SC DoR PT-401O 2022-2026 free printable template

Show details

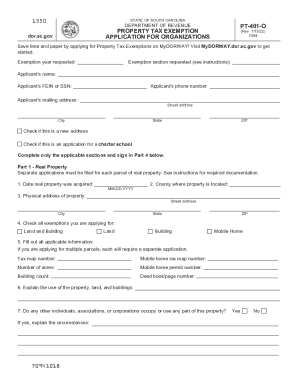

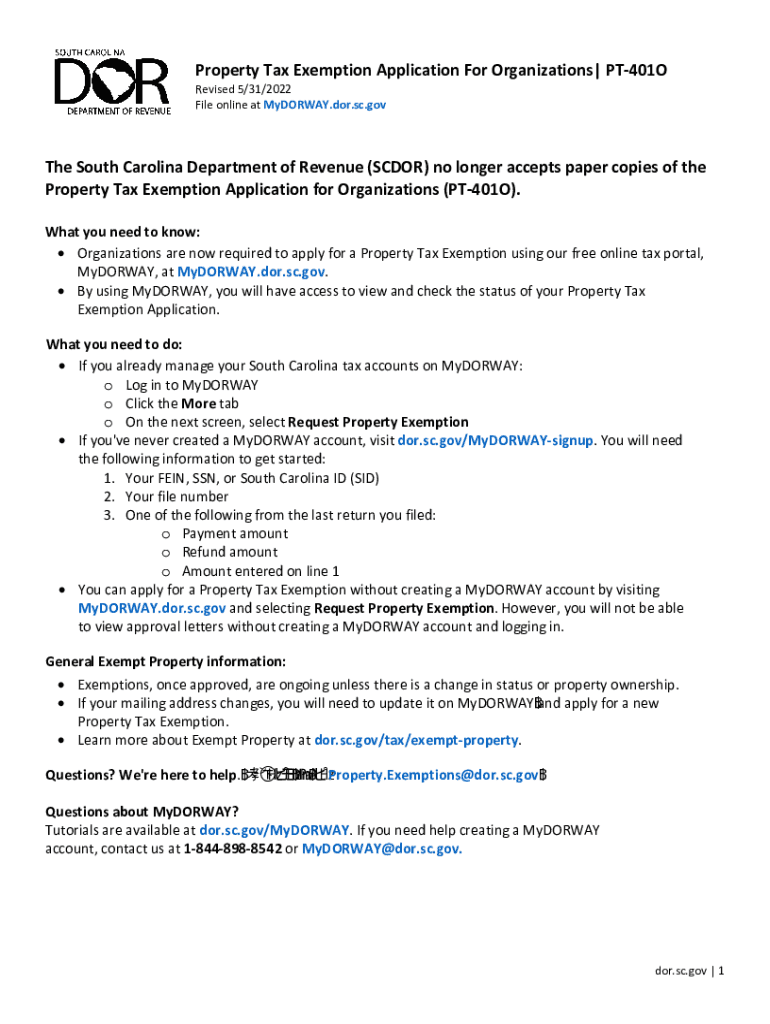

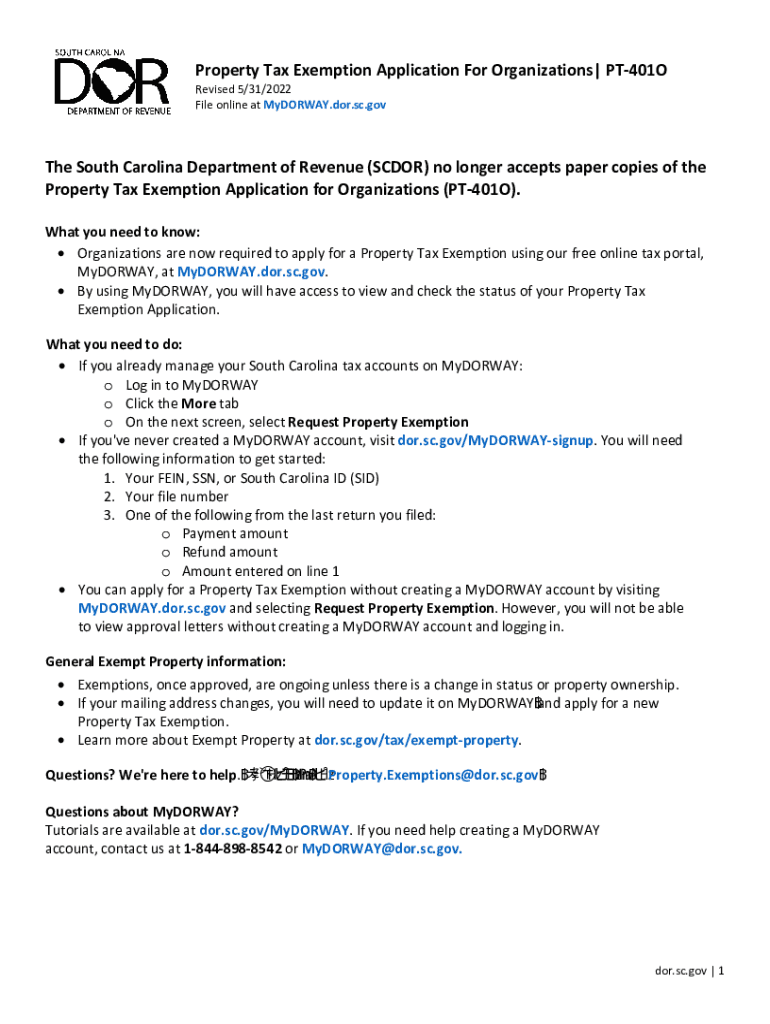

Property Tax Exemption Application For Organizations| PT401ORevised 5/31/2022

File online at MyDORWAY.dor.sc.govThe South Carolina Department of Revenue (SCDOR) no longer accepts paper copies of the

Property

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 706392621 form

Edit your SC DoR PT-401O form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SC DoR PT-401O form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing SC DoR PT-401O online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit SC DoR PT-401O. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC DoR PT-401O Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SC DoR PT-401O

How to fill out SC DoR PT-401O

01

Obtain a copy of the SC DoR PT-401O form from the official website or office.

02

Carefully read the instructions provided with the form to understand the requirements.

03

Fill out personal identification information at the top of the form, including your name, address, and contact details.

04

Enter the relevant tax year for which you are filing.

05

Provide detailed information on income, deductions, and any credits you are claiming.

06

Ensure all entries are accurate and that required documents are attached where indicated.

07

Review the form for completeness and accuracy before signing.

08

Submit the completed form to the appropriate tax office by the specified deadline.

Who needs SC DoR PT-401O?

01

Individuals or businesses required to report certain financial information to the South Carolina Department of Revenue.

02

Taxpayers who are claiming specific deductions or credits that necessitate the use of SC DoR PT-401O.

03

Anyone who has income or transactions during the tax year that falls under the reporting requirements outlined by the form.

Fill

form

: Try Risk Free

People Also Ask about

How do I apply for 4% property taxes in SC?

To qualify for the special 4% property tax assessment ratio, the owner of the property must have actually owned and occupied the residence as his legal residence and been occupying that address for some period during the applicable tax year.

What month are property taxes due in South Carolina?

Real Estate Taxes Payment is due in full on or before January 15th of the following year. Other tax notices mailed in October in addition to real property tax notices include: mobile homes, watercraft, outboard motors, documented vessels, aircraft, furniture-fixture-appliance-equipment (FFAE), S.C.

Who qualifies for property tax exemption in SC?

The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally and permanently disabled, or legally blind.

Do senior citizens pay school taxes in South Carolina?

This tax exemption is available to South Carolina property owners over the age of 65. So, with the Homestead Tax Exemption, the first $50,000 of your home is exempt from the municipal, county, school, and real property taxes. To receive this exemption, you must apply at your county auditor's office.

Are property taxes deductible in South Carolina?

These state and local property taxes are not itemized deductions allowed on the individual's Federal Form 1040, Schedule A, but may be deducted on the individuals' Federal Form 1040, Schedules C, E or F, as appropriate.

How long can property taxes go unpaid in South Carolina?

Following a tax sale in South Carolina, you get twelve months to redeem the property by paying off the delinquent amounts. Redeeming the home will prevent the purchaser from taking title to your property.

How are property taxes paid in SC?

Tax bills are typically mailed to the homeowner in October and must be paid by January 15.

At what age do senior citizens stop paying property taxes in SC?

What is the Homestead Exemption benefit? The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally and permanently disabled, or legally blind.

How often are property taxes due in South Carolina?

Payment is due in full on or before January 15th of the following year. Other tax notices mailed in October in addition to real property tax notices include: mobile homes, watercraft, outboard motors, documented vessels, aircraft, furniture-fixture-appliance-equipment (FFAE), S.C.

What are the tax breaks for seniors in SC?

2021 Senior Citizen Standard Income Tax Deduction For those 65 years of age or legally blind, the standard deduction was increased in 2021 to $1,700 for Single filers or Head of Household, and $1,350 (per person) for married filing jointly, married filing separately, and Surviving Spouses.

Are property taxes paid in advance SC?

Taxes are paid in arrears and the property will remain as it was on December 31 for the following tax year. For instance if you purchase a portion of a parcel in January, that tax bill will be mailed to the owner of record as of the previous December 31st.

How do I apply for the Homestead Act in South Carolina?

You must apply for the Homestead Exemption at your County Auditor's office. If you are unable to go to the Auditor's office, you may authorize someone to apply for you. Contact the County Auditor's Office for details.

At what age do you stop paying property taxes in South Carolina?

What is the Homestead Exemption benefit? The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally and permanently disabled, or legally blind.

Do senior citizens pay taxes in South Carolina?

South Carolina taxpayers ages 65 and older do not need to file a state income tax return. In addition, Social Security benefits are not taxed by the state of South Carolina. Overall, Kiplinger rates South Carolina as a tax-friendly state for retirees.

How long do you have to pay property taxes in SC?

Taxes for the current year must be paid by January 15 of the following year. Payments made after January 15 will incur a 3% penalty. Payments made after February 1 will incur a 10% penalty.

At what age do seniors stop paying property taxes in South Carolina?

What is the Homestead Exemption benefit? The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally and permanently disabled, or legally blind.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send SC DoR PT-401O for eSignature?

Once you are ready to share your SC DoR PT-401O, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I create an electronic signature for the SC DoR PT-401O in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your SC DoR PT-401O in seconds.

How do I edit SC DoR PT-401O straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing SC DoR PT-401O, you need to install and log in to the app.

What is SC DoR PT-401O?

SC DoR PT-401O is a tax form used in South Carolina for reporting income and determining tax liabilities related to specific activities or types of income.

Who is required to file SC DoR PT-401O?

Individuals and entities engaged in certain activities or receiving specific types of income in South Carolina may be required to file SC DoR PT-401O.

How to fill out SC DoR PT-401O?

To fill out SC DoR PT-401O, gather all relevant financial information, follow the instructions provided with the form, and accurately report all required income and deductions before submitting it to the South Carolina Department of Revenue.

What is the purpose of SC DoR PT-401O?

The purpose of SC DoR PT-401O is to provide the South Carolina Department of Revenue with the necessary information to assess and collect the appropriate tax owed based on reported income.

What information must be reported on SC DoR PT-401O?

On SC DoR PT-401O, taxpayers must report details including income amounts, deductions, credits, and any other relevant financial data that pertains to their tax obligations.

Fill out your SC DoR PT-401O online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC DoR PT-401o is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.