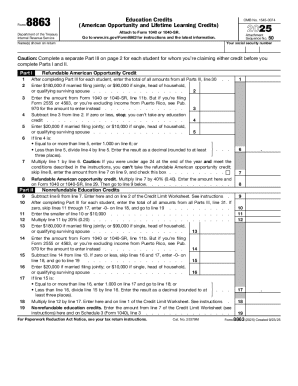

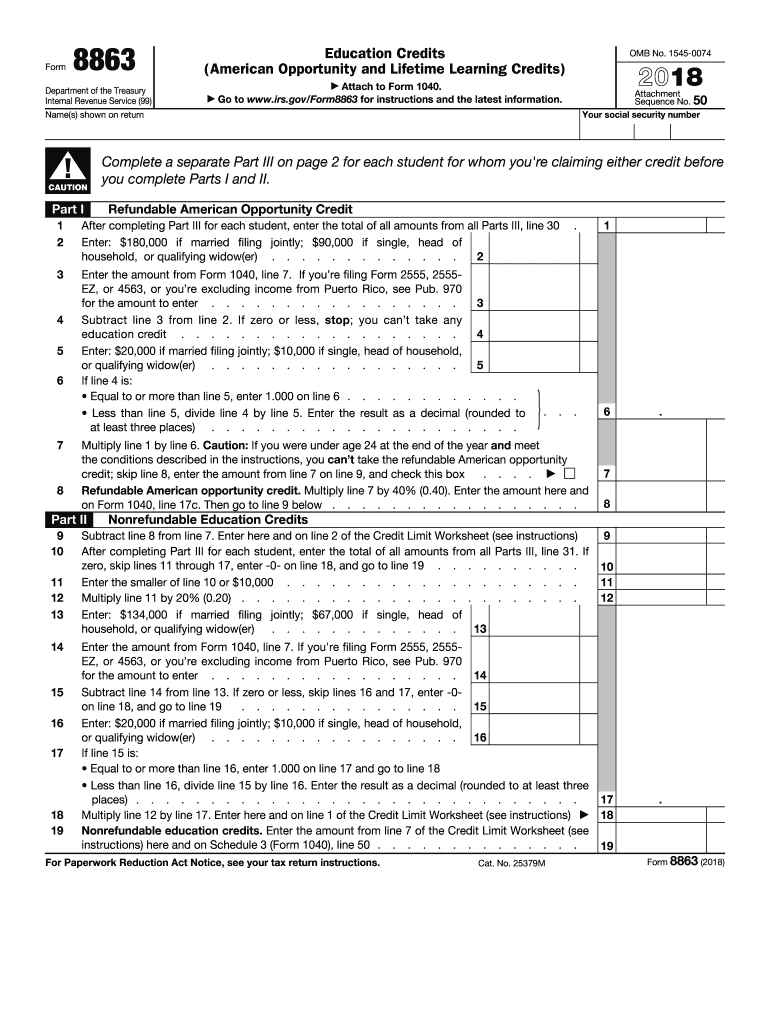

IRS 8863 2018 free printable template

Instructions and Help about IRS 8863

How to edit IRS 8863

How to fill out IRS 8863

About IRS 8 previous version

What is IRS 8863?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

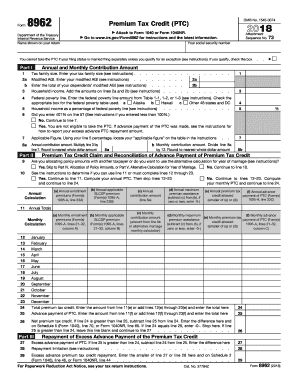

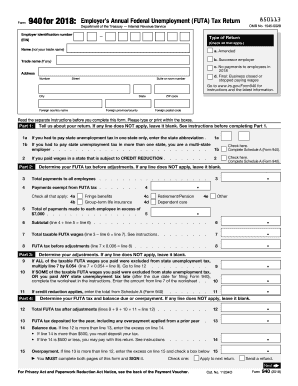

Is the form accompanied by other forms?

FAQ about IRS 8863

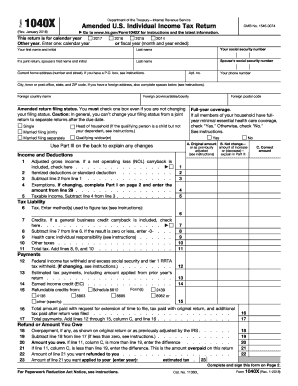

What should I do if I need to correct mistakes on my IRS 8863 after filing?

If you realize that you've made errors on your submitted IRS 8863, you should file an amended return using Form 1040-X. Make sure to include the correct IRS 8863 with the amended filing. This not only corrects the mistakes but also helps ensure your tax records are accurate.

How can I verify the status of my submitted IRS 8863?

To track the status of your IRS 8863, you can visit the IRS 'Where's My Refund?' tool online. This resource provides updates on the processing of your return, including whether your IRS 8863 has been received and is being processed.

What are some common errors to avoid when filing the IRS 8863?

When filing the IRS 8863, common mistakes include incorrect Social Security numbers, failing to report education expenses accurately, and not meeting eligibility requirements. Carefully review your submission before filing to ensure all information is correct and complete.

What are the privacy and data security measures for filing IRS 8863 electronically?

When filing your IRS 8863 electronically, ensure you use a reputable e-filing service that complies with federal privacy standards. Your personal data should be encrypted during transmission, and it's advisable to maintain a digital backup of your submitted forms for record-keeping.

See what our users say