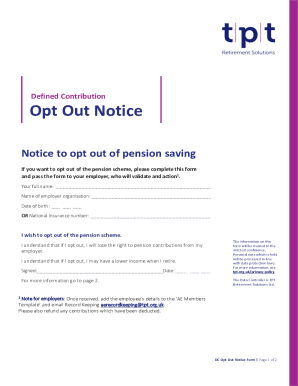

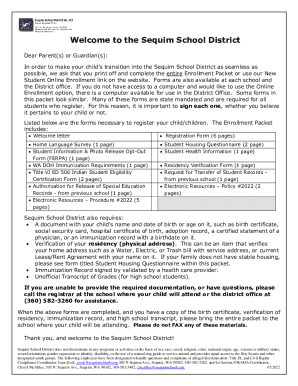

UK TPT Retirement Solutions Opt Out Notice 2016 free printable template

Show details

Defined Contributions Out Notice to opt out of pension saving

If you want to opt out of pension saving, please complete this form and pass

the form to your employer.

Your full name:

Name of Employer

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign UK TPT Retirement Solutions Opt Out

Edit your UK TPT Retirement Solutions Opt Out form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK TPT Retirement Solutions Opt Out form via URL. You can also download, print, or export forms to your preferred cloud storage service.

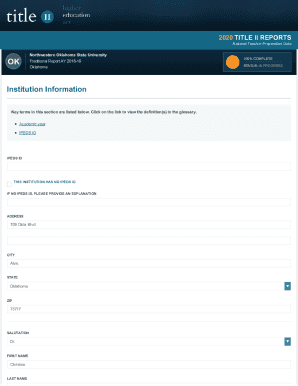

Editing UK TPT Retirement Solutions Opt Out online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit UK TPT Retirement Solutions Opt Out. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK TPT Retirement Solutions Opt Out Notice Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK TPT Retirement Solutions Opt Out

How to fill out UK TPT Retirement Solutions Opt Out Notice

01

Obtain the UK TPT Retirement Solutions Opt Out Notice form from your employer or the official website.

02

Read the instructions provided on the form carefully.

03

Fill in your personal details, including your name, address, and National Insurance number.

04

Indicate your decision to opt out of the pension scheme by ticking the appropriate box.

05

Sign and date the form to confirm your intent to opt out.

06

Submit the completed form to your employer or the designated HR department within the specified timeframe.

Who needs UK TPT Retirement Solutions Opt Out Notice?

01

Employees who are automatically enrolled in the UK TPT Retirement Solutions Pension Scheme but wish to opt out.

02

Individuals who do not wish to contribute to the pension plan for any personal or financial reasons.

Fill

form

: Try Risk Free

People Also Ask about

Should I pull out my pension?

If your income just covers your expenses, you may want to stick to monthly pension payments. You will depend more on that income to stay afloat in retirement. However, if your guaranteed income far exceeds your expenses, it may make sense to withdraw your pension before retirement as a lump sum.

Is it better to opt out of NHS pension?

'Many are opting out of the scheme because they are facing tax charges, but they may be better off staying put, even after the tax charges are taken into account, or could find ways to reduce their tax charges, for example, by taking a larger retirement lump sum.

Do I get a refund if I opt out of NHS pension?

A refund can only be made if a member has opted out of or left all pensionable NHS employments.

How do I opt out of my pension?

To opt out, you have to contact the pension scheme provider. They will tell you how to opt out. Your employer will provide you with their contact details. If you opt out within a month of your employer enrolling you, you'll get back any money you've already paid in.

Can I opt out of pension contributions UK?

You can leave (called 'opting out') if you want to. If you opt out within a month of your employer adding you to the scheme, you'll get back any money you've already paid in. You may not be able to get your payments refunded if you opt out later - they'll usually stay in your pension until you retire.

Can I take all of my NHS pension out?

You may be able to take up to a maximum lump sum of 25% of your capital value normally up to the tax free amount. The capital value is the value placed on your NHS Pension Scheme benefits by HMRC and is calculated by multiplying your reduced pension by 20 and adding the value of any lump sum.

How do I stop my pension contributions?

To opt out, you have to contact the pension scheme provider. They will tell you how to opt out. Your employer will provide you with their contact details. If you opt out within a month of your employer enrolling you, you'll get back any money you've already paid in.

What are the disadvantages of having a pension plan?

Cons of Pension Plans Employees have no control over how their pension money is invested. Company failure could lead to bankruptcy and reduction in employee pension benefits. Not all pensions transfer if you change employers. They're difficult to access.

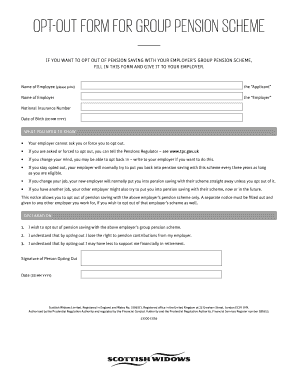

How do I opt out of auto Enrolment pension scheme?

You need to ask the pension provider for an opt out form so you can opt out of auto enrolment. Your employer must give you the contact details for the pension provider if you ask for them. You need to complete and sign the pension scheme opt out form, and return it to your employer (or the address given on the form).

What happens if I opt out of NHS pension?

It is possible to submit a written election to opt-out of the NHS pension scheme for future service. If you have two or more years qualifying scheme membership this will result in you being treated as a deferred member of the scheme, in the same way as if you had left pensionable service with your employer.

How do I opt out of my NHS pension?

To opt out, you must complete the application to leave the NHS Pension Scheme (SD502) form (PDF: 219KB). You and your NHS employer must complete the form. This is the only way to opt out of the NHS Pension Scheme.

How do I opt out of automatic Enrolment pension?

You need to ask the pension provider for an opt out form so you can opt out of auto enrolment. Your employer must give you the contact details for the pension provider if you ask for them. You need to complete and sign the pension scheme opt out form, and return it to your employer (or the address given on the form).

Should you opt out of pension?

Contributing to a pension does come at a cost. However, opting out now and giving up on the money your employer puts in will greatly reduce your pension at retirement and could mean that you're still going into work long after the point when you're ready to stop.

Is the NHS pension compulsory?

The NHS Pension Scheme is the default Scheme for all NHS employees. Employees need to actively opt out of the Scheme if they don't want to pay into it.

Can you opt out of paying pension UK?

You can leave (called 'opting out') if you want to. If you opt out within a month of your employer adding you to the scheme, you'll get back any money you've already paid in. You may not be able to get your payments refunded if you opt out later - they'll usually stay in your pension until you retire.

Can you pause auto Enrolment?

You will need to speak to your pension provider. It will then give you an opt-out form, which you will need to complete. Some of these forms are available online. If you opt out of the scheme within one month of being automatically enrolled, you will be treated as if you had never joined the scheme.

Are pensions worth keeping?

Why do you need a pension? Saving for retirement is one of the smartest financial habits you can develop. A pension plan means guaranteed income in retirement, giving you peace of mind in the present and future. In addition, many pension plans give the option of adding joint and survivor benefits for a spouse.

What happens if I leave NHS Pension Scheme?

If you leave the NHS scheme before completing two years of qualifying membership*, you're entitled to apply for a refund of the contributions you've made, rather than deferring or transferring your benefits. You can do this via the RF12 form, available from the NHS pensions hub.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit UK TPT Retirement Solutions Opt Out from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your UK TPT Retirement Solutions Opt Out into a dynamic fillable form that you can manage and eSign from anywhere.

Where do I find UK TPT Retirement Solutions Opt Out?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific UK TPT Retirement Solutions Opt Out and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I sign the UK TPT Retirement Solutions Opt Out electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your UK TPT Retirement Solutions Opt Out in seconds.

What is UK TPT Retirement Solutions Opt Out Notice?

The UK TPT Retirement Solutions Opt Out Notice is a formal document that allows individuals to opt out of certain pension schemes managed by TPT Retirement Solutions, which is responsible for administering pension benefits.

Who is required to file UK TPT Retirement Solutions Opt Out Notice?

Individuals who do not wish to participate in the pension scheme and want to officially opt out are required to file the UK TPT Retirement Solutions Opt Out Notice.

How to fill out UK TPT Retirement Solutions Opt Out Notice?

To fill out the UK TPT Retirement Solutions Opt Out Notice, individuals typically need to provide personal information, including their name, address, and member details, along with a signed declaration of their intent to opt out.

What is the purpose of UK TPT Retirement Solutions Opt Out Notice?

The purpose of the UK TPT Retirement Solutions Opt Out Notice is to provide a clear and documented process for individuals who choose not to contribute to the pension scheme, ensuring their decision is recorded and acknowledged.

What information must be reported on UK TPT Retirement Solutions Opt Out Notice?

The information that must be reported on the UK TPT Retirement Solutions Opt Out Notice includes the individual's full name, date of birth, member identification number, contact details, and signature, along with the date of the request.

Fill out your UK TPT Retirement Solutions Opt Out online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK TPT Retirement Solutions Opt Out is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.