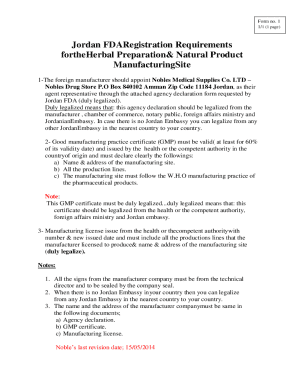

OH W-3 2018 free printable template

Show details

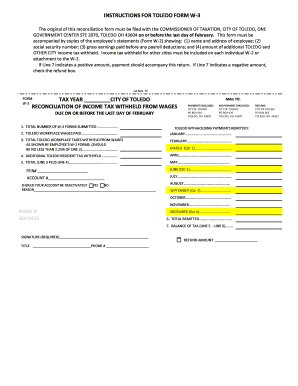

INSTRUCTIONS FOR TOLEDO FORM W3

The original of this reconciliation form must be filed with the COMMISSIONER OF TAXATION, CITY OF TOLEDO, ONE

GOVERNMENT CTR STE 2070, TOLEDO OH 436042280 on or before

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OH W-3

Edit your OH W-3 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OH W-3 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing OH W-3 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit OH W-3. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OH W-3 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OH W-3

How to fill out OH W-3

01

Gather all required information, including total wages paid and taxes withheld.

02

Locate the OH W-3 form on the Ohio Department of Taxation website or obtain a physical copy.

03

Fill in your business information, including name, address, and federal identification number.

04

Enter the total number of employees for whom you are submitting the form.

05

Report the total taxable wages in the appropriate section.

06

Calculate and enter the total amount of Ohio withholding tax collected.

07

Double-check all entries for accuracy before submission.

08

Sign and date the form where indicated.

09

Submit the completed OH W-3 to the Ohio Department of Taxation by the due date.

Who needs OH W-3?

01

Employers in Ohio who have withheld state income tax from employees' wages must complete the OH W-3 form.

02

Businesses that file quarterly or annual withholding tax returns in Ohio are required to submit the form.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to file a city of Toledo tax return?

Any taxpayer having or anticipating an annual tax liability to the city of Toledo exceeding $200 shall file a declaration of estimated tax and pay the estimated tax due in quarterly installments. Complete the appropriate Estimated Toledo Tax Form D-1 for each quarterly payment.

Do I have to pay city of Toledo taxes?

All residents and non-residents working in Toledo who have earned income are subject to the 2.5% City of Toledo income tax regardless of age.

What is Toledo Ohio code?

Area Code 419 phone numbers - Toledo.

What is the tax code for the city of Toledo?

In ance with Toledo Municipal Code 1905.011, effective January 1, 2021, the city of Toledo income tax rate is two and one-half percent (2.5%).

Who must file city of Toledo taxes?

Any income that was earned in the city of Toledo is taxable regardless of your residency. Fill in your First Name and Middle Initial, Last Name and your Social Security Number. (Your complete social security number is required).

Who needs to file a Toledo tax return?

Any income that was earned in the city of Toledo is taxable regardless of your residency. Fill in your First Name and Middle Initial, Last Name and your Social Security Number. (Your complete social security number is required).

What is the city tax rate for Toledo Ohio?

The minimum combined 2023 sales tax rate for Toledo, Ohio is 7.75%.

Who has to file Toledo tax return?

Any income that was earned in the city of Toledo is taxable regardless of your residency. Fill in your First Name and Middle Initial, Last Name and your Social Security Number. (Your complete social security number is required).

Do I have to file city of Toledo taxes?

Any taxpayer having or anticipating an annual tax liability to the city of Toledo exceeding $200 shall file a declaration of estimated tax and pay the estimated tax due in quarterly installments. Complete the appropriate Estimated Toledo Tax Form D-1 for each quarterly payment.

Who must file a city of Toledo tax return?

Any income that was earned in the city of Toledo is taxable regardless of your residency. Fill in your First Name and Middle Initial, Last Name and your Social Security Number. (Your complete social security number is required).

Who is required to file an Ohio state tax return?

Every Ohio resident and every part-year resident is subject to the Ohio income tax. Every nonresident having Ohio-sourced income must also file.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my OH W-3 in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your OH W-3 and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I execute OH W-3 online?

pdfFiller has made it simple to fill out and eSign OH W-3. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How can I edit OH W-3 on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing OH W-3.

What is OH W-3?

OH W-3 is the annual reconciliation form used in Ohio for reporting wages and tax withholdings to the state of Ohio, typically submitted by employers.

Who is required to file OH W-3?

Employers who have withheld Ohio income tax from their employees' wages during the tax year are required to file the OH W-3.

How to fill out OH W-3?

To fill out the OH W-3, employers must provide their identification information, total wages paid, total Ohio income tax withheld, and any other specific details required by the form.

What is the purpose of OH W-3?

The purpose of OH W-3 is to summarize the total wages and tax withholdings for the year and to ensure proper reporting and compliance with Ohio tax laws.

What information must be reported on OH W-3?

The information that must be reported on OH W-3 includes the employer's name and identification number, total wages paid, total Ohio income tax withheld, and any adjustments or corrections to those figures.

Fill out your OH W-3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OH W-3 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.