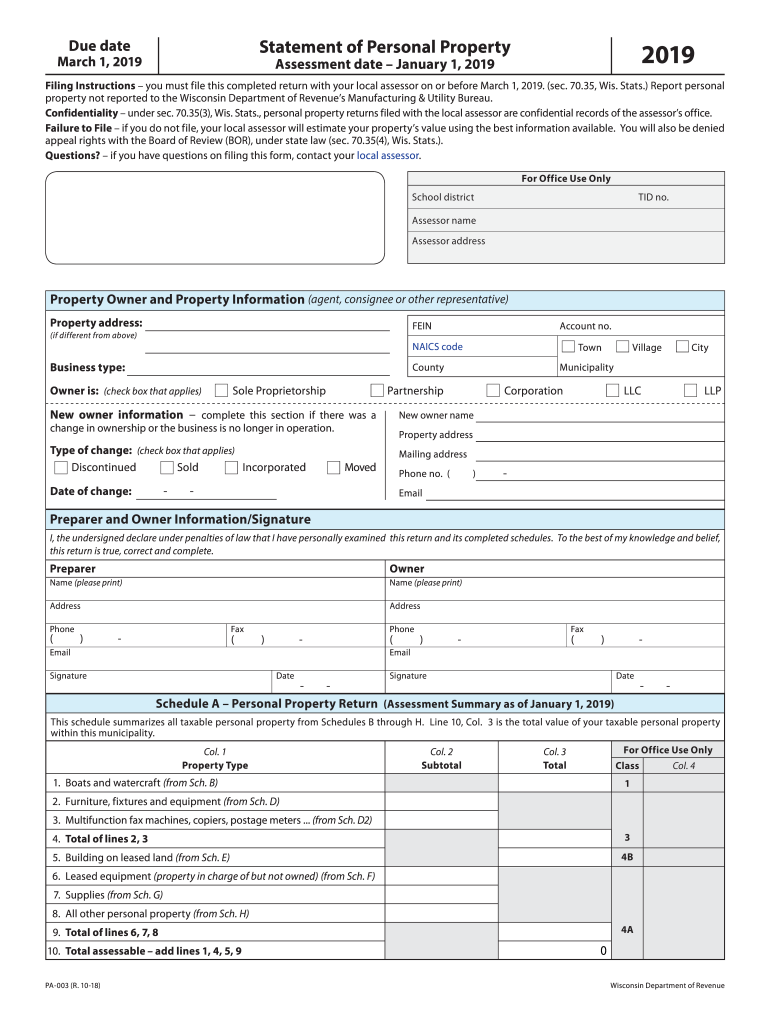

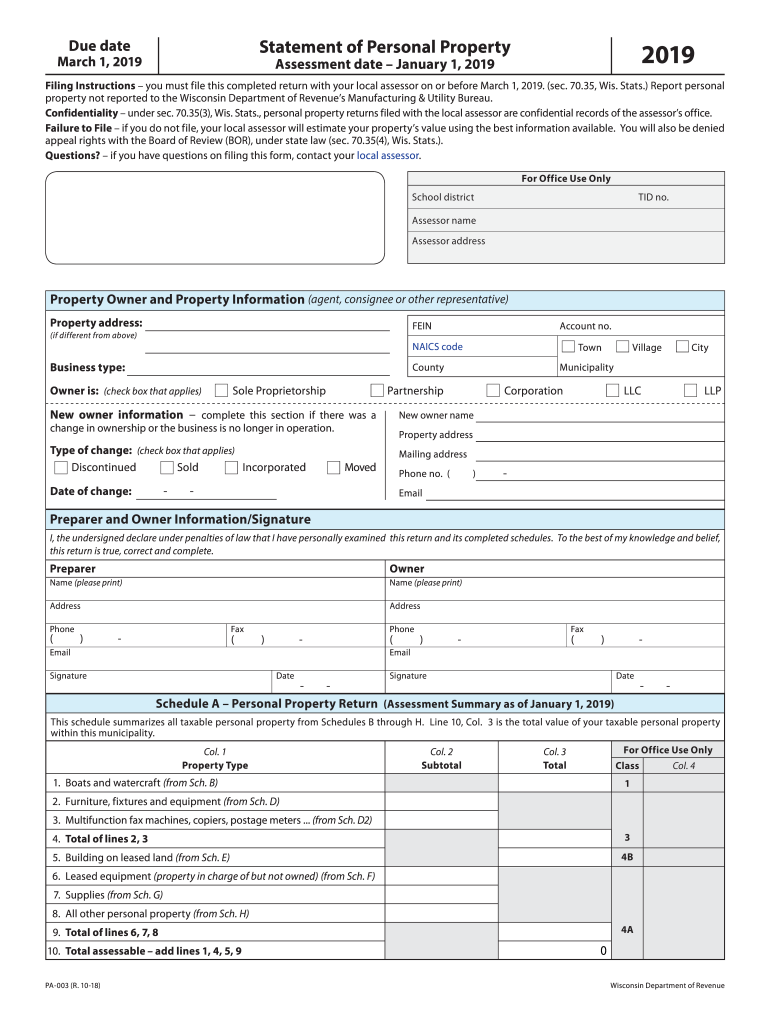

WI DoR PA-003 2019 free printable template

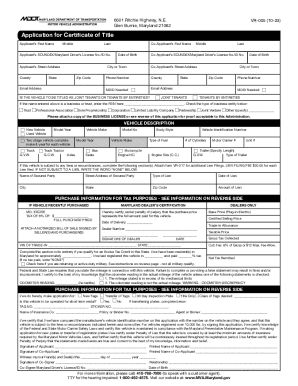

Get, Create, Make and Sign WI DoR PA-003

Editing WI DoR PA-003 online

Uncompromising security for your PDF editing and eSignature needs

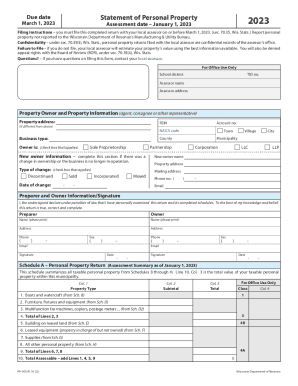

WI DoR PA-003 Form Versions

How to fill out WI DoR PA-003

How to fill out WI DoR PA-003

Who needs WI DoR PA-003?

Instructions and Help about WI DoR PA-003

New tonight Wisconsin lawmakers sound off after new test results show elevated levels of pee FFA's Stark weather creek that creek runs near True field where workers used firefighting foam which is now known to contain the cancer-causing chemical the DNR is now testing fish from the waterway to find out whether wildlife might be impacted by the contamination officials also found pitas in Silver Creek up in Monroe County just before this newscast senator Tammy Baldwin released a statement saying in part that P FFA's contamination is a public health crisis, and she's been working with other federal lawmakers to establish Petals testing standards

People Also Ask about

What is the Wisconsin statement of assessment?

What is a Wisconsin state levy?

How do I find out how much I owe the Wisconsin Department of Revenue?

Why am I getting mail from Department of Revenue?

Why did I get a letter from the Wisconsin Department of Revenue?

How do I find out how much I owe the state of Wisconsin?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

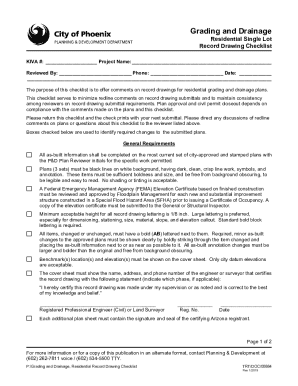

How do I modify my WI DoR PA-003 in Gmail?

How do I edit WI DoR PA-003 in Chrome?

How do I complete WI DoR PA-003 on an iOS device?

What is WI DoR PA-003?

Who is required to file WI DoR PA-003?

How to fill out WI DoR PA-003?

What is the purpose of WI DoR PA-003?

What information must be reported on WI DoR PA-003?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.