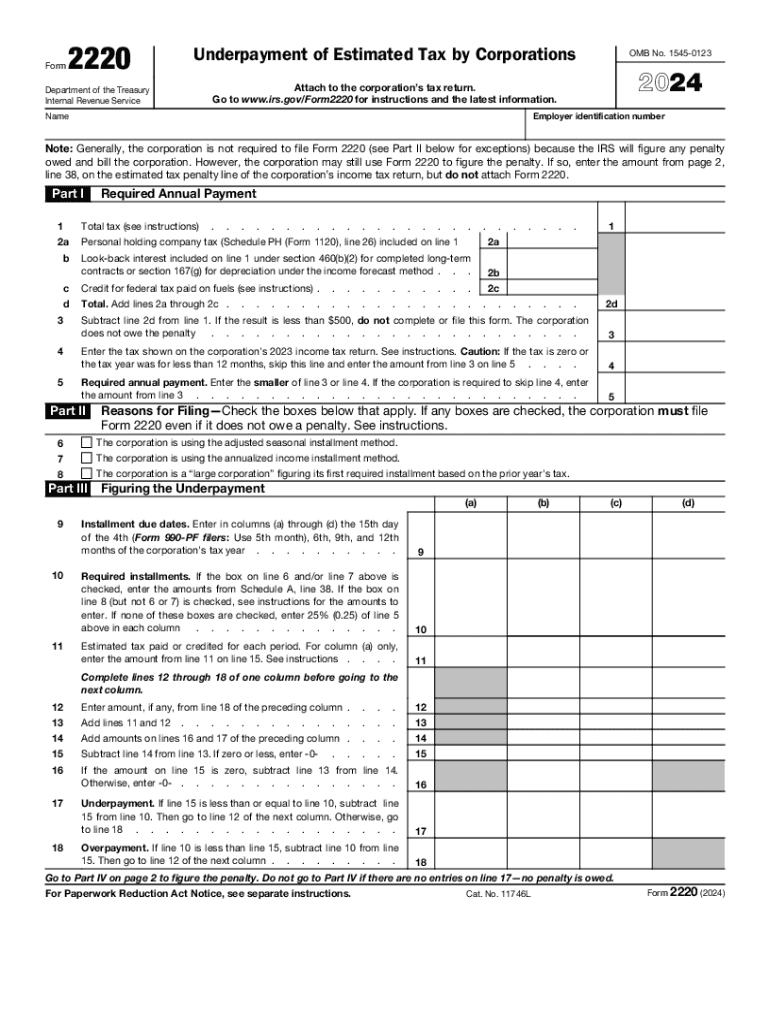

IRS 2220 2024 free printable template

Instructions and Help about IRS 2220

How to edit IRS 2220

How to fill out IRS 2220

Latest updates to IRS 2220

About IRS 2 previous version

What is IRS 2220?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 2220

What should I do if I realize I've made a mistake on my IRS 2220 after submitting?

If you discover an error on your submitted IRS 2220, you can correct it by filing an amended version. Ensure that you clearly mark the amended form and provide the correct information. Refer to the IRS guidelines on how to properly amend the form to avoid complications.

How can I verify if my IRS 2220 has been received by the IRS?

To verify the receipt of your IRS 2220, you can use the IRS online tracking tool if you filed electronically. If you mailed the form, consider contacting the IRS directly or checking the status through your account if available. Always retain proof of submission for your records.

What should I know about data security when filing IRS 2220 electronically?

When filing your IRS 2220 electronically, ensure that the software you use is compliant with IRS security requirements. It’s crucial to use secure internet connections and protect your personal data through encryption and secure passwords to safeguard your information.

What special considerations should foreign payees take when filing IRS 2220?

Foreign payees filing IRS 2220 must consider their residency status and any applicable tax treaties that may affect their obligations. It's advisable to consult with a tax professional familiar with international tax law to ensure compliance with IRS requirements and proper reporting.

What are common errors when filing the IRS 2220 and how can I avoid them?

Common errors when filing the IRS 2220 include incorrect calculations and missing supporting documentation. To avoid these mistakes, double-check your figures, ensure that you attach all necessary documents, and review the form thoroughly before submission. Consulting with a tax expert can also help.