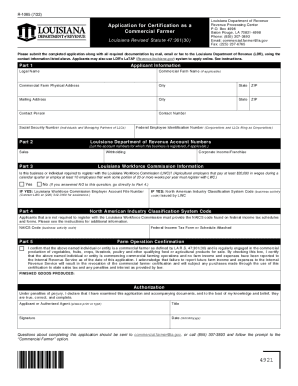

LA R-1085 2021 free printable template

Show details

R1085 (11/21)

Louisiana Department of Revenue Processing Center

P.O. Box 4998

Baton Rouge, LA 708214998

Phone: (855) 3073893

Email: commercial.farmer@la.gov

Fax: (225) 2376765Application for Certification

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign LA R-1085

Edit your LA R-1085 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your LA R-1085 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing LA R-1085 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit LA R-1085. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

LA R-1085 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out LA R-1085

How to fill out LA R-1085

01

Obtain the LA R-1085 form from the appropriate state department or website.

02

Read the instructions carefully to understand the requirements.

03

Fill out your personal information in the designated fields, including name, address, and contact details.

04

Provide any necessary identification numbers, such as Social Security Number or Tax ID.

05

Complete the sections related to your specific situation, referencing any required documentation.

06

Double-check all entries for accuracy and completeness.

07

Sign and date the form at the indicated sections.

08

Submit the completed form through the specified submission method (online, by mail, etc.).

Who needs LA R-1085?

01

Individuals or entities required to report specific information to the state tax authority.

02

Taxpayers filing for tax credits or deductions that necessitate the use of LA R-1085.

03

Business owners needing to provide specific financial or operational details.

Fill

form

: Try Risk Free

People Also Ask about

How do I become a tax exempt farm in Louisiana?

Farmer Certification The purchaser must complete the R-1060 and attach a copy of their LDR-approved R-1085 (Farmer or Agricultural Facility Certification) to be exempted from state sales tax on the first $50,000 of the sales price of the items listed below.

What is Farmer exemption?

• Farm saved seed exception or exemption (also known as farmers' privilege) refers to the. optional exception permitted by the breeder's right in Article 15(2) of the 1991 Act of the. UPOV Convention which “within reasonable limits and subject to the safeguarding of the.

How many chickens do you need to be considered a farm?

To be a legal “farm” for tax purposes you have minimum acreage requirements and there there are maximum amounts of livestock depending on zoning, A1, A2, etc. So, legally, if your plot of land qualifies as a farm, 1 chicken should be enough. If it does not meet the land qualifications, the # of chickens doesn't matter.

What does the IRS consider a farm?

A farm includes livestock, dairy, poultry, fish, fruit, and truck farms. It also includes plantations, ranches, ranges, and orchards.

When can you call yourself a farm?

ing to the United States Internal Revenue Service, a business qualifies as a farm if it is actively cultivating, operating or managing land for profit. A farm includes livestock, dairy, poultry, fish, vegetables and fruit.

What qualifies as a farm to the IRS?

A farm includes livestock, dairy, poultry, fish, fruit, and truck farms. It also includes plantations, ranches, ranges, and orchards.

What qualifies as a farm in Louisiana?

Bona Fide Agricultural Land – land devoted to the production for sale, in reasonable commercial quantities, of plants and animals, or their products, useful to man and agricultural land under a contract with a state or federal agency restricting its use for agricultural production.

How do I get tax exempt for farming in Louisiana?

Farmer Certification The purchaser must complete the R-1060 and attach a copy of their LDR-approved R-1085 (Farmer or Agricultural Facility Certification) to be exempted from state sales tax on the first $50,000 of the sales price of the items listed below.

Who qualifies for farm tax exemption in Louisiana?

Farmer Certification The purchaser must complete the R-1060 and attach a copy of their LDR-approved R-1085 (Farmer or Agricultural Facility Certification) to be exempted from state sales tax on the first $50,000 of the sales price of the items listed below.

How do you become tax exempt in Louisiana?

INFORMATION ON APPLYING FOR TAX EXEMPTION IN LOUISIANA You can apply to obtain Louisiana sales tax exemption by filing form R-1048, the Application for Exemption from Collection of Louisiana State Sales Tax with the Louisiana Department of Revenue.

What justifies a farm?

IRS definition of what qualifies as a farm ing to the United States Internal Revenue Service, a business qualifies as a farm if it is actively cultivating, operating or managing land for profit. A farm includes livestock, dairy, poultry, fish, vegetables and fruit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my LA R-1085 directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign LA R-1085 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I modify LA R-1085 without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your LA R-1085 into a dynamic fillable form that you can manage and eSign from anywhere.

How do I complete LA R-1085 on an Android device?

Complete LA R-1085 and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is LA R-1085?

LA R-1085 is a tax form used in Louisiana for the reporting of certain income and deductions related to business activities.

Who is required to file LA R-1085?

Entities or individuals engaged in specific business activities in Louisiana that meet certain income thresholds or other criteria are required to file LA R-1085.

How to fill out LA R-1085?

To fill out LA R-1085, taxpayers must provide their business details, report total income, and claim any deductions that apply to their business activities following the instructions provided with the form.

What is the purpose of LA R-1085?

The purpose of LA R-1085 is to ensure that businesses report their income accurately and pay the correct amount of taxes to the state of Louisiana.

What information must be reported on LA R-1085?

Information that must be reported includes the entity's name, tax identification number, total income earned, qualifying deductions, and other relevant financial data.

Fill out your LA R-1085 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

LA R-1085 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.