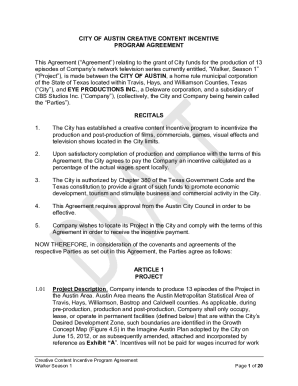

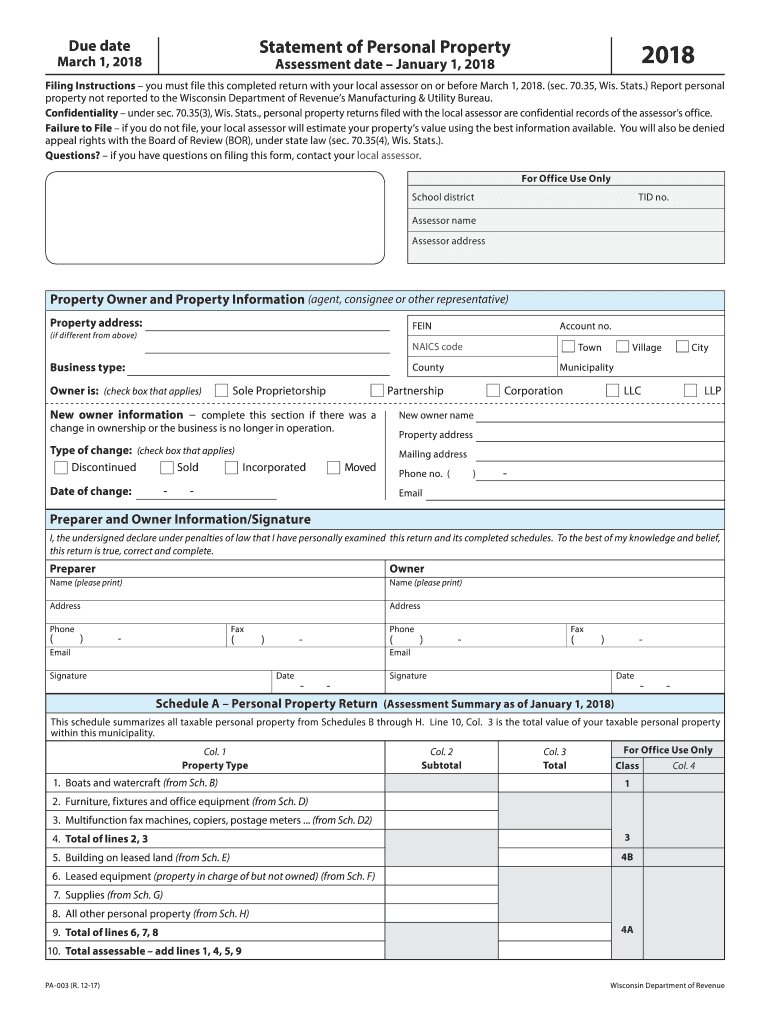

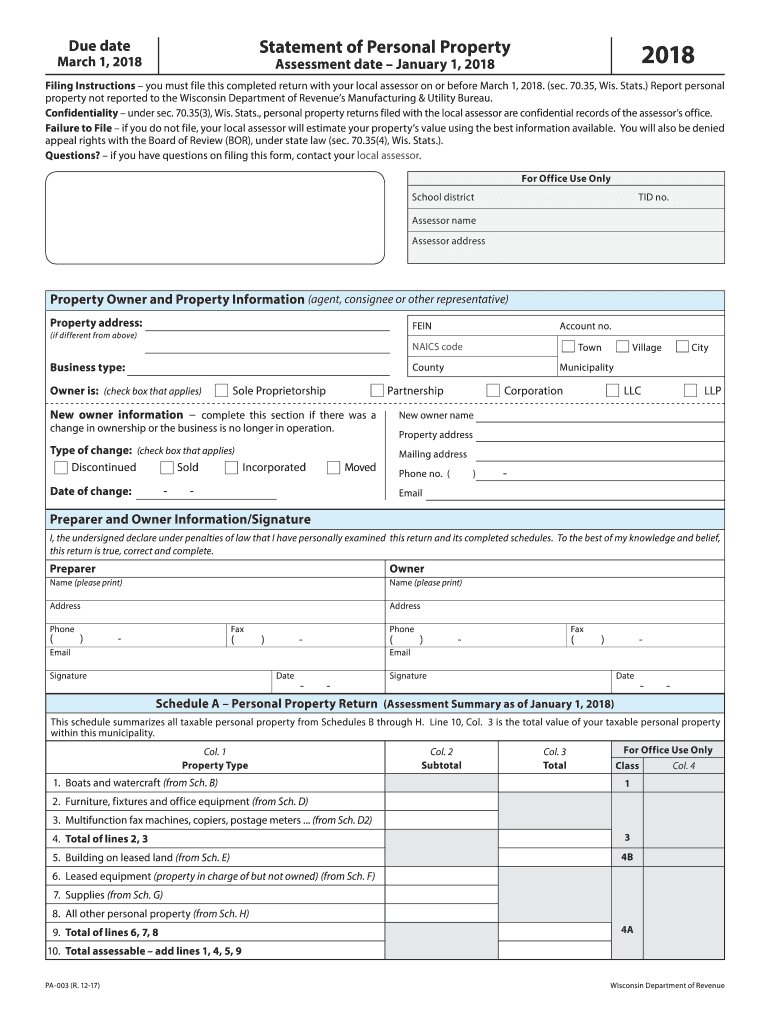

WI DoR PA-003 2018 free printable template

Show details

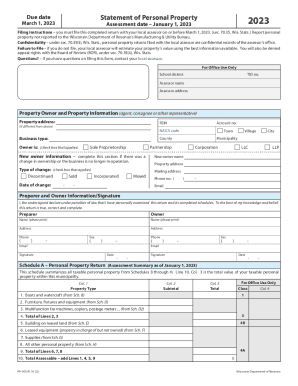

Total assessable add lines 1 4 5 9 PA-003 R. 12-17 Wisconsin Department of Revenue Schedule B Boats and Watercraft Report All boats and watercraft subject to general property taxation. Review the Composite Conversion Factors and Composite Useful Lives Table on various equipment revenue. Statement of Personal Property Due date March 1 2018 Assessment date January 1 2018 Filing Instructions you must file this completed return with your local assessor on or before March 1 2018. sec. 70. 35...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WI DoR PA-003

Edit your WI DoR PA-003 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WI DoR PA-003 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing WI DoR PA-003 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit WI DoR PA-003. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI DoR PA-003 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WI DoR PA-003

How to fill out WI DoR PA-003

01

Obtain the WI DoR PA-003 form from the Wisconsin Department of Revenue website.

02

Fill in your personal information in the designated sections, including name, address, and identification number.

03

Indicate the type of claim or request you are filing.

04

Provide any necessary details or explanations related to your claim.

05

Attach any supporting documents that may be required for your submission.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the form either online or by mail according to the provided instructions.

Who needs WI DoR PA-003?

01

Individuals or businesses in Wisconsin seeking to claim a tax exemption or credit.

02

Taxpayers who need to report specific information to the Wisconsin Department of Revenue.

03

Those involved in property tax assessments or adjustments.

Instructions and Help about WI DoR PA-003

Fill

form

: Try Risk Free

People Also Ask about

What items are tax exempt in Wisconsin?

Sales Tax Exemptions in Wisconsin There are many exemptions to state sales tax. This includes, burial caskets, certain agricultural items, certain grocery items, prescription medicine and medical devices, modular or manufactured homes, and certain pieces of manufacturing equipment.

How are property taxes determined in Wisconsin?

Rates are calculated based on the total levy (the revenue a tax district would like to generate) divided by the total assessed value in the district. So, to use a simple example, if a district's levy is $1,000 and the total of assessed value in the district is $100,000, the rate would be . 01, or 1%.

Are Wisconsin property taxes paid in arrears?

Wisconsin collects property taxes in arrears. In other words, like your income taxes, your property taxes are due the following year.

What is exempt from personal property tax in Wisconsin?

Common Exemptions Household furniture, apparel and motor vehicles. Manufacturing machinery specific processing equipment approved by the Department of Revenue. Livestock, inventories, and merchant's stocks. Computers and electronic peripheral equipment.

At what age do you stop paying property taxes in Wisconsin?

At least one owner of the property must be at least 65 years of age.

What is subject to personal property tax in Wisconsin?

By law, all tangible real property (land and buildings located on that land) and personal property (property with no land attached to it) are to be taxed unless specifically exempt from taxation. Property owned by the federal government, the state, and by local governments is generally exempt.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send WI DoR PA-003 for eSignature?

Once your WI DoR PA-003 is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I complete WI DoR PA-003 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your WI DoR PA-003. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I fill out WI DoR PA-003 on an Android device?

Use the pdfFiller mobile app to complete your WI DoR PA-003 on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is WI DoR PA-003?

WI DoR PA-003 is a form used by the Wisconsin Department of Revenue for reporting various tax information related to partnerships, corporations, and other entities.

Who is required to file WI DoR PA-003?

Entities such as partnerships, LLCs treated as partnerships, and S corporations doing business in Wisconsin are typically required to file WI DoR PA-003.

How to fill out WI DoR PA-003?

To fill out WI DoR PA-003, gather all required financial information, enter identification details of the entity, provide income and deduction information, and sign the form as required.

What is the purpose of WI DoR PA-003?

The purpose of WI DoR PA-003 is to report pass-through income to the state of Wisconsin and to ensure proper taxation of the income generated by the reporting entity.

What information must be reported on WI DoR PA-003?

The information that must be reported includes the income and losses of the entity, deductions, credits, and identification details of partners or shareholders.

Fill out your WI DoR PA-003 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WI DoR PA-003 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.