PA Schedule PA-40X 2018 free printable template

Show details

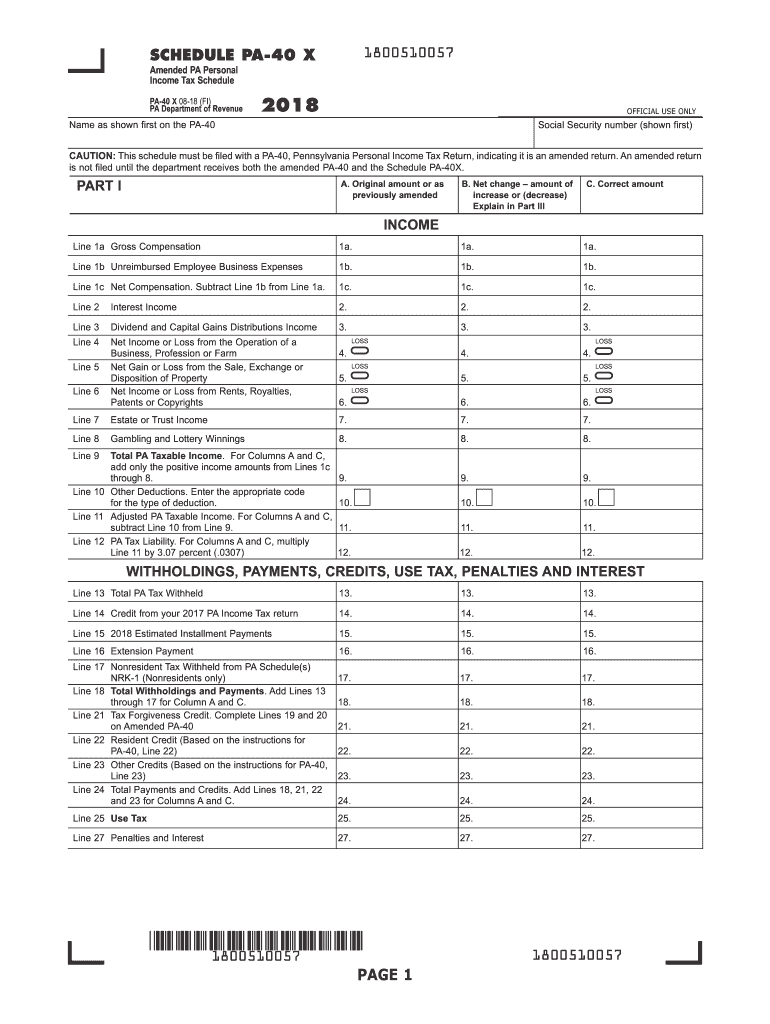

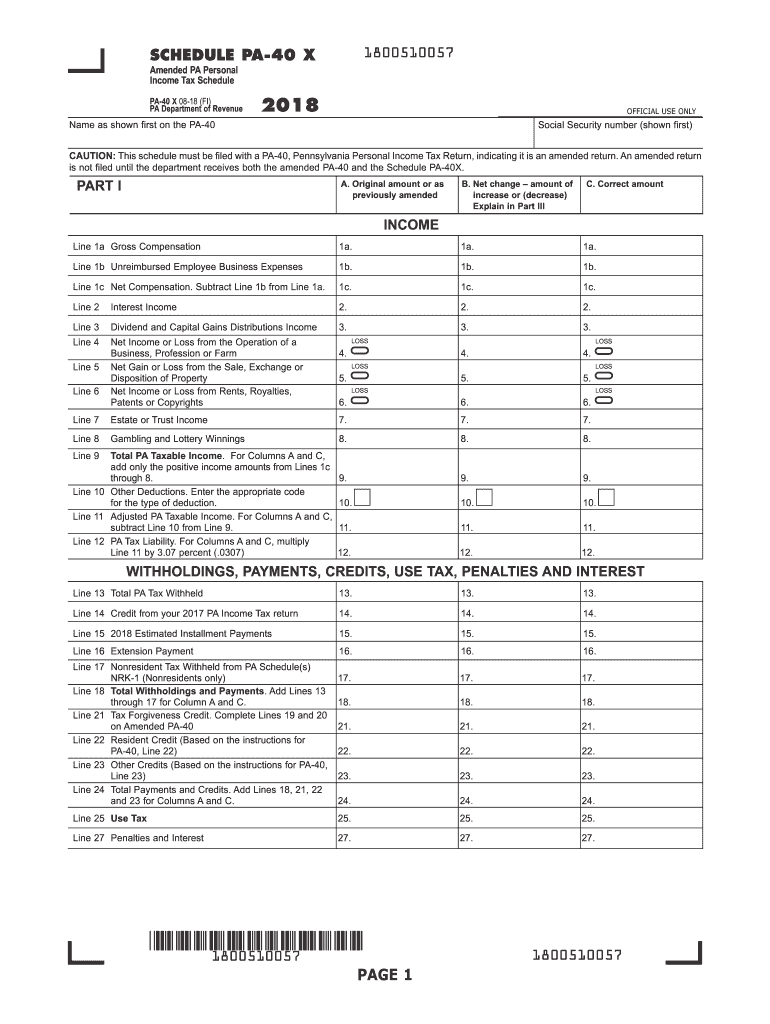

1800510057SCHEDULE PA40 X

Amended PA Personal

Income Tax Schedule

START

HERE

PA40 X 0818 (FI)

PA Department of Revenue2018OFFICIAL USE Online as shown first on the PA40Social Security number (shown

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign schedule pa tax

Edit your schedule pa tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule pa tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing schedule pa tax online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit schedule pa tax. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA Schedule PA-40X Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out schedule pa tax

How to fill out PA Schedule PA-40X

01

Obtain a copy of PA Schedule PA-40X from the Pennsylvania Department of Revenue website or your tax preparer.

02

Review your original PA-40 tax return to understand what changes you need to report.

03

Complete the top section of the form with your personal information including your name and Social Security number.

04

In the section for 'Amended Return', indicate the tax year you are amending.

05

Explain the reasons for amending your return in the designated area.

06

Complete the rest of the form by entering the corrected information and calculations.

07

Attach any necessary supporting documents that justify the changes.

08

Sign and date the form before submitting it to the Pennsylvania Department of Revenue.

Who needs PA Schedule PA-40X?

01

Any taxpayer who needs to amend their previously filed Pennsylvania personal income tax return.

02

Taxpayers who made errors in reporting income, deductions, credits, or other tax-related items on their PA-40 form.

03

Individuals who received a notice from the Pennsylvania Department of Revenue indicating discrepancies in their filed return.

Fill

form

: Try Risk Free

People Also Ask about

What is Schedule O on PA tax return?

PA SCHEDULE O (LINE 10) Taxpayers claiming deductions for IRC Section 529 Qualified Tuition Program contributions, Medical Savings Account contributions or Health Savings Account contributions must complete PA Schedule O.

Who has to file a PA tax return?

State law requires Pennsylvania residents with earned income, wages and net profits, to file an annual tax return along with supporting documentation, such as a W-2. You must file the tax return even if you are: subject to employer withholding.

Who must file PA Schedule A?

PA resident and part-year resident taxpayers must complete and include PA-40 Schedule A with an originally filed PA-40, Personal Income Tax Return, if there are any amounts on Lines 2 through 15 (not including subtotal Lines 4 and 10).

Who Must File Pa Schedule A?

PA resident and part-year resident taxpayers must complete and include PA-40 Schedule A with an originally filed PA-40, Personal Income Tax Return, if there are any amounts on Lines 2 through 15 (not including subtotal Lines 4 and 10).

Who is subject to PA income tax withholding?

Pennsylvania law requires every employer located or transacting business in Pennsylvania to withhold Pennsylvania personal income tax from compensation of resident employees for services performed either within or outside Pennsylvania, and from compensation of nonresident employees for services performed within

What is PA Schedule J?

Income from Estates or Trusts. PA-20S/PA-65 J IN (DR) 05-20. PURPOSE OF SCHEDULE. Use the PA-20S/PA-65 Schedule J to report the total income received from an estate or trust or that the estate or trust credited as reported on PA-20S/PA-65 Schedule RK-1 and/or NRK-1.

Who must file a PA partnership Return?

A partnership must file a PA-20S/PA-65 Information Return to report the income, deductions, gains, losses etc. from their operations. The partnership passes through any profits (losses) to the resident and nonresident partners.

What is the tax rate schedule?

There are seven federal tax brackets for the 2022 tax year: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Your bracket depends on your taxable income and filing status.

Who must file a PA nonresident return?

Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA-40) when they received total PA gross taxable income more than $33, even if no PA tax is due.

What is schedule GL PA?

Use PA Schedule G-L to calculate and report the amount of resident credit claimed for income tax, wage tax or other tax (measured by gross or net earned or unearned income) paid to another state when the other state imposes its tax on income also subject to PA personal income tax in the same taxable year.

Do all tax returns have a schedule A?

Schedule A is required in any year you choose to itemize your deductions. The schedule has seven categories of expenses: medical and dental expenses, taxes, interest, gifts to charity, casualty and theft losses, job expenses and certain miscellaneous expenses.

What is a Schedule C in PA?

Even if you have no differences between your federal and Pennsylvania expenses, you must complete and include PA Schedule C to report your income for Pennsylvania personal income tax purposes. You may use any accounting method for PA purposes, as long as you apply your accounting methods consistently.

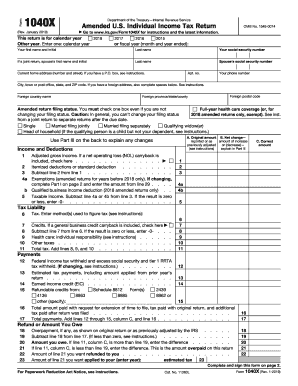

Is schedule 1 the same as 1040?

One of those forms is Schedule 1 (Form 1040), which lists additional types of income that aren't listed on Form 1040, as well as some additional adjustments to income.

What is PA Schedule D?

The Schedule D form is what most people use to report capital gains and losses that result from the sale or trade of certain property during the year.

What deductions can I claim on PA state taxes?

What Tax Deductions Are There in Pennsylvania? Medical and dental expenses. Charitable donations. Casualty or theft losses. Student loan interest. Alimony. IRA deduction. Self-employment taxes.

What is a PA Schedule SP form?

More about the Pennsylvania Form PA-40 SP This form is for income earned in tax year 2021, with tax returns due in April 2022. We will update this page with a new version of the form for 2023 as soon as it is made available by the Pennsylvania government.

What is Schedule O for PA taxes?

PA SCHEDULE O (LINE 10) Taxpayers claiming deductions for IRC Section 529 Qualified Tuition Program contributions, Medical Savings Account contributions or Health Savings Account contributions must complete PA Schedule O.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my schedule pa tax directly from Gmail?

schedule pa tax and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I edit schedule pa tax online?

The editing procedure is simple with pdfFiller. Open your schedule pa tax in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I create an electronic signature for the schedule pa tax in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your schedule pa tax in seconds.

What is PA Schedule PA-40X?

PA Schedule PA-40X is a form used by residents of Pennsylvania to amend their state income tax returns. It allows taxpayers to correct previously filed PA-40 returns.

Who is required to file PA Schedule PA-40X?

Taxpayers who need to correct errors or omissions on a previously filed Pennsylvania personal income tax return (PA-40) are required to file PA Schedule PA-40X.

How to fill out PA Schedule PA-40X?

To fill out PA Schedule PA-40X, taxpayers need to provide their personal information, indicate the tax year being amended, explain the reason for the amendment, and report the correct amounts for income, deductions, and tax liability.

What is the purpose of PA Schedule PA-40X?

The purpose of PA Schedule PA-40X is to allow taxpayers to amend their previously filed Pennsylvania income tax returns to correct any errors, report additional income, or claim deductions/credits that were initially overlooked.

What information must be reported on PA Schedule PA-40X?

On PA Schedule PA-40X, taxpayers must report their identification information, the tax year being amended, details of the changes being made, the corrected amounts for income, deductions, and the resulting tax liability.

Fill out your schedule pa tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule Pa Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.