Get the free form 568 california tax

Show details

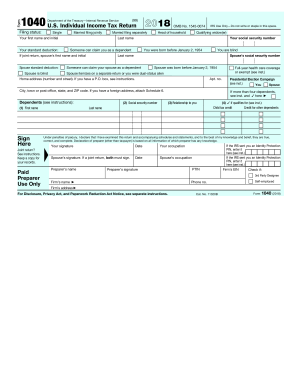

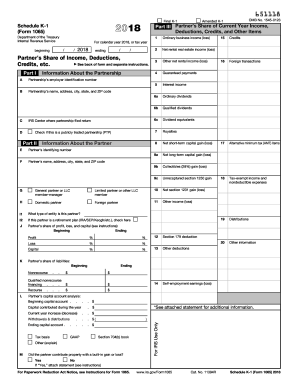

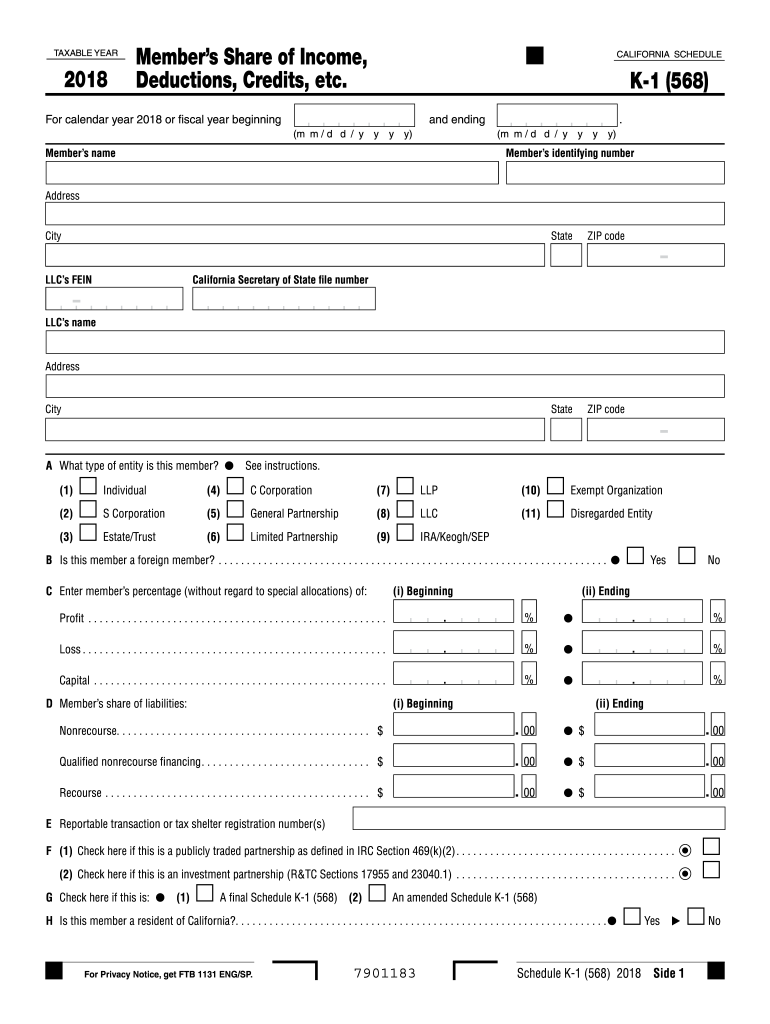

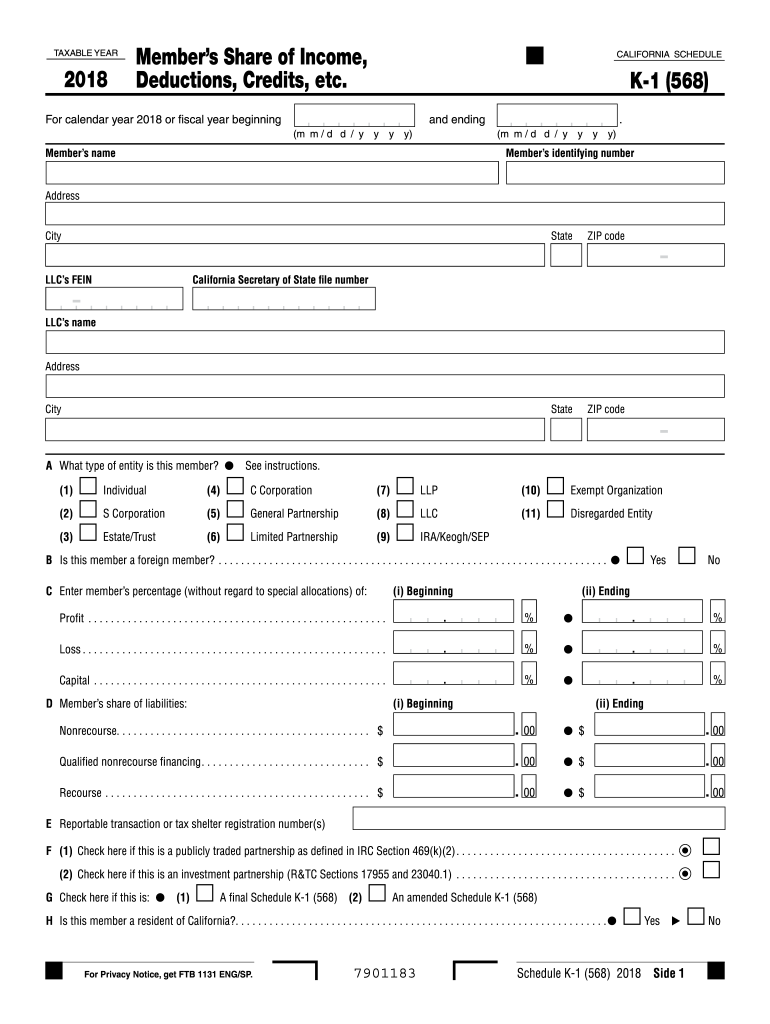

Attach schedule. Side 2 Schedule K-1 568 2018 California source amounts and credits Schedule K-1 1065 15 a Total withholding equals amount on Form 592-B if calendar year LLC. A final Schedule K-1 568 An amended Schedule K-1 568 For Privacy Notice get FTB 1131 ENG/SP. 7901183 Schedule K-1 568 2018 Side 1 I Analysis of member s capital account Check the box a Capital account at beginning of year 1 Tax Basis 2 GAAP 3 IRC Section 704 b Book 4 Other explain b Capital contributed...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form 568 california tax

Edit your form 568 california tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 568 california tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 568 california tax online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 568 california tax. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 568 california tax

How to fill out California Schedule K-1:

01

Obtain a copy of the California Schedule K-1 form from the California Franchise Tax Board website or your tax preparer.

02

Begin by filling out the top section of the form, which includes your name, Social Security number, and the fiscal year ending date.

03

Indicate whether you are filing as an individual, partnership, or limited liability company (LLC), and provide the corresponding entity's information.

04

If you are a partner or shareholder in a pass-through entity, such as a partnership or S corporation, report your share of income, deductions, and credits on the Schedule K-1.

05

The form will have specific sections where you need to report your share of items such as ordinary business income, rental real estate income, interest income, capital gains, and losses.

06

Follow the instructions on the form to accurately calculate your share of each item and transfer the amounts to the Schedule K-1.

07

Complete the remaining sections of the Schedule K-1, including adjustments and other required information.

08

If you are a nonresident of California but have California source income, you may need to fill out additional sections of the form to calculate the nonresident withholding and California source income or loss.

09

Ensure that all information is accurately entered and calculations are correct before submitting your completed Schedule K-1 with your California tax return.

Who needs California Schedule K-1:

01

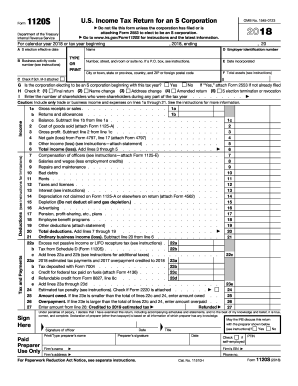

California Schedule K-1 is typically required for partners or shareholders in a pass-through entity, such as a partnership, limited partnership, limited liability company (LLC), or S corporation, who need to report their share of income, deductions, and credits for tax purposes.

02

Individuals who are a part of such entities and have California source income or are nonresidents but have California source income may also need to fill out the Schedule K-1.

03

It is important to consult with a tax advisor or the California Franchise Tax Board to determine if you need to file the Schedule K-1 based on your specific circumstances.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to file California state taxes if I had no income?

You can file a state tax return even if you have no income from work — this includes seniors living off of Social Security — wrote tax board spokesperson Andrew LePage in an email.

What is California form 568 Schedule K-1?

An LLC that has elected to be treated as a partnership for tax purposes uses Schedule K‑1 (568), Member's Share of Income, Deductions, Credits, etc., to report your distributive share of the LLC's income, deductions, credits, etc. Keep Schedule K-1 (568) for your records.

Do I need to file form 568 if no income?

The LLC is still required to file Form 568 if the LLC is registered in California even if both of the following apply: The LLC is not actively doing business in California. The LLC does not have California source income.

How do I fill out a California form 568?

If you have an LLC, here's how to fill in the California Form 568: Line 1—Total income from Schedule IW. Enter the total income. Line 2—Limited liability company fee. Enter the amount of the LLC fee. The LLC must pay a fee if the total California income is equal to or greater than $250,000.

Do I have to pay taxes on an LLC that made no money California?

LLC Corporations It is mandatory for all corporations to file annual tax returns, even if the business was inactive or did not receive income.

Does a single member LLC need to file form 568 in California?

While a single member LLC does not file California Form 565, they must file California Form 568 which provides details about the LLC.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form 568 california tax?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the form 568 california tax. Open it immediately and start altering it with sophisticated capabilities.

How do I edit form 568 california tax in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your form 568 california tax, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I fill out the form 568 california tax form on my smartphone?

Use the pdfFiller mobile app to fill out and sign form 568 california tax. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is california schedule k 1?

California Schedule K-1 is a tax form used to report income, deductions, and credits from partnerships, S corporations, or limited liability companies (LLCs) in California. It is a supplemental form that provides detailed information to the partners, shareholders, or members about their share of the entity's income, deductions, and credits.

Who is required to file california schedule k 1?

Partnerships, S corporations, and multi-member LLCs in California are required to file California Schedule K-1 for each partner, shareholder, or member, reporting their respective shares of income, deductions, and credits.

How to fill out california schedule k 1?

To fill out California Schedule K-1, entities must provide details such as the partner's or shareholder's name, address, and taxpayer identification number. They must also report the income, gains, losses, deductions, and credits attributable to each partner or shareholder using the appropriate line items on the form.

What is the purpose of california schedule k 1?

The purpose of California Schedule K-1 is to ensure that partners, shareholders, or members accurately report their respective share of income, deductions, and credits from partnerships, S corporations, or LLCs on their individual tax returns, facilitating proper income taxation.

What information must be reported on california schedule k 1?

California Schedule K-1 must report information including the partner's or shareholder's share of income, deductions, credits, and other tax-related items from the entity, as well as the partner's or shareholder's identification information such as name, address, and taxpayer identification number.

Fill out your form 568 california tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 568 California Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.