SC DoR SC4506 2018 free printable template

Show details

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SC DoR SC4506

Edit your SC DoR SC4506 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SC DoR SC4506 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing SC DoR SC4506 online

Follow the guidelines below to use a professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit SC DoR SC4506. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC DoR SC4506 Form Versions

Version

Form Popularity

Fillable & printabley

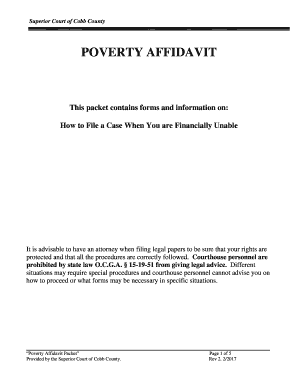

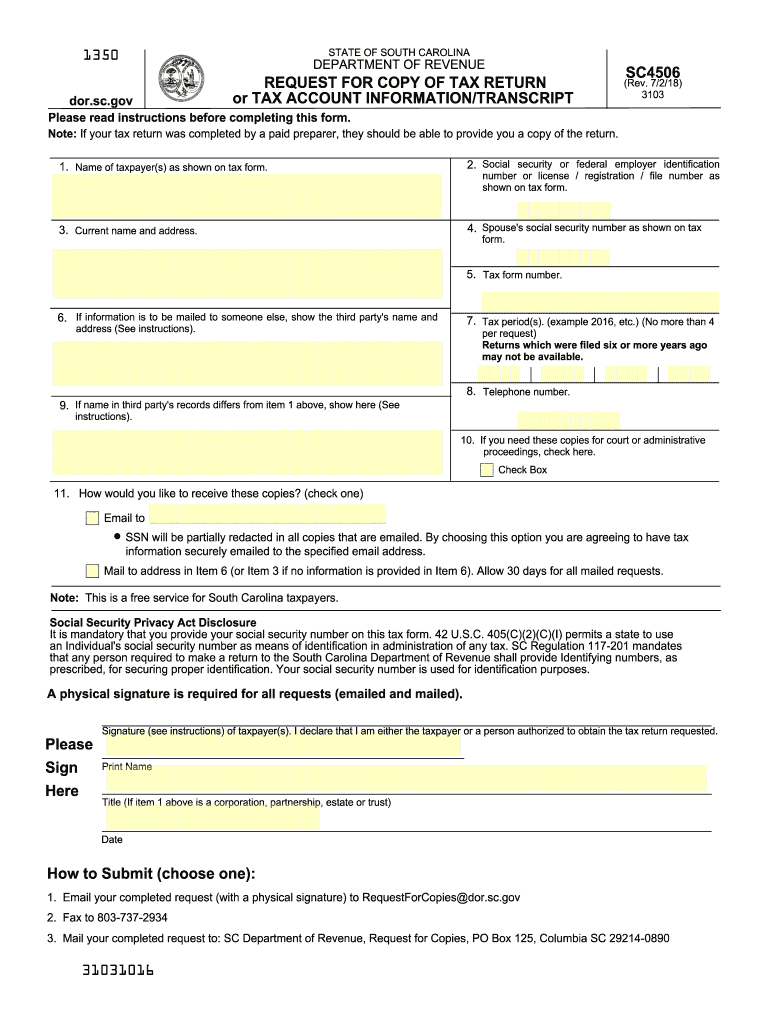

How to fill out SC DoR SC4506

How to fill out SC DoR SC4506

01

Start by gathering all relevant personal and financial information required for the form.

02

Read the instructions at the top of the SC DoR SC4506 carefully to understand each section.

03

Fill out your name, address, and contact details in the designated fields.

04

Provide your Social Security number and date of birth as requested.

05

Complete the section detailing your income sources and amounts.

06

Fill in the expenses section with accurate figures from your monthly budget.

07

Review any additional questions that may pertain to your financial situation.

08

Sign and date the form at the end, certifying that the information provided is true and correct.

09

Submit the completed form as per the submission guidelines provided.

Who needs SC DoR SC4506?

01

Individuals applying for financial assistance or benefits from the Department of Revenue.

02

Taxpayers needing to report certain financial information for assessment purposes.

03

Anyone required to provide detailed income and expense information for tax-related issues.

Fill

form

: Try Risk Free

People Also Ask about

Why do lenders need a 4506-T form?

Mortgage lenders may require you to fill out Form 4506-T as part of your mortgage application. It allows them to obtain a transcript of your tax return information directly from the IRS. They use it to verify the other income documentation you provided during the loan application process.

What is a 4506c?

Form 4506-C was created to be utilized by authorized IVES participants to order tax transcripts with the consent of the taxpayer. General Instructions. Caution: Do not sign this form unless all applicable lines have been completed.

How long does 4506-C take?

Yes, but it can take anywhere between 6 to 60 days to receive the data from the IRS.

What is SBA looking for on 4506-t?

All COVID EIDL applicants are required to submit a signed and dated Form 4506-T authorizing the IRS to release business tax transcripts for SBA to verify their revenue. If you receive repeated requests to submit your Form 4506-T, there may have been an error on your previous submission.

Why would a credit card company request a 4506-C?

It allows the financial institution or credit issuer to look into your IRS tax returns. Most lenders use the form to verify the self-reported income portion of your application to your tax return. American Express and Discover are the two main credit issuers who routinely request Form 4506-T to verify your income.

What is 4506-C used for?

Use Form 4506-C to request tax return information through an authorized IVES participant. You will designate an IVES participant to receive the information on line 5a. Note: If you are unsure of which type of transcript you need, check with the party requesting your tax information.

What is the difference between a 4506t and a 4506c?

The IRS Form 4506 is used to retrieve photo copies of the tax returns that were filed by the taxpayer. 4506 can take the IRS up to 60 days to complete. The IRS Form 4506-T is used to request tax transcripts directly from the IRS. The IRS Form 4506-C is used to obtain IRS Tax through Veri-Tax (a “veri-tax”).

What is the 4506 used for?

Use Form 4506 to: Request a copy of your tax return, or. Designate a third party to receive the tax return.

Is form 4506-C required for mortgage?

Fannie Mae requires lenders to have each borrower whose income (regardless of income source) is used to qualify for the loan to complete and sign a separate IRS Form 4506-C at or before closing.

What is the quickest way to get a tax transcript?

We recommend requesting a transcript online since that's the fastest method. If you can't get your transcript online, you can request a tax return or tax account transcript by mail instead.

What is a 4506c form for?

Use Form 4506-C to request tax return information through an authorized IVES participant. You will designate an IVES participant to receive the information on line 5a. Note: If you are unsure of which type of transcript you need, check with the party requesting your tax information.

How can I get my tax transcript online immediately online?

Taxpayers may also obtain a tax transcript online from the IRS. Use Get Transcript Online to immediately view the AGI. Taxpayers must pass the Secure Access identity verification process. Use Get Transcript by Mail or call 800-908-9946.

Do all lenders require form 4506?

If you're a mortgage lender, you're undoubtedly familiar with IRS Form 4506. Introduced as a fraud prevention measure, Form 4506 is required from nearly every borrower to prove that their tax returns from the past two years are authentic and properly filed.

What is the difference between 4506 and 4506-C?

What is the difference between the IRS Form 4506 and the IRS Form 4506-C? The IRS Form 4506 is used to retrieve photo copies of the tax returns that were filed by the taxpayer. 4506 can take the IRS up to 60 days to complete. The IRS Form 4506-C is used to obtain IRS Tax TRANSCRIPTS.

How long does IRS take to process 4506?

Use Form 4506 to request a copy of your tax return. You can also designate (on line 5) a third party to receive the tax return. How long will it take? It may take up to 75 calendar days for us to process your request.

Why do lenders pull tax transcripts?

Tax transcripts obtained from the IRS can be used to document borrower income, however, the intent of this policy is to use the transcripts to validate the income documentation provided by the borrower and used in the underwriting process.

Is there another way to get a tax transcript?

If you're unable to register, or you prefer not to use Get Transcript Online, you may order a tax return transcript and/or a tax account transcript through Get Transcript by Mail or by calling 800-908-9946. Please allow 5 to 10 calendar days for delivery.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get SC DoR SC4506?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific SC DoR SC4506 and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit SC DoR SC4506 straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit SC DoR SC4506.

How do I complete SC DoR SC4506 on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your SC DoR SC4506, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is SC DoR SC4506?

SC DoR SC4506 is a specific document or form related to the State of South Carolina's Department of Revenue that is used for reporting certain financial information.

Who is required to file SC DoR SC4506?

Individuals or entities that meet specific criteria established by the South Carolina Department of Revenue are required to file SC DoR SC4506.

How to fill out SC DoR SC4506?

To fill out SC DoR SC4506, one must follow the instructions provided by the South Carolina Department of Revenue, which include providing relevant personal or business information, financial data, and signatures as required.

What is the purpose of SC DoR SC4506?

The purpose of SC DoR SC4506 is to collect necessary information for tax compliance and ensure that relevant financial activities are reported appropriately.

What information must be reported on SC DoR SC4506?

SC DoR SC4506 requires reporting of personal information, financial activities, tax identification numbers, and any other pertinent data as specified in the form's instructions.

Fill out your SC DoR SC4506 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC DoR sc4506 is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.