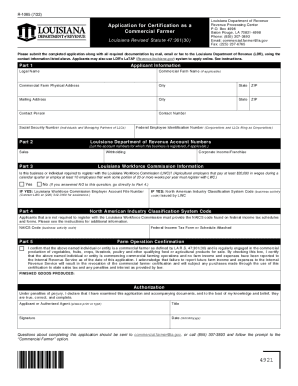

LA R-1085 2018 free printable template

Show details

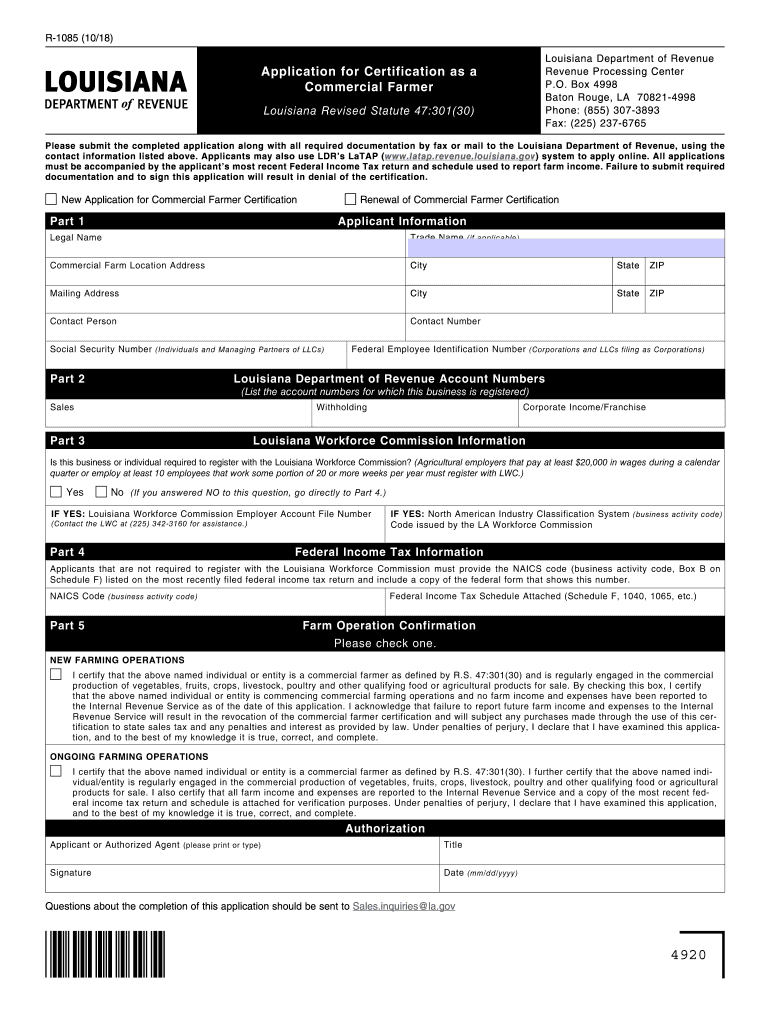

R1085 (10/18)

Louisiana Department of Revenue Processing Center

P.O. Box 4998

Baton Rouge, LA 708214998

Phone: (855) 3073893

Fax: (225) 2376765Application for Certification as a

Commercial Farmer

Louisiana

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign LA R-1085

Edit your LA R-1085 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your LA R-1085 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit LA R-1085 online

Follow the guidelines below to use a professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit LA R-1085. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

LA R-1085 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out LA R-1085

How to fill out LA R-1085

01

Obtain the LA R-1085 form from the official website or your local tax office.

02

Begin filling out your personal information in the designated fields, including your name, address, and social security number.

03

Carefully read each section and provide the required financial information, such as income details and deductions.

04

Make sure to double-check your entries for accuracy and completeness to avoid delays.

05

Sign and date the form where indicated.

06

Submit the completed form through the prescribed method, either electronically or by mail, to the relevant tax authority.

Who needs LA R-1085?

01

Individuals or households in need of tax relief or assistance.

02

Taxpayers who qualify for certain credits and deductions available through the form.

03

Residents of the jurisdiction that requires filing this particular form for tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is the tax exempt form for farmers in Louisiana?

Farmer Certification The purchaser must complete the R-1060 and attach a copy of their LDR-approved R-1085 (Farmer or Agricultural Facility Certification) to be exempted from state sales tax on the first $50,000 of the sales price of the items listed below.

Can you have a farm in Louisiana?

Growing crops in Louisiana Sugar cane is the leading farm product in Louisiana. Other important field crops include rice, soybeans, cotton and corn for grain. Sweet potatoes and tomatoes are the state's most important vegetable crops, and peaches, strawberries and melons lead the fruit crops.

How many acres do you need to qualify for ag exemption in louisiana?

Louisiana vaguely stipulates that agricultural properties must be a least three acres in size or have produced an average gross annual income of $2,000 or more for the preceding four years.

How do I become tax exempt in Louisiana?

You can apply for federal tax exemption with the IRS. They will in turn send you a Letter of Determination stating your tax exempt status if granted after the long review process. Once you have Federal tax exempt 501c3 status you can work with the Department of Revenue to apply for Louisiana tax exemptions.

What is the property tax on a farm in Louisiana?

Agricultural, horticultural, marsh and timber lands are assessed at 15% of use value.

What is considered a farm in Louisiana?

Bona Fide Agricultural Land – land devoted to the production for sale, in reasonable commercial quantities, of plants and animals, or their products, useful to man and agricultural land under a contract with a state or federal agency restricting its use for agricultural production.

What classifies you as a farm?

USDA defines a farm as any place that produced and sold—or normally would have produced and sold—at least $1,000 of agricultural products during a given year. USDA uses acres of crops and head of livestock to determine if a place with sales less than $1,000 could normally produce and sell at least that amount.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete LA R-1085 online?

pdfFiller has made it easy to fill out and sign LA R-1085. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I sign the LA R-1085 electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your LA R-1085 in seconds.

How do I edit LA R-1085 on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign LA R-1085 right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is LA R-1085?

LA R-1085 is a Louisiana state tax form used to report certain types of income and deductions for individual taxpayers.

Who is required to file LA R-1085?

Individuals who have specific types of income not reported on other Louisiana tax forms, or those claiming certain deductions are required to file LA R-1085.

How to fill out LA R-1085?

To fill out LA R-1085, taxpayers should provide their personal information, report income from various sources, claim applicable deductions, and calculate the tax owed based on the reported figures.

What is the purpose of LA R-1085?

The purpose of LA R-1085 is to ensure proper reporting of miscellaneous income and deductions that are not captured in standard Louisiana income tax forms, allowing the state to accurately assess taxes owed.

What information must be reported on LA R-1085?

LA R-1085 requires the reporting of specific income types, deductions claimed, taxpayer identification details, and any necessary calculations related to the tax obligation.

Fill out your LA R-1085 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

LA R-1085 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.