SC DoR SC4506 2022 free printable template

Show details

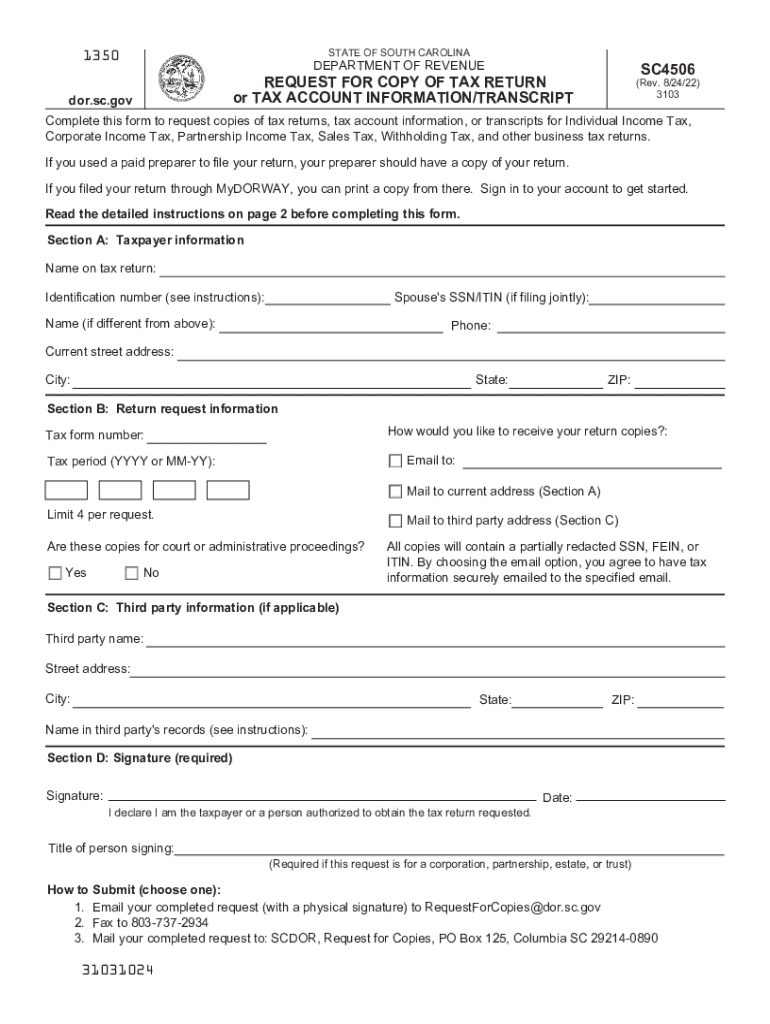

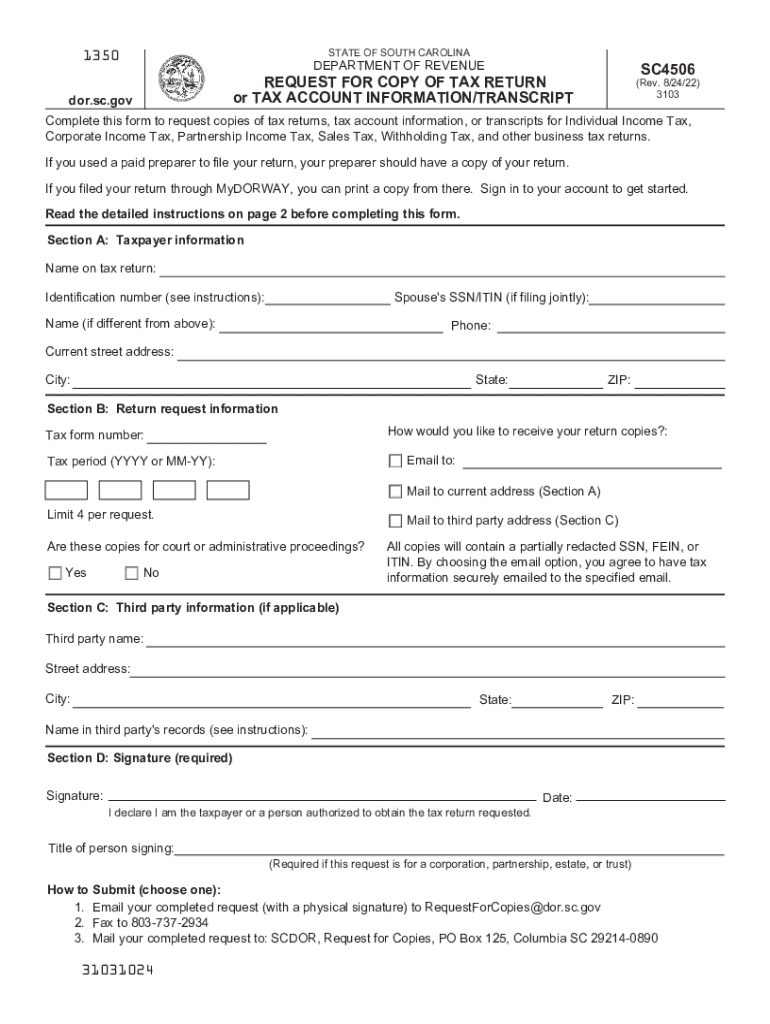

1350STATE OF SOUTH CAROLINADEPARTMENT OF REVENUESC4506REQUEST FOR COPY OF TAX RETURN or TAX ACCOUNT INFORMATION/Transcription.SC.gov(Rev. 8/24/22) 3103Complete this form to request copies of tax returns,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SC DoR SC4506

Edit your SC DoR SC4506 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SC DoR SC4506 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit SC DoR SC4506 online

To use the professional PDF editor, follow these steps below:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit SC DoR SC4506. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC DoR SC4506 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SC DoR SC4506

How to fill out SC DoR SC4506

01

Begin by gathering all necessary documentation related to the property for which you're submitting the SC DoR SC4506.

02

Ensure you have the correct form version to avoid issues during processing.

03

Fill out the applicant's information section, including name, address, and contact details.

04

Provide a clear description of the property and the purpose of the request in the designated sections.

05

Attach any required supporting documents as specified in the form instructions.

06

Review the form for completeness and accuracy before submitting.

07

Submit the form through the indicated submission method, whether online or by mail.

Who needs SC DoR SC4506?

01

Individuals or organizations seeking to request a Declaration of Restrictions for a property.

02

Property owners who want to ensure their property complies with local regulations.

03

Real estate professionals assisting clients with property modifications or restrictions.

04

Legal representatives involved in property-related matters.

Fill

form

: Try Risk Free

People Also Ask about

Why do lenders need a 4506-T form?

Mortgage lenders may require you to fill out Form 4506-T as part of your mortgage application. It allows them to obtain a transcript of your tax return information directly from the IRS. They use it to verify the other income documentation you provided during the loan application process.

What is a 4506c?

Form 4506-C was created to be utilized by authorized IVES participants to order tax transcripts with the consent of the taxpayer. General Instructions. Caution: Do not sign this form unless all applicable lines have been completed.

How long does 4506-C take?

Yes, but it can take anywhere between 6 to 60 days to receive the data from the IRS.

What is SBA looking for on 4506-t?

All COVID EIDL applicants are required to submit a signed and dated Form 4506-T authorizing the IRS to release business tax transcripts for SBA to verify their revenue. If you receive repeated requests to submit your Form 4506-T, there may have been an error on your previous submission.

Why would a credit card company request a 4506-C?

It allows the financial institution or credit issuer to look into your IRS tax returns. Most lenders use the form to verify the self-reported income portion of your application to your tax return. American Express and Discover are the two main credit issuers who routinely request Form 4506-T to verify your income.

What is 4506-C used for?

Use Form 4506-C to request tax return information through an authorized IVES participant. You will designate an IVES participant to receive the information on line 5a. Note: If you are unsure of which type of transcript you need, check with the party requesting your tax information.

What is the difference between a 4506t and a 4506c?

The IRS Form 4506 is used to retrieve photo copies of the tax returns that were filed by the taxpayer. 4506 can take the IRS up to 60 days to complete. The IRS Form 4506-T is used to request tax transcripts directly from the IRS. The IRS Form 4506-C is used to obtain IRS Tax through Veri-Tax (a “veri-tax”).

What is the 4506 used for?

Use Form 4506 to: Request a copy of your tax return, or. Designate a third party to receive the tax return.

Is form 4506-C required for mortgage?

Fannie Mae requires lenders to have each borrower whose income (regardless of income source) is used to qualify for the loan to complete and sign a separate IRS Form 4506-C at or before closing.

What is the quickest way to get a tax transcript?

We recommend requesting a transcript online since that's the fastest method. If you can't get your transcript online, you can request a tax return or tax account transcript by mail instead.

What is a 4506c form for?

Use Form 4506-C to request tax return information through an authorized IVES participant. You will designate an IVES participant to receive the information on line 5a. Note: If you are unsure of which type of transcript you need, check with the party requesting your tax information.

How can I get my tax transcript online immediately online?

Taxpayers may also obtain a tax transcript online from the IRS. Use Get Transcript Online to immediately view the AGI. Taxpayers must pass the Secure Access identity verification process. Use Get Transcript by Mail or call 800-908-9946.

Do all lenders require form 4506?

If you're a mortgage lender, you're undoubtedly familiar with IRS Form 4506. Introduced as a fraud prevention measure, Form 4506 is required from nearly every borrower to prove that their tax returns from the past two years are authentic and properly filed.

What is the difference between 4506 and 4506-C?

What is the difference between the IRS Form 4506 and the IRS Form 4506-C? The IRS Form 4506 is used to retrieve photo copies of the tax returns that were filed by the taxpayer. 4506 can take the IRS up to 60 days to complete. The IRS Form 4506-C is used to obtain IRS Tax TRANSCRIPTS.

How long does IRS take to process 4506?

Use Form 4506 to request a copy of your tax return. You can also designate (on line 5) a third party to receive the tax return. How long will it take? It may take up to 75 calendar days for us to process your request.

Why do lenders pull tax transcripts?

Tax transcripts obtained from the IRS can be used to document borrower income, however, the intent of this policy is to use the transcripts to validate the income documentation provided by the borrower and used in the underwriting process.

Is there another way to get a tax transcript?

If you're unable to register, or you prefer not to use Get Transcript Online, you may order a tax return transcript and/or a tax account transcript through Get Transcript by Mail or by calling 800-908-9946. Please allow 5 to 10 calendar days for delivery.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify SC DoR SC4506 without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your SC DoR SC4506 into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I edit SC DoR SC4506 on an Android device?

You can make any changes to PDF files, such as SC DoR SC4506, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

How do I complete SC DoR SC4506 on an Android device?

Use the pdfFiller mobile app to complete your SC DoR SC4506 on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is SC DoR SC4506?

SC DoR SC4506 is a form used by South Carolina to report certain financial information to the Department of Revenue.

Who is required to file SC DoR SC4506?

Individuals and businesses that meet specific thresholds for income or tax liabilities in South Carolina are required to file SC DoR SC4506.

How to fill out SC DoR SC4506?

SC DoR SC4506 can be filled out by providing the required financial information as indicated on the form, ensuring all fields are completed accurately.

What is the purpose of SC DoR SC4506?

The purpose of SC DoR SC4506 is to collect data that assists the state in assessing taxes and ensuring compliance with tax laws.

What information must be reported on SC DoR SC4506?

SC DoR SC4506 requires information such as income, deductions, credits, and other relevant financial details necessary for tax assessment.

Fill out your SC DoR SC4506 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC DoR sc4506 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.