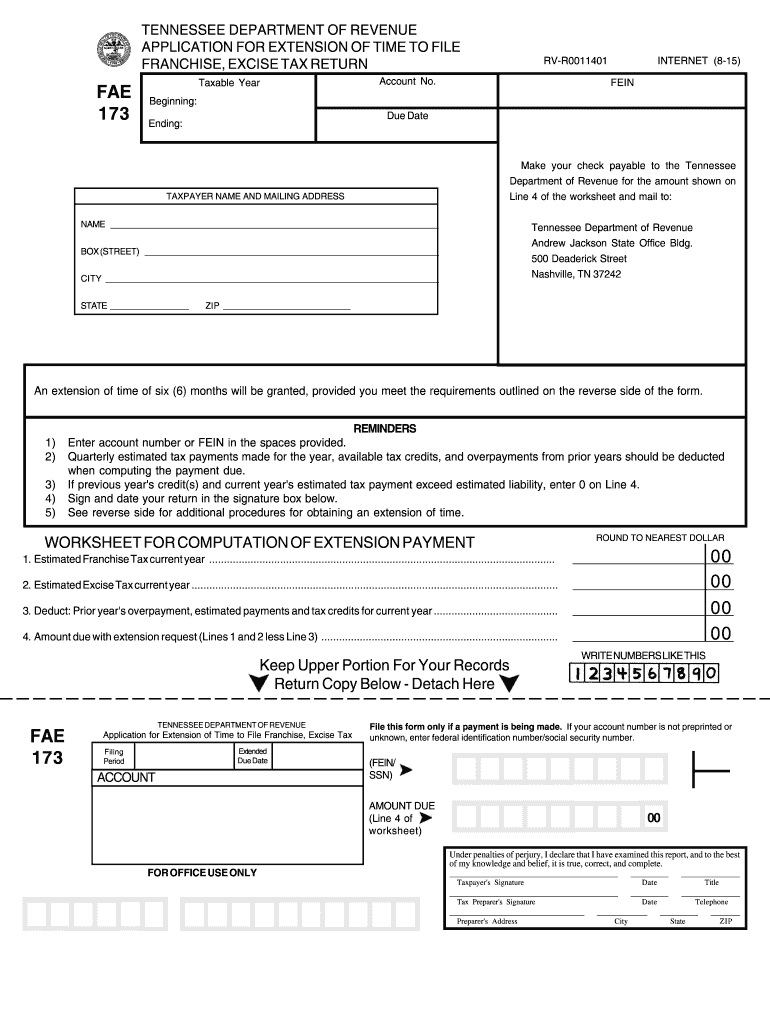

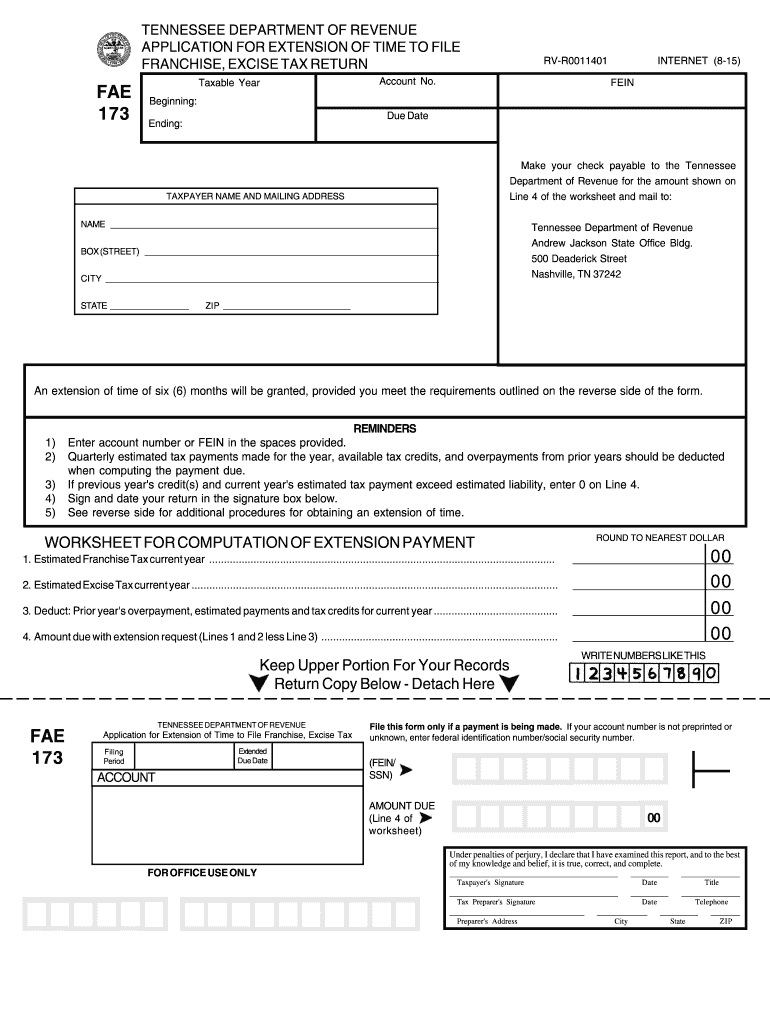

TN DoR FAE 173 2015 free printable template

Show details

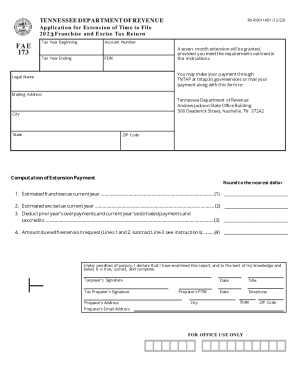

TENNESSEE DEPARTMENT OF REVENUE APPLICATION FOR EXTENSION OF TIME TO FILE FRANCHISE EXCISE TAX RETURN FAE Taxable Year RV-R0011401 Account No. INTERNET 8-15 FEIN Beginning Due Date Ending Make your check payable to the Tennessee Department of Revenue for the amount shown on Line 4 of the worksheet and mail to TAXPAYER NAME AND MAILING ADDRESS NAME Tennessee Department of Revenue Andrew Jackson State Office Bldg. 500 Deaderick Street Nashville TN 37242 BOX STREET CITY STATE ZIP An extension of...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TN DoR FAE 173

Edit your TN DoR FAE 173 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TN DoR FAE 173 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TN DoR FAE 173 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit TN DoR FAE 173. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TN DoR FAE 173 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TN DoR FAE 173

How to fill out TN DoR FAE 173

01

Obtain the TN DoR FAE 173 form from the Tennessee Department of Revenue website or local office.

02

Read the instructions provided with the form carefully to understand the requirements.

03

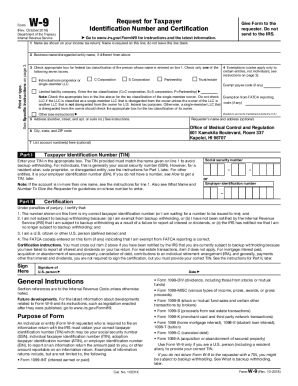

Fill out your personal information in the designated sections, including your name, address, and contact information.

04

Provide the relevant financial information required, including income sources and deductions.

05

Review any additional sections that may require specific data based on your situation, such as business details if applicable.

06

Double-check all entries for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the completed form to the address specified in the instructions or through the designated online portal.

Who needs TN DoR FAE 173?

01

Individuals or businesses in Tennessee who need to report financial or tax information to the Department of Revenue.

02

Taxpayers seeking to claim specific exemptions or deductions that require reporting through this form.

03

Those undergoing audits or verifications by the Tennessee Department of Revenue.

Fill

form

: Try Risk Free

People Also Ask about

Who is required to file a TN franchise tax return?

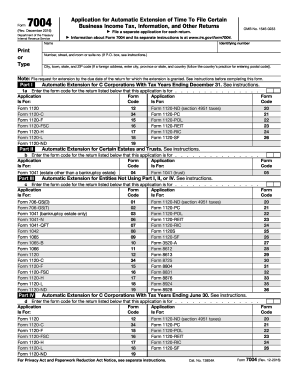

Overview. If you are a corporation, limited partnership, limited liability company, or business trust chartered, qualified, or registered in Tennessee or doing business in this state, then you must register for and pay franchise and excise taxes.

Who must file Tennessee FAE 170?

Overview. If you are a corporation, limited partnership, limited liability company, or business trust chartered, qualified, or registered in Tennessee or doing business in this state, then you must register for and pay franchise and excise taxes.

How is Tennessee excise tax calculated?

Franchise tax is figured at . 25% of the net worth of corporation or the tangible property. The excise tax is 6.5% of the net taxable income made in TN.

How do I file tn franchise and excise tax?

Registration of Franchise Tax & Excise Taxes is available on the Tennessee Taxpayer Access Point (TNTAP). To apply, please go to the Tennessee Taxpayer Access Point (TNTAP) and select Register a New Business.

Does a single member LLC pay franchise and excise tax in Tennessee?

A single-member LLC is a disregarded entity for federal tax purposes. Therefore, if the single-member is an individual, the business income is reported on the member's personal tax return on Schedule C of Form 1040. A single-member LLC is subject to Tennessee franchise and excise taxes.

What is the due date for Form FAE 170?

F&E-5 - Due Date for Filing Form FAE170 and Online Filing Requirement. The franchise and excise tax return is due on the 15th day of the fourth month following the closing of the taxpayer's books and records. For example, a calendar year taxpayer's return is due on April 15.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my TN DoR FAE 173 in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign TN DoR FAE 173 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I fill out TN DoR FAE 173 using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign TN DoR FAE 173 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Can I edit TN DoR FAE 173 on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign TN DoR FAE 173. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is TN DoR FAE 173?

TN DoR FAE 173 is a form used in Tennessee for reporting the income and franchise tax liability for certain entities.

Who is required to file TN DoR FAE 173?

Entities that are subject to Tennessee's franchise and excise taxes are required to file TN DoR FAE 173.

How to fill out TN DoR FAE 173?

To fill out TN DoR FAE 173, you need to provide information including the entity's name, type of business, revenue details, and any applicable tax credits.

What is the purpose of TN DoR FAE 173?

The purpose of TN DoR FAE 173 is to comply with state tax requirements by reporting income, calculating tax liabilities, and ensuring the correct amount is paid.

What information must be reported on TN DoR FAE 173?

The information that must be reported includes the entity's gross receipts, deductions, credits, and the calculated tax due for the period.

Fill out your TN DoR FAE 173 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TN DoR FAE 173 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.