TN DoR FAE 173 2017 free printable template

Show details

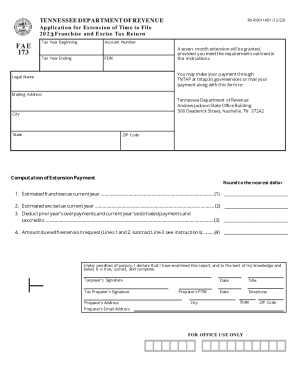

TENNESSEE DEPARTMENT OF REVENUE RV-R0011401 12/17 Application for Extension of Time to File Franchise and Excise Tax Return FAE Account Number Tax Year Beginning Tax Year Ending A six- month extension will be granted provided you meet the requirements outlined in the instructions. FEIN Quarterly estimated tax payments made for the year available tax credits and overpayments from prior years should be deducted when computing the payment due. Legal Name Mailing Address You may file your...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign tennessee franchise excise

Edit your tennessee franchise excise form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tennessee franchise excise form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tennessee franchise excise online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tennessee franchise excise. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TN DoR FAE 173 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out tennessee franchise excise

How to fill out tennessee franchise excise

01

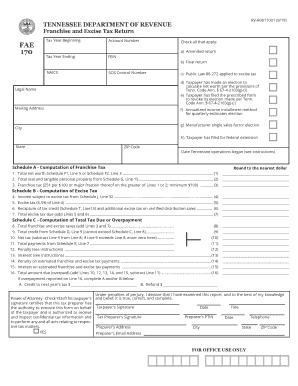

To fill out the Tennessee franchise excise tax, follow these steps:

02

Gather all necessary documents, such as financial statements, federal tax returns, and business registration information.

03

Determine the applicable tax rate based on your business classification and income bracket.

04

Complete the relevant sections of the Form FAE 170, including providing accurate financial information, business activities, and apportionment factors.

05

Attach any required schedules or additional documentation, such as supporting worksheets or tax computations.

06

Review the completed form for any errors or omissions.

07

Sign and date the form.

08

Submit the completed form and any applicable payment to the Tennessee Department of Revenue by the deadline.

09

Keep a copy of the filled-out form and all supporting documents for your records.

Who needs tennessee franchise excise?

01

Any business entity or individual engaged in certain activities within the state of Tennessee may be required to pay the franchise excise tax.

02

This includes corporations, limited liability companies (LLCs), partnerships, and individuals operating as sole proprietors.

03

The tax may apply to both in-state and out-of-state businesses that meet the specified criteria.

04

It is recommended to consult with a tax professional or refer to the Tennessee Department of Revenue guidelines to determine if your business or individual circumstances require the payment of franchise excise tax.

Instructions and Help about tennessee franchise excise

Fill

form

: Try Risk Free

People Also Ask about

How is excise tax revenue calculated?

The amount of revenue collected by the government can then be calculated by multiplying the excise tax itself (t) by the quantity of goods that will be produced at this equilibrium (Q).

Who is exempt from franchise and excise tax in Tennessee?

There are some exemptions to filing franchise and excise tax. For example, certain limited liability companies, limited partnerships and limited liability partnerships whose activities are at least 66% farming or holding personal residences where one or more of its partners or members reside are exempt.

Do I need to pay franchise tax in Tennessee?

The minimum franchise tax of $100 is payable if you are incorporated, domesticated, qualified, or otherwise registered through the Secretary of State to do business in Tennessee, regardless of whether the company is active or inactive.

Does Tennessee have a franchise tax?

Franchise tax – 0.25% of the greater of net worth or real and tangible property in Tennessee. The minimum tax is $100.

Who is exempt from TN business tax?

Certain entities under specific circumstances are exempt from paying the business tax. These may include, but are not limited to, people acting as employees, manufacturers, religious and charitable entities selling donated items, direct-to-home satellite providers, and movie theaters.

How is franchise excise tax calculated in Tennessee?

The franchise tax is based on the greater of the entity's net worth or the book value of certain fixed assets, plus an imputed value of rented property. The excise tax is 6.5% of the net taxable income.

How much is excise tax in Tennessee?

Franchise tax is figured at . 25% of the net worth of corporation or the tangible property. The excise tax is 6.5% of the net taxable income made in TN.

How much is franchise tax in TN?

Franchise tax – 0.25% of the greater of net worth or real and tangible property in Tennessee.

Who is subject to TN franchise and excise tax?

If you are a corporation, limited partnership, limited liability company, or business trust chartered, qualified, or registered in Tennessee or doing business in this state, then you must register for and pay franchise and excise taxes.

Do sole proprietors pay franchise and excise tax in Tennessee?

Sole Proprietorships Sole proprietorships are not subject to franchise and excise tax because they do not provide their owners limited liability protection. Sole proprietorships report their business activity on federal Form 1040, Schedules C, E, or F.

Does a single member LLC pay franchise and excise tax in Tennessee?

A SMLLC will not be disregarded if its single member is not classified as a corporation for federal tax purposes. In such cases, the SMLLC will be treated as a separate entity for franchise and excise tax purposes, and it must file its own separate franchise and excise tax return.

Who is exempt from TN franchise tax?

There are numerous exemptions for F&E purposes that allow an LLC to not be taxable. The most common exemptions are: Family-owned non-corporate entity (“FONCE”) Farming or the holding of a personal residence.

How do you avoid franchise and excise tax in Tennessee?

Seventeen different types of entities are exempt from the franchise and excise taxes. Industrial Development Corporations. Masonic lodges and similar lodges. Regulated Investment Companies owning 75% in United States, Tennessee, or local bonds. Federal and state credit unions. Venture Capital Funds.

Does an LLC pay franchise tax in Tennessee?

Overview. If you are a corporation, limited partnership, limited liability company, or business trust chartered, qualified, or registered in Tennessee or doing business in this state, then you must register for and pay franchise and excise taxes.

What is franchise excise tax in TN?

Franchise tax – 0.25% of the greater of net worth or real and tangible property in Tennessee. The minimum tax is $100. Excise tax – 6.5% of Tennessee taxable income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the tennessee franchise excise electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your tennessee franchise excise in seconds.

How do I edit tennessee franchise excise straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing tennessee franchise excise.

How do I edit tennessee franchise excise on an iOS device?

Create, edit, and share tennessee franchise excise from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is TN DoR FAE 173?

TN DoR FAE 173 is a tax form used in Tennessee for reporting franchise and excise taxes.

Who is required to file TN DoR FAE 173?

Entities engaged in business in Tennessee, including corporations and limited liability companies, are required to file TN DoR FAE 173 if their gross receipts or taxable income exceed certain thresholds.

How to fill out TN DoR FAE 173?

To fill out TN DoR FAE 173, taxpayers must provide information about their business structure, calculate their taxable revenues, and report any applicable deductions and credits based on the instructions provided with the form.

What is the purpose of TN DoR FAE 173?

The purpose of TN DoR FAE 173 is to assess and collect the franchise and excise taxes from various business entities operating in Tennessee.

What information must be reported on TN DoR FAE 173?

Information that must be reported on TN DoR FAE 173 includes the entity's gross receipts, adjusted gross income, apportionment factors, and any applicable deductions.

Fill out your tennessee franchise excise online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tennessee Franchise Excise is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.