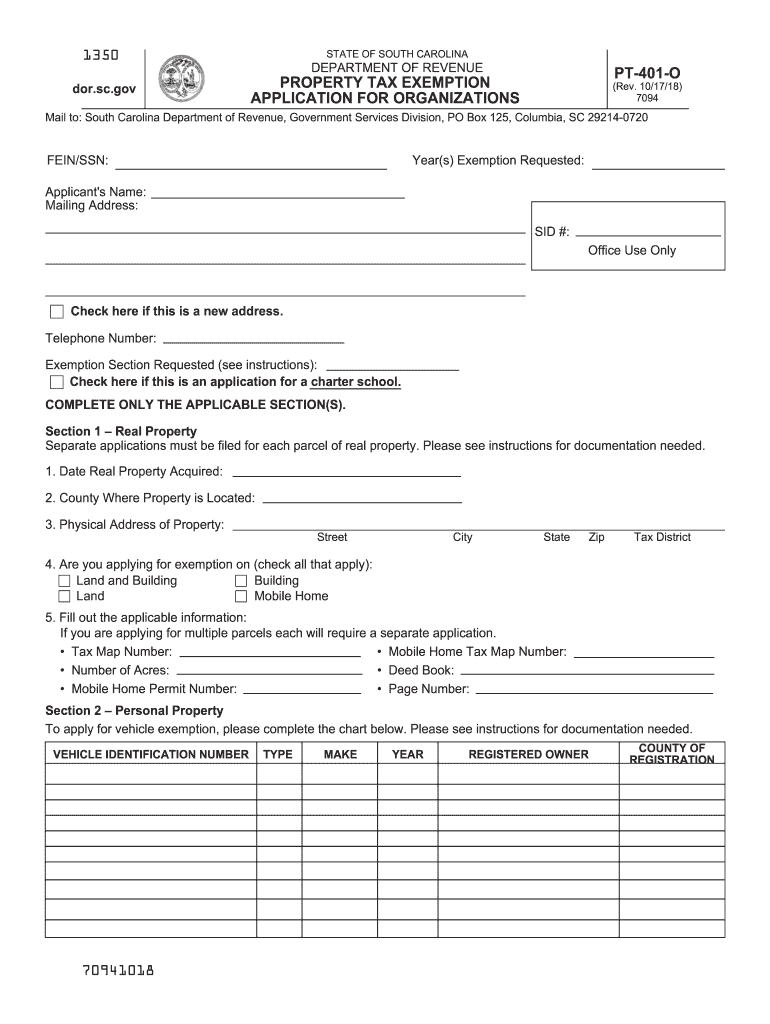

for.SC.gestate OF SOUTH CAROLINADEPARTMENT OF REVENUEPT401OPROPERTY TAX EXEMPTION

APPLICATION FOR ORGANIZATIONS(Rev. 10/17/18)

7094Mail to: South Carolina Department of Revenue, Government Services

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SC DoR PT-401O

Edit your SC DoR PT-401O form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SC DoR PT-401O form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing SC DoR PT-401O online

Follow the steps below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit SC DoR PT-401O. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC DoR PT-401O Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SC DoR PT-401O

How to fill out SC DoR PT-401O

01

Obtain the SC DoR PT-401O form from the official website or the local Department of Revenue office.

02

Fill in your name, address, and contact information in the designated sections.

03

Provide your Social Security Number or Employee Identification Number as required.

04

Complete the income section, detailing all sources of income for the reporting period.

05

Include any deductions or credits you are eligible for in the respective sections.

06

Review the form to ensure all information is accurate and complete.

07

Sign and date the form before submission.

08

Submit the form either electronically or by mailing it to the address specified in the instructions.

Who needs SC DoR PT-401O?

01

Individuals who are required to report certain financial information to the South Carolina Department of Revenue.

02

Self-employed individuals who need to report their income and expenses.

03

Taxpayers who are eligible for specific deductions and credits offered by the state.

04

Anyone who needs to rectify or amend their previously filed tax information.

Fill

form

: Try Risk Free

People Also Ask about

How many acres is agricultural exemption in SC?

The tract is owned in combination with non-timberland tracts that qualify as agricultural real property. Non-timberland (cropland) tracts must be at least 10 acres.

How do I get a 4% property tax in South Carolina?

To qualify for the special 4% property tax assessment ratio, the owner of the property must have actually owned and occupied the residence as his legal residence and been occupying that address for some period during the applicable tax year. Only an owner-occupant is eligible to apply for the 4% special assessment.

What is SC1040 form?

If you file as a full-year resident, file the SC1040. Report all your income as though you were a resident for the entire year. You will be allowed a credit for taxes paid on income taxed by South Carolina and another state. Complete the SC1040TC and attach a copy of the other state's Income Tax return.

What is considered agricultural land in South Carolina?

Agricultural Real Property shall mean any tract of real property which is used to raise, harvest or store crops, feed, breed or manage livestock, or to produce plants, trees, fowl or animals useful to man, including the preparation of the products raised thereon for man's use and disposed of by marketing or other means

What qualifies for agricultural exemption in South Carolina?

Farm machinery and their replacement parts and attachments, used in planting, cultivating or harvesting farm crops, including bulk coolers (farm dairy tanks) used in the production and preservation of milk on dairy farms, and machines used in the production of poultry and poultry products on poultry farms, when such

Who files SC1040?

South Carolina residents should file an SC1040. A part-year resident or nonresident of South Carolina should file an SC1040 with a completed Schedule NR (Nonresident Schedule) attached. You can file your South Carolina tax return using one of the following methods: Electronic filing using a professional tax preparer.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send SC DoR PT-401O for eSignature?

When your SC DoR PT-401O is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I fill out the SC DoR PT-401O form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign SC DoR PT-401O and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I complete SC DoR PT-401O on an Android device?

Complete your SC DoR PT-401O and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is SC DoR PT-401O?

SC DoR PT-401O is a tax form used by certain businesses in South Carolina to report their income and calculate the tax owed to the state.

Who is required to file SC DoR PT-401O?

Entities operating in South Carolina that meet specific income thresholds or are engaged in certain business activities are required to file SC DoR PT-401O.

How to fill out SC DoR PT-401O?

To fill out SC DoR PT-401O, businesses should gather their financial information, complete the form according to the provided instructions, and ensure all calculations are accurate before submission.

What is the purpose of SC DoR PT-401O?

The purpose of SC DoR PT-401O is to establish the tax liability of businesses in South Carolina and ensure compliance with state tax laws.

What information must be reported on SC DoR PT-401O?

The form requires businesses to report their gross income, deductions, and any credits applicable to calculate their taxable income and the corresponding tax owed.

Fill out your SC DoR PT-401O online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC DoR PT-401o is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.