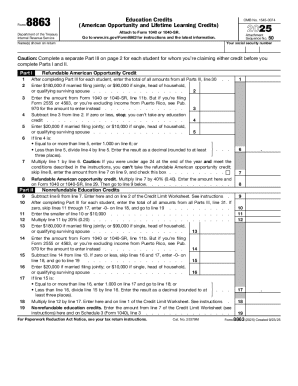

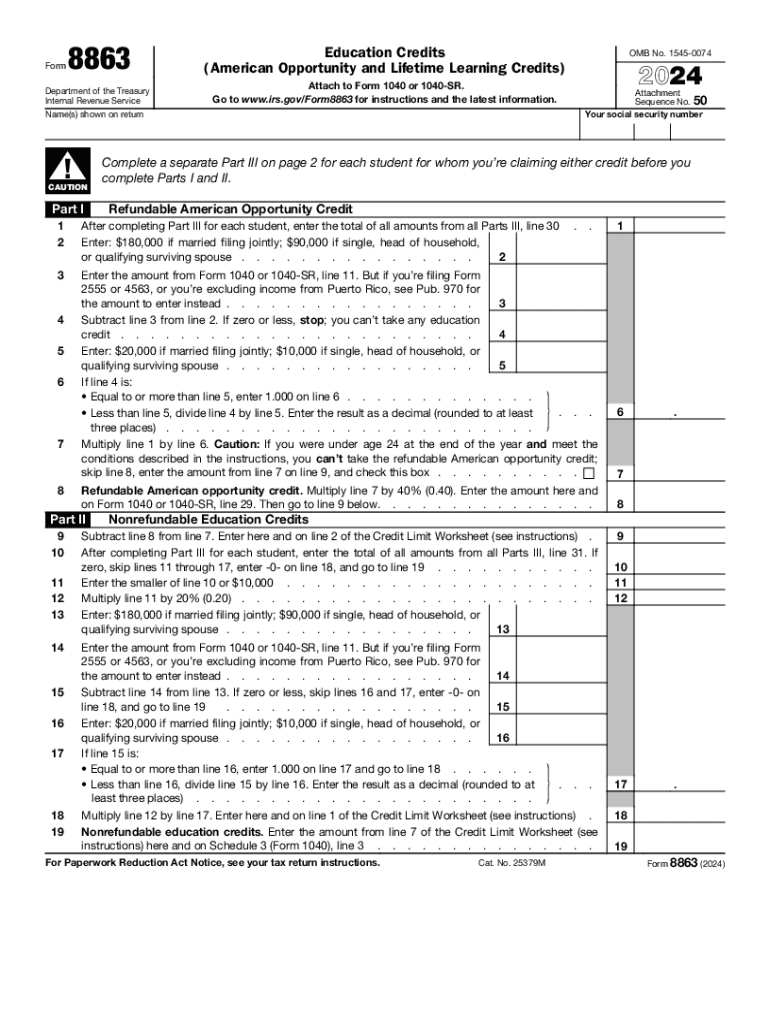

IRS 8863 2024 free printable template

Instructions and Help about IRS 8863

How to edit IRS 8863

How to fill out IRS 8863

Latest updates to IRS 8863

About IRS 8 previous version

What is IRS 8863?

When am I exempt from filling out this form?

Components of the form

What information do you need when you file the form?

What is the purpose of this form?

Who needs the form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8863

What should I do if I realize I made an error after filing my IRS 8863?

If you discover an error after submitting your IRS 8863, you can file an amended return using Form 1040-X. Clearly indicate the corrections made in your amendment to ensure accurate processing. Make sure to attach the corrected IRS 8863 along with the amendment for clarity.

How can I check the status of my IRS 8863 submission?

To verify the status of your IRS 8863, use the IRS 'Where's My Refund?' tool if you filed electronically. If you submitted on paper, consider waiting a few weeks and contacting the IRS directly or checking their website for more information on processing times.

What common mistakes should I watch for when submitting IRS 8863?

Common errors on IRS 8863 include incorrect Social Security numbers, failing to sign the form, or not including all necessary documentation. Review your submission carefully to avoid these pitfalls and ensure all supporting details are accurate.

Can I e-file my IRS 8863 using third-party software, and are there specific requirements?

Yes, you can utilize e-filing software to submit your IRS 8863, but ensure the software is compatible with the IRS guidelines. Check for any technical requirements, such as browser compatibility and secure e-signature options, to facilitate a smooth filing process.

What should I do if the IRS sends me a notice related to my IRS 8863 submission?

If you receive a notice from the IRS regarding your IRS 8863, carefully read the correspondence for the specific issue addressed. Prepare any requested documentation and respond promptly, ensuring that you keep a record of all communications with the IRS for future reference.

See what our users say