Get the free Donation of Real Estate - SchwabWeiler

Show details

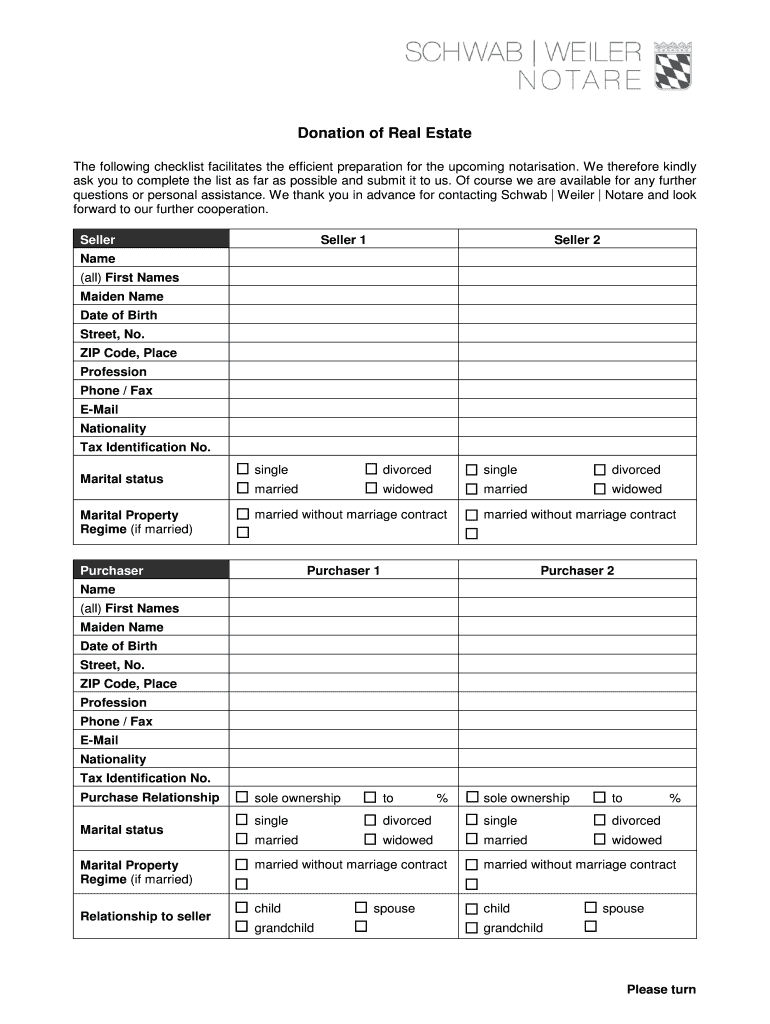

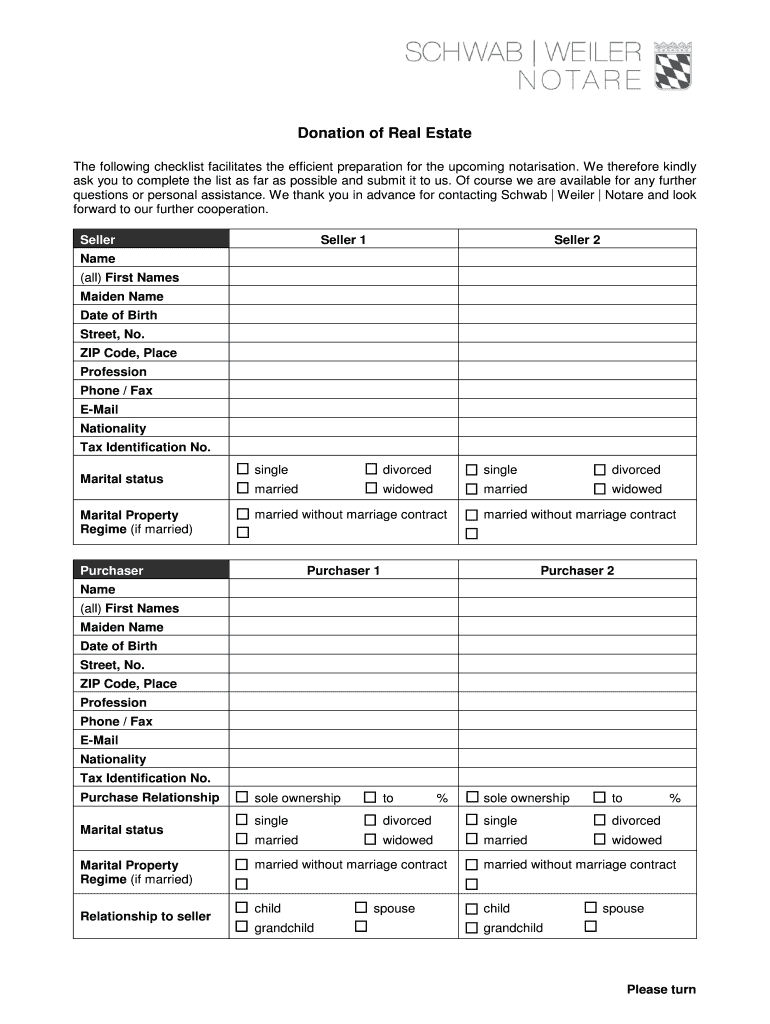

Donation of Real Estate The following checklist facilitates the efficient preparation for the upcoming notarization. We therefore kindly ask you to complete the list as far as possible and submit

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign donation of real estate

Edit your donation of real estate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your donation of real estate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit donation of real estate online

To use the professional PDF editor, follow these steps below:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit donation of real estate. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

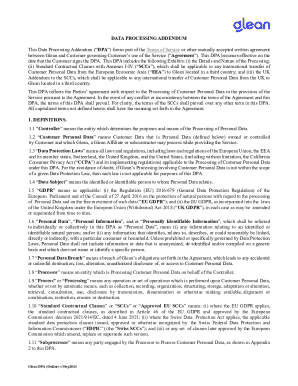

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out donation of real estate

How to fill out donation of real estate

01

Determine the organization or recipient of the donation. Research and choose a reputable non-profit organization or charity that accepts real estate donations.

02

Consult with a tax advisor or attorney to understand the legal and tax implications of donating real estate.

03

Gather all necessary documents related to the property, such as deed, title insurance, property tax statements, and any appraisals or evaluations.

04

Contact the chosen organization and discuss the process of donating real estate. They may have specific requirements or guidelines to follow.

05

Arrange for a professional appraisal of the property to determine its fair market value. This is important for tax purposes.

06

Complete the necessary paperwork provided by the organization, including a deed transfer and any additional forms required by your state or country.

07

Notify your mortgage lender, if applicable, about your intention to donate the property. They may need to provide consent or release any liens on the property.

08

Coordinate with the organization to schedule the transfer of the property's ownership.

09

Obtain a receipt or acknowledgement from the organization for tax purposes. This will help you claim a deduction on your tax returns.

10

Consult with a tax professional to understand the tax benefits and reporting requirements related to the donation of real estate.

Who needs donation of real estate?

01

Various organizations and individuals may benefit from real estate donations. These can include:

02

- Non-profit organizations or charities that rely on the sale or use of donated real estate to further their missions.

03

- Community development organizations that work towards revitalizing neighborhoods or providing affordable housing.

04

- Educational institutions, such as universities or schools, that may use the donated property for academic or research purposes.

05

- Environmental conservation groups that aim to protect and preserve natural lands or historical sites.

06

- Individuals or families in need of housing or shelter, who may benefit from donated real estate.

07

Ultimately, the specific recipients of real estate donations depend on the goals and focus of the donating individual or organization.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send donation of real estate to be eSigned by others?

To distribute your donation of real estate, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I create an electronic signature for the donation of real estate in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your donation of real estate and you'll be done in minutes.

How do I fill out donation of real estate using my mobile device?

Use the pdfFiller mobile app to fill out and sign donation of real estate. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is donation of real estate?

Donation of real estate is the transfer of ownership of a property from one party to another without any exchange of money.

Who is required to file donation of real estate?

The donor or the person giving away the real estate is required to file the donation of real estate.

How to fill out donation of real estate?

Donation of real estate can be filled out by completing the necessary forms provided by the relevant tax authority, and submitting them along with any required documentation.

What is the purpose of donation of real estate?

The purpose of donation of real estate is to legally transfer ownership of a property to another party as a gift.

What information must be reported on donation of real estate?

The information that must be reported on donation of real estate includes the details of the property being donated, the value of the property, the relationship between the donor and the recipient, and any other relevant information.

Fill out your donation of real estate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Donation Of Real Estate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.