Get the free Mobile Remote Deposit Services Disclosure and Agreement

Show details

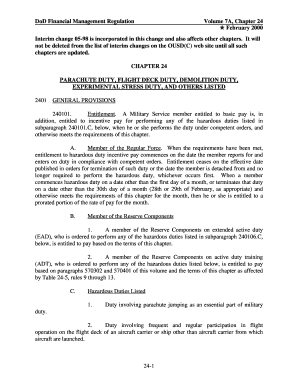

MOBILE REMOTE DEPOSIT SERVICES AGREEMENT

Limits

$2,500 per day

AND

$10,000 over any 30day period

Mobile Deposit is designed to allow you to make deposits of checks (original checks)

to your accounts

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mobile remote deposit services

Edit your mobile remote deposit services form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mobile remote deposit services form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mobile remote deposit services online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit mobile remote deposit services. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mobile remote deposit services

How to fill out mobile remote deposit services

01

To fill out mobile remote deposit services, follow the steps below:

02

Download and open the mobile banking application on your smartphone.

03

Log in to your account using your username and password.

04

Locate the 'Deposit' or 'Check Deposit' option within the application.

05

Select the account you want to deposit the check into.

06

Place the check on a well-lit surface and ensure it is not folded or torn.

07

Capture images of the front and back of the check using the camera feature within the application.

08

Verify the check's details, such as amount and recipient, and confirm the deposit.

09

Keep the physical check in a safe place until it is clearly indicated as deposited.

10

Wait for confirmation of successful deposit and funds availability in your account.

11

Review your account balance to ensure the deposited amount is correctly reflected.

12

Consider securely disposing of the physical check to prevent double depositing.

13

Repeat the process for additional check deposits if needed.

14

Note: The specific steps may vary depending on the mobile banking application you are using. Refer to the application's user guide or contact customer support for any additional assistance.

Who needs mobile remote deposit services?

01

Mobile remote deposit services are beneficial for individuals and businesses who want to conveniently deposit checks without visiting a physical bank branch. This service is particularly useful for:

02

- Individuals who receive checks regularly, such as salary payments, reimbursements, or insurance claims, and prefer the convenience of depositing them from their mobile devices.

03

- Small business owners and freelancers who want to streamline their cash flow by depositing customer payments through mobile remote deposit services.

04

- Individuals who have limited access to physical bank branches or face mobility challenges, making it difficult to deposit checks in person.

05

- Busy professionals who want to save time by avoiding trips to the bank for check deposits.

06

By using mobile remote deposit services, these individuals and businesses can enjoy the benefits of faster and more convenient check deposits, improved accessibility, and increased efficiency in managing their finances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit mobile remote deposit services from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including mobile remote deposit services, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I get mobile remote deposit services?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific mobile remote deposit services and other forms. Find the template you need and change it using powerful tools.

How do I edit mobile remote deposit services straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing mobile remote deposit services right away.

What is mobile remote deposit services?

Mobile remote deposit services allow users to deposit checks into their bank accounts using a mobile device.

Who is required to file mobile remote deposit services?

Financial institutions offering mobile remote deposit services are required to file reports.

How to fill out mobile remote deposit services?

Mobile remote deposit services must be filled out electronically through the designated reporting system.

What is the purpose of mobile remote deposit services?

The purpose of mobile remote deposit services is to provide users with a convenient way to deposit checks without visiting a physical bank branch.

What information must be reported on mobile remote deposit services?

Information such as the amount of checks deposited, the date of deposit, and the account number must be reported on mobile remote deposit services.

Fill out your mobile remote deposit services online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mobile Remote Deposit Services is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.