NE Form 21 2020-2025 free printable template

Show details

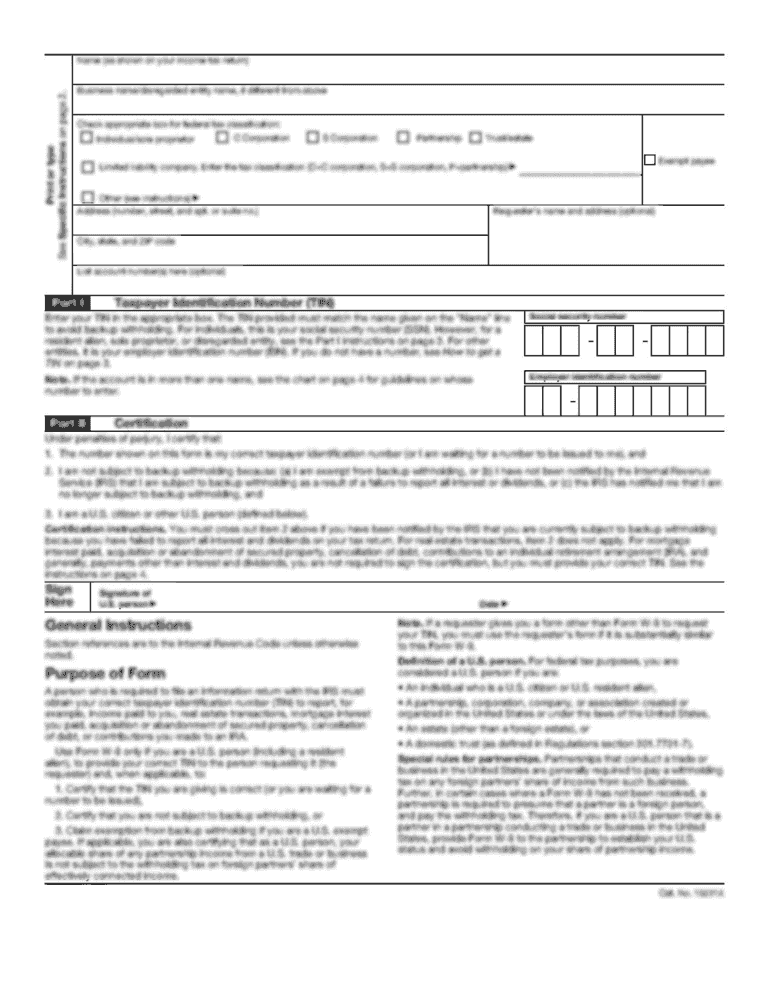

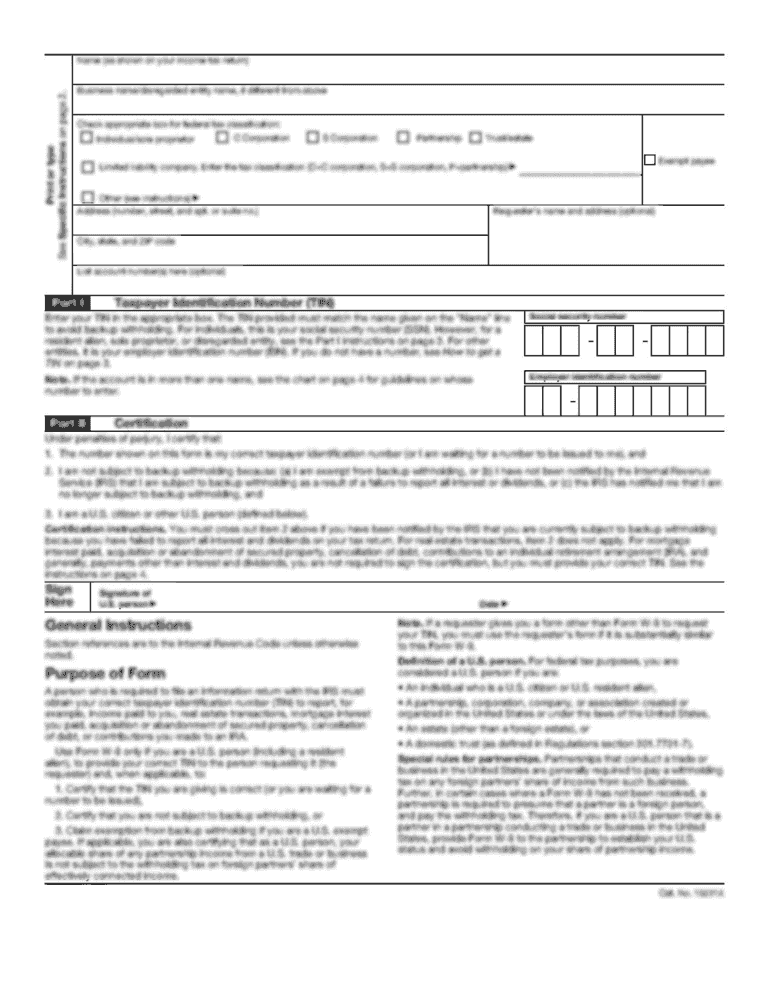

RESET FOOTPRINT FORMRequest for Abatement of PenaltyFORM21Complete a separate application for each penalty assessment. Nebraska ID Number as It Appears on Your Return Social Security Number (for individual

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign nebraska request form

Edit your nebraska form 21 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nebraska dor penalty 7 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 21 abatement penalty 7 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit nebraska dor 21 request 7103 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NE Form 21 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out nebraska form 2020-2025

How to fill out NE Form 21

01

Obtain NE Form 21 from the appropriate regulatory website or office.

02

Read the instructions carefully to understand the requirements.

03

Fill out personal information in the designated fields including name, address, and contact details.

04

Provide relevant details pertaining to the specific purpose of the form.

05

Ensure all required signatures are included where indicated.

06

Review the form for accuracy and completeness before submission.

07

Submit the form by the specified deadline, either electronically or by mailing it to the designated address.

Who needs NE Form 21?

01

Individuals or entities seeking to file specific applications or declarations regulated by the NE authority.

02

Business owners who need to comply with local regulations regarding permits or licenses.

03

Residents who are required to report certain information to local government agencies.

04

Anyone involved in activities that require formal approval from the NE regulatory body.

Fill

form

: Try Risk Free

People Also Ask about

Who must file a Nebraska tax return?

A Nebraska Resident: You must file a Nebraska tax return if you are required to file a federal tax return. You have at least $5,000 of net Nebraska adjustments to your federal adjusted gross income.

What is the 2210 form?

Use Form 2210 to see if you owe a penalty for underpaying your estimated tax. The IRS will generally figure your penalty for you and you should not file Form 2210. You can, however, use Form 2210 to figure your penalty if you wish and include the penalty on your return.

What is the Nebraska Form 2210n?

Nebraska — Individual Underpayment of Estimated Tax This form is for income earned in tax year 2022, with tax returns due in April 2023. We will update this page with a new version of the form for 2024 as soon as it is made available by the Nebraska government.

What are the causes for reduction of penalty?

Fires, natural disasters or civil disturbances. Inability to get records. Death, serious illness or unavoidable absence of the taxpayer or immediate family. System issues that delayed a timely electronic filing or payment.

How do I write a tax penalty waiver letter?

State the type of penalty you want removed. Include an explanation of the events and specific facts and circumstances of your situation, and explain how these events were outside of your control. Attach documents that will prove your case.

What is exempt from Nebraska sales tax?

Nebraska Sales Tax Exemptions SaleDocumentation Required (in addition to the normal books and records of the retailer)Medicines & medical equipmentPrescription from health care professional (except insulin)NewspapersNonePolitical Campaign FundraisersNoneRepair laborNone9 more rows

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find nebraska form 2020-2025?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the nebraska form 2020-2025 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I create an electronic signature for the nebraska form 2020-2025 in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your nebraska form 2020-2025 in seconds.

How do I fill out nebraska form 2020-2025 on an Android device?

Complete your nebraska form 2020-2025 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is NE Form 21?

NE Form 21 is a tax form used for reporting certain types of non-resident income to the tax authorities.

Who is required to file NE Form 21?

Individuals or entities that receive income that is subject to withholding tax and are classified as non-residents are required to file NE Form 21.

How to fill out NE Form 21?

To fill out NE Form 21, you need to provide personal identification information, details of the income received, and any applicable deductions or credits.

What is the purpose of NE Form 21?

The purpose of NE Form 21 is to ensure proper reporting and withholding of taxes on income earned by non-residents.

What information must be reported on NE Form 21?

The information that must be reported on NE Form 21 includes the taxpayer's identification, type of income, total amount earned, and any tax withheld.

Fill out your nebraska form 2020-2025 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nebraska Form 2020-2025 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.