IL A/114 2004 free printable template

Show details

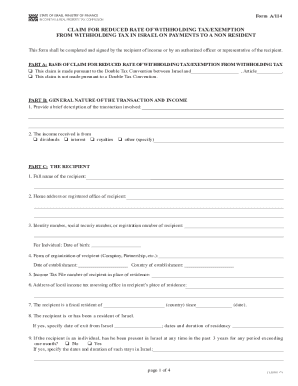

STATE OF ISRAEL MINISTRY OF FINANCE INCOME TAX & REAL PROPERTY TAX Commissioner A/114CLAIM FOR REDUCED RATE OF WITHHOLDING TAX/EXEMPTION FROM WITHHOLDING TAX IN ISRAEL ON PAYMENTS TO A NON-RESIDENT

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign IL A114

Edit your IL A114 form online

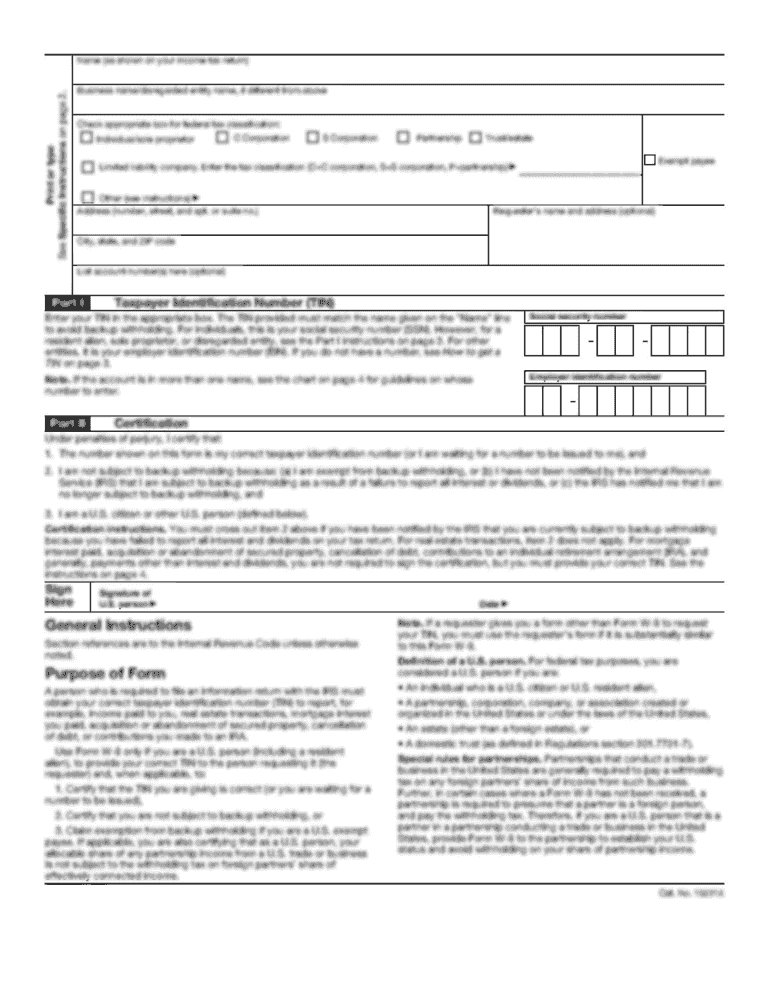

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL A114 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IL A114 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IL A114. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL A/114 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL A114

How to fill out IL A/114

01

Obtain the IL A/114 form from the appropriate government website or office.

02

Read the instructions carefully to understand the requirements.

03

Fill out your personal information, including name, address, and contact details.

04

Provide any necessary identification numbers, such as Social Security Number or tax identification number.

05

Complete the relevant sections as per your situation, ensuring accuracy in all entries.

06

Review the completed form for any errors or omissions.

07

Sign and date the form where required.

08

Submit the form by the designated method, whether by mail or electronically, according to the guidelines.

Who needs IL A/114?

01

Individuals or entities that are required to report specific income or financial information to the tax authorities.

02

Businesses that need to comply with legal reporting requirements in the state.

03

Any applicants seeking grants, loans, or financial assistance that require the submission of financial documentation.

Fill

form

: Try Risk Free

People Also Ask about

What is the withholding tax on dividends paid to foreign shareholders?

All persons ('withholding agents') making US-source fixed, determinable, annual, or periodical (FDAP) payments to foreign persons generally must report and withhold 30% of the gross US-source FDAP payments, such as dividends, interest, royalties, etc.

How much tax do I pay on shares from US to UK?

Yes, UK residents are charged withholding tax (WHT) of 15% on dividends or income received from US stocks.

Are foreign dividends subject to withholding tax?

Foreign dividends are often subject to withholding tax - the overseas company will deduct tax before paying you the dividend.

Do you pay tax on US dividends?

Anyone who receives dividends must pay taxes on them. The tax treatment of dividends in the U.S. depends on whether the Internal Revenue Code classifies them as qualified or ordinary dividends. Qualified dividends are taxed at the same rates as the capital gains tax rate, which is lower than ordinary income tax rates.

Do I pay tax on US dividends in the UK?

You usually need to fill in a Self Assessment tax return if you're a UK resident with foreign income or capital gains. But there's some foreign income that's taxed differently. You do not need to fill in a tax return if all the following apply: your only foreign income is dividends.

How much tax do you pay on royalties UK?

Since royalties are part of your income, they count towards your annual tax. Declaring royalties on your UK tax return is therefore necessary if you receive them from your original music, production, or any other intellectual property.

What is the tax payable on foreign dividends?

Remittance basis and foreign dividends The dividend tax rates do not apply to relevant foreign income; instead this income is taxable at the default income tax rates that apply in the year of remittance (currently 20%, 40% and 45%). For more on the remittance basis, see the Remittance basis ― overview guidance note.

How are US dividends taxed for UK investors?

How are dividends in the UK generally taxed by the IRS? Because the UK has a Tax Treaty with the US, UK dividends are subject to preferential tax rates instead of the regular tax rate of up to 39.6%. These UK 'qualified dividends' are only subject to 0-20% tax.

What is the tax rate for royalties in the UK?

UK domestic law requires a UK payer to withhold income tax of 20% on the payment of interest and royalties to non-residents. There is no withholding requirement for dividend payments.

How much tax do I pay on US dividends in the UK?

Hi, Article 10(2)(b) of the UK and USA double taxation agreement allows for both countries to tax the dividends and limits Foreign Tax Credit Relief for dividends to a maximum of 15%.

What is HMRC withholding tax on interest?

UK domestic law requires a UK payer to withhold income tax of 20% on the payment of interest and royalties to non-residents. There is no withholding requirement for dividend payments.

What is withholding tax on interest payments?

Interest determined with reference to the profits of the issuer or one of its associated enterprises typically is taxed at 15%.

Is interest subject to withholding tax?

Most interest income is taxable as ordinary income on your federal tax return, and is therefore subject to ordinary income tax rates. There are a few exceptions, however. Generally speaking, most interest is considered taxable at the time you receive it or can withdraw it.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in IL A114 without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your IL A114, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I edit IL A114 straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit IL A114.

How do I fill out IL A114 using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign IL A114 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is IL A/114?

IL A/114 is a tax form used in the state of Illinois for reporting certain financial information related to foreign income or investments.

Who is required to file IL A/114?

Individuals and entities that have income from foreign sources, own foreign financial accounts, or hold investments in foreign entities are required to file IL A/114.

How to fill out IL A/114?

To fill out IL A/114, you will need to provide personal identification information, details of foreign accounts or investments, and any relevant income figures. Instructions are usually provided with the form to guide you through the process.

What is the purpose of IL A/114?

The purpose of IL A/114 is to collect information on foreign income and financial assets to ensure compliance with state tax laws and to identify potential tax liabilities.

What information must be reported on IL A/114?

Information that must be reported on IL A/114 includes the names of foreign accounts, account numbers, maximum values of accounts during the year, details of foreign investments, and any income derived from those sources.

Fill out your IL A114 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL a114 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.