NE Form 21 2018 free printable template

Show details

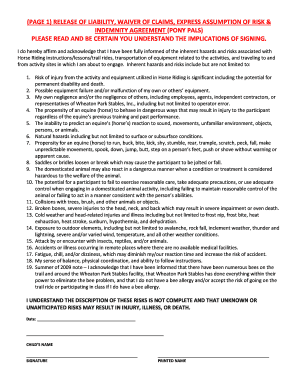

Request for Abatement of PenaltyFORM21Complete a separate application for each penalty assessment. Nebraska ID Number as It Appears on Your Return Social Security Number (for individual income tax)

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NE Form 21

Edit your NE Form 21 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NE Form 21 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NE Form 21 online

Follow the steps below to take advantage of the professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NE Form 21. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NE Form 21 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NE Form 21

How to fill out NE Form 21

01

Begin by downloading NE Form 21 from the official website or obtain a physical copy.

02

Provide your personal details at the top of the form, including your full name, address, and contact information.

03

Carefully read the instructions on the form to ensure you understand the requirements.

04

Complete Section A by entering relevant data such as the purpose of the form and any identification numbers required.

05

Move to Section B and provide any additional necessary information related to your request.

06

Review the form for accuracy, ensuring all fields are completed correctly.

07

Sign and date the form where indicated to certify the information is true and complete.

08

Submit the completed form as per the instructions, either electronically or by mailing it to the designated office.

Who needs NE Form 21?

01

Anyone who needs to report certain types of changes or information to the relevant authority may need to fill out NE Form 21.

02

Individuals or entities involved in specific financial or legal processes that require this form for compliance.

03

Businesses that need to update their records with the regulatory body may also be required to fill out NE Form 21.

Fill

form

: Try Risk Free

People Also Ask about

Who must file a Nebraska tax return?

A Nebraska Resident: You must file a Nebraska tax return if you are required to file a federal tax return. You have at least $5,000 of net Nebraska adjustments to your federal adjusted gross income.

What is the 2210 form?

Use Form 2210 to see if you owe a penalty for underpaying your estimated tax. The IRS will generally figure your penalty for you and you should not file Form 2210. You can, however, use Form 2210 to figure your penalty if you wish and include the penalty on your return.

What is the Nebraska Form 2210n?

Nebraska — Individual Underpayment of Estimated Tax This form is for income earned in tax year 2022, with tax returns due in April 2023. We will update this page with a new version of the form for 2024 as soon as it is made available by the Nebraska government.

What are the causes for reduction of penalty?

Fires, natural disasters or civil disturbances. Inability to get records. Death, serious illness or unavoidable absence of the taxpayer or immediate family. System issues that delayed a timely electronic filing or payment.

How do I write a tax penalty waiver letter?

State the type of penalty you want removed. Include an explanation of the events and specific facts and circumstances of your situation, and explain how these events were outside of your control. Attach documents that will prove your case.

What is exempt from Nebraska sales tax?

Nebraska Sales Tax Exemptions SaleDocumentation Required (in addition to the normal books and records of the retailer)Medicines & medical equipmentPrescription from health care professional (except insulin)NewspapersNonePolitical Campaign FundraisersNoneRepair laborNone9 more rows

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit NE Form 21 from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including NE Form 21, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I get NE Form 21?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific NE Form 21 and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit NE Form 21 straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing NE Form 21.

What is NE Form 21?

NE Form 21 is a tax form used to report certain income and transactions that are not reported on other standard tax forms, primarily related to non-resident entities.

Who is required to file NE Form 21?

Entities that earn income from sources within the jurisdiction where NE Form 21 is applicable, but do not meet the criteria for other tax forms, are required to file NE Form 21.

How to fill out NE Form 21?

To fill out NE Form 21, provide accurate income details, complete the identification sections, ensure all applicable fees are included, and submit the form by the designated deadline.

What is the purpose of NE Form 21?

The purpose of NE Form 21 is to ensure compliance with tax regulations by reporting specific income types and ensuring accurate tax calculations for non-resident entities.

What information must be reported on NE Form 21?

NE Form 21 must report income amounts, entity identification information, sources of income, applicable deductions, and any other relevant financial details as specified by the tax authority.

Fill out your NE Form 21 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NE Form 21 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.