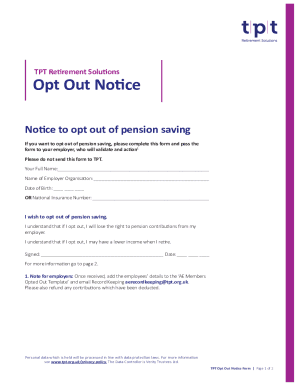

UK TPT Retirement Solutions Opt Out Notice 2020-2025 free printable template

Show details

Defined Contributions Out Notice to opt out of pension saving

If you want to opt out of the pension scheme, please complete this form

and pass the form to your employer, who will validate and action1.

Your

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign opt out notice pension form

Edit your opt out notice pension template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your uk opt out pension form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tpt retirement opt online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit opt out notice pension saving form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK TPT Retirement Solutions Opt Out Notice Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out opt out pension saving form

How to fill out UK TPT Retirement Solutions Opt Out Notice

01

Obtain the UK TPT Retirement Solutions Opt Out Notice form from your employer or the TPT website.

02

Fill in your personal details, including your name, address, and employee number.

03

Clearly indicate your decision to opt out of the pension scheme by tick marking the appropriate box provided.

04

Provide the date when you are filling out the form.

05

Sign the form to confirm your decision.

06

Submit the completed form to your employer's HR or payroll department as instructed.

Who needs UK TPT Retirement Solutions Opt Out Notice?

01

Individuals who wish to opt out of the UK TPT Retirement Solutions pension scheme.

02

Employees who are automatically enrolled in the pension scheme but prefer not to contribute.

03

Workers who have not previously opted in and want to formally decline participation.

Fill

tpt opt out pension form

: Try Risk Free

People Also Ask about uk opt out pension form pdf

Should I pull out my pension?

If your income just covers your expenses, you may want to stick to monthly pension payments. You will depend more on that income to stay afloat in retirement. However, if your guaranteed income far exceeds your expenses, it may make sense to withdraw your pension before retirement as a lump sum.

Is it better to opt out of NHS pension?

'Many are opting out of the scheme because they are facing tax charges, but they may be better off staying put, even after the tax charges are taken into account, or could find ways to reduce their tax charges, for example, by taking a larger retirement lump sum.

Do I get a refund if I opt out of NHS pension?

A refund can only be made if a member has opted out of or left all pensionable NHS employments.

How do I opt out of my pension?

To opt out, you have to contact the pension scheme provider. They will tell you how to opt out. Your employer will provide you with their contact details. If you opt out within a month of your employer enrolling you, you'll get back any money you've already paid in.

Can I opt out of pension contributions UK?

You can leave (called 'opting out') if you want to. If you opt out within a month of your employer adding you to the scheme, you'll get back any money you've already paid in. You may not be able to get your payments refunded if you opt out later - they'll usually stay in your pension until you retire.

Can I take all of my NHS pension out?

You may be able to take up to a maximum lump sum of 25% of your capital value normally up to the tax free amount. The capital value is the value placed on your NHS Pension Scheme benefits by HMRC and is calculated by multiplying your reduced pension by 20 and adding the value of any lump sum.

How do I stop my pension contributions?

To opt out, you have to contact the pension scheme provider. They will tell you how to opt out. Your employer will provide you with their contact details. If you opt out within a month of your employer enrolling you, you'll get back any money you've already paid in.

What are the disadvantages of having a pension plan?

Cons of Pension Plans Employees have no control over how their pension money is invested. Company failure could lead to bankruptcy and reduction in employee pension benefits. Not all pensions transfer if you change employers. They're difficult to access.

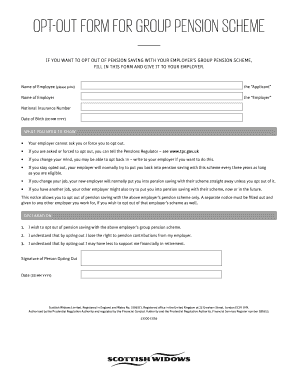

How do I opt out of auto Enrolment pension scheme?

You need to ask the pension provider for an opt out form so you can opt out of auto enrolment. Your employer must give you the contact details for the pension provider if you ask for them. You need to complete and sign the pension scheme opt out form, and return it to your employer (or the address given on the form).

What happens if I opt out of NHS pension?

It is possible to submit a written election to opt-out of the NHS pension scheme for future service. If you have two or more years qualifying scheme membership this will result in you being treated as a deferred member of the scheme, in the same way as if you had left pensionable service with your employer.

How do I opt out of my NHS pension?

To opt out, you must complete the application to leave the NHS Pension Scheme (SD502) form (PDF: 219KB). You and your NHS employer must complete the form. This is the only way to opt out of the NHS Pension Scheme.

How do I opt out of automatic Enrolment pension?

You need to ask the pension provider for an opt out form so you can opt out of auto enrolment. Your employer must give you the contact details for the pension provider if you ask for them. You need to complete and sign the pension scheme opt out form, and return it to your employer (or the address given on the form).

Should you opt out of pension?

Contributing to a pension does come at a cost. However, opting out now and giving up on the money your employer puts in will greatly reduce your pension at retirement and could mean that you're still going into work long after the point when you're ready to stop.

Is the NHS pension compulsory?

The NHS Pension Scheme is the default Scheme for all NHS employees. Employees need to actively opt out of the Scheme if they don't want to pay into it.

Can you opt out of paying pension UK?

You can leave (called 'opting out') if you want to. If you opt out within a month of your employer adding you to the scheme, you'll get back any money you've already paid in. You may not be able to get your payments refunded if you opt out later - they'll usually stay in your pension until you retire.

Can you pause auto Enrolment?

You will need to speak to your pension provider. It will then give you an opt-out form, which you will need to complete. Some of these forms are available online. If you opt out of the scheme within one month of being automatically enrolled, you will be treated as if you had never joined the scheme.

Are pensions worth keeping?

Why do you need a pension? Saving for retirement is one of the smartest financial habits you can develop. A pension plan means guaranteed income in retirement, giving you peace of mind in the present and future. In addition, many pension plans give the option of adding joint and survivor benefits for a spouse.

What happens if I leave NHS Pension Scheme?

If you leave the NHS scheme before completing two years of qualifying membership*, you're entitled to apply for a refund of the contributions you've made, rather than deferring or transferring your benefits. You can do this via the RF12 form, available from the NHS pensions hub.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit uk tpt notice from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including tpt out pension form, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Can I create an eSignature for the pension opt out form template in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your tpt opt out form and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I fill out uk opt out pension form online using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign out notice pension form and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is UK TPT Retirement Solutions Opt Out Notice?

The UK TPT Retirement Solutions Opt Out Notice is a formal document that allows individuals to opt out of participating in the TPT Retirement Solutions pension scheme.

Who is required to file UK TPT Retirement Solutions Opt Out Notice?

Employees who wish to opt out of the TPT Retirement Solutions pension scheme are required to file the Opt Out Notice.

How to fill out UK TPT Retirement Solutions Opt Out Notice?

To fill out the UK TPT Retirement Solutions Opt Out Notice, individuals need to provide their personal details such as name, address, and employee identification number, as well as indicate their decision to opt out.

What is the purpose of UK TPT Retirement Solutions Opt Out Notice?

The purpose of the UK TPT Retirement Solutions Opt Out Notice is to formally inform the pension scheme administrators of an individual's decision to decline membership in the pension plan.

What information must be reported on UK TPT Retirement Solutions Opt Out Notice?

The information that must be reported on the UK TPT Retirement Solutions Opt Out Notice includes the individual's full name, address, employee identification number, and a declaration of their decision to opt out of the scheme.

Fill out your opt out notice pension online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tpt Notice Pension is not the form you're looking for?Search for another form here.

Keywords relevant to uk tpt opt

Related to tpt opt out pension

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.