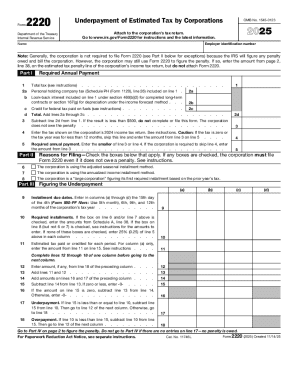

IRS 2220 2018 free printable template

Instructions and Help about IRS 2220

How to edit IRS 2220

How to fill out IRS 2220

About IRS 2 previous version

What is IRS 2220?

Who needs the form?

Components of the form

What payments and purchases are reported?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

How many copies of the form should I complete?

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 2220

What should I do if I need to amend my IRS 2220 after submission?

If you realize there are errors on your IRS 2220 after submission, you must file an amended version with the corrections. Ensure that you reference the original submission and highlight the changes made. It's advisable to keep a copy of both the original and amended forms for your records.

How can I track the status of my submitted IRS 2220?

To verify the receipt and processing of your IRS 2220, utilize the IRS online tracking tools available for filers. This offers confirmation if your form is processed, as well as insights into any issues or rejection codes that may arise during e-filing. Maintaining communication with the IRS can be vital for resolving any discrepancies.

What are common errors to avoid when filing the IRS 2220?

When filing the IRS 2220, ensure that all numerical entries are accurate and properly calculated, as mathematical errors are a frequent cause of rejection. Additionally, double-check all personal and business identification details to prevent mismatches. Familiarizing yourself with common rejection codes can help you avoid these issues.

Can I e-file my IRS 2220 and what should I know about technical requirements?

Yes, you can e-file your IRS 2220, and it is essential to ensure that your software is compatible with IRS guidelines. Be aware of the specific technical requirements necessary for submission, such as supported file formats and browser compatibility. These factors can significantly affect the successful filing of your form.

What should I do if I receive an audit notice after filing the IRS 2220?

If you receive an audit notice after filing your IRS 2220, it's crucial to gather all related documentation and review your submission carefully. Respond to the notice promptly, addressing any specific inquiries or issues raised. Consulting with a tax professional may also be beneficial to navigate the audit process effectively.