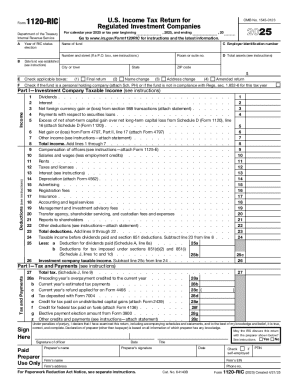

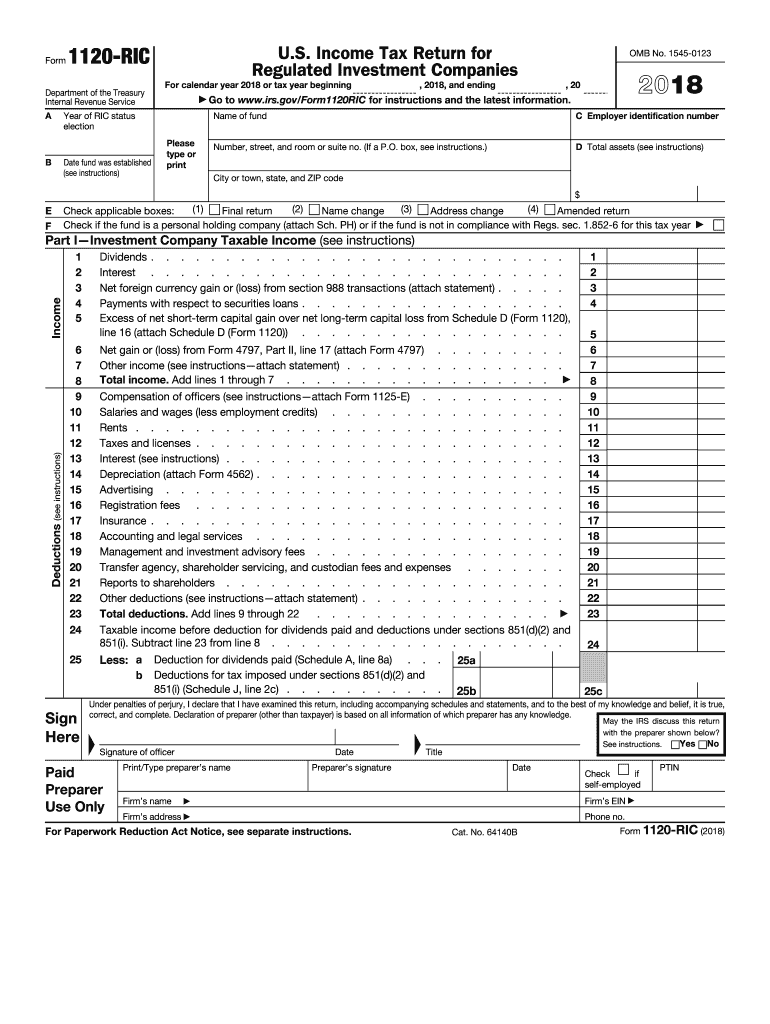

IRS 1120-RIC 2018 free printable template

Instructions and Help about IRS 1120-RIC

How to edit IRS 1120-RIC

How to fill out IRS 1120-RIC

About IRS 1120-RIC 2018 previous version

What is IRS 1120-RIC?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1120-RIC

What should I do if I realize I made a mistake on my ric 2015 form after submission?

If you've filed your ric 2015 and notice a mistake, you can submit an amended return. It's important to acknowledge the error promptly to avoid complications. Prepare the corrected information and follow the specific steps for amending as outlined by the IRS to ensure proper processing.

How can I verify the status of my ric 2015 form submission?

To check the status of your ric 2015, utilize the IRS's online tracking tools or contact their support. Keep your submission details handy to facilitate the inquiry. If you encounter issues such as e-file rejections, consult the common rejection codes provided by the IRS for guidance.

What are some common errors people make when filing the ric 2015, and how can I avoid them?

Common errors when filing the ric 2015 include incorrect taxpayer identification numbers or mismatched data. Double-check all entries against official documents before submission, and consider using software that can help catch these mistakes. Being meticulous can save you time and potential audits.

Are e-signatures accepted when filing the ric 2015, and what are the implications for record retention?

Yes, e-signatures are accepted for filing the ric 2015. However, it’s crucial to follow the guidelines provided by the IRS to ensure compliance. As for record retention, keep copies of your forms and e-signature records for at least three years to align with IRS recommendations.