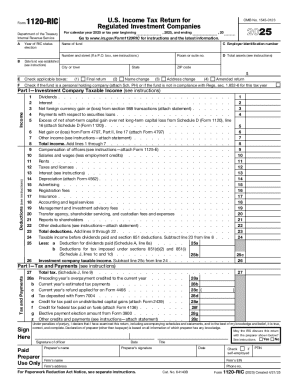

IRS 1120-RIC 2024 free printable template

Instructions and Help about IRS 1120-RIC

How to edit IRS 1120-RIC

How to fill out IRS 1120-RIC

Latest updates to IRS 1120-RIC

About IRS 1120-RIC 2024 previous version

What is IRS 1120-RIC?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1120-RIC

What should I do if I realize I've made a mistake after submitting my IRS 1120-RIC?

If you discover an error in your submitted IRS 1120-RIC, you can file an amended return using Form 1120-X. It's important to clearly state the changes being made, as this will help the IRS process your amendments more smoothly.

How can I track the status of my IRS 1120-RIC after submission?

To verify the status of your IRS 1120-RIC, you can visit the IRS website and utilize their online tracking tools. Keep your confirmation receipt handy, as it will help in identifying your submission in the system.

Are there any common errors that filers should watch out for when submitting the IRS 1120-RIC?

Yes, common errors include incorrect amounts, missing signatures, and overlooking required attachments. Conducting a thorough review of your IRS 1120-RIC before submission can save you from future complications.

How do I respond if I receive a notice from the IRS regarding my IRS 1120-RIC?

If you receive a notice from the IRS concerning your IRS 1120-RIC, it's crucial to read it carefully and follow the instructions provided. Ensure to gather all requested documentation and respond within the specified timeframe.