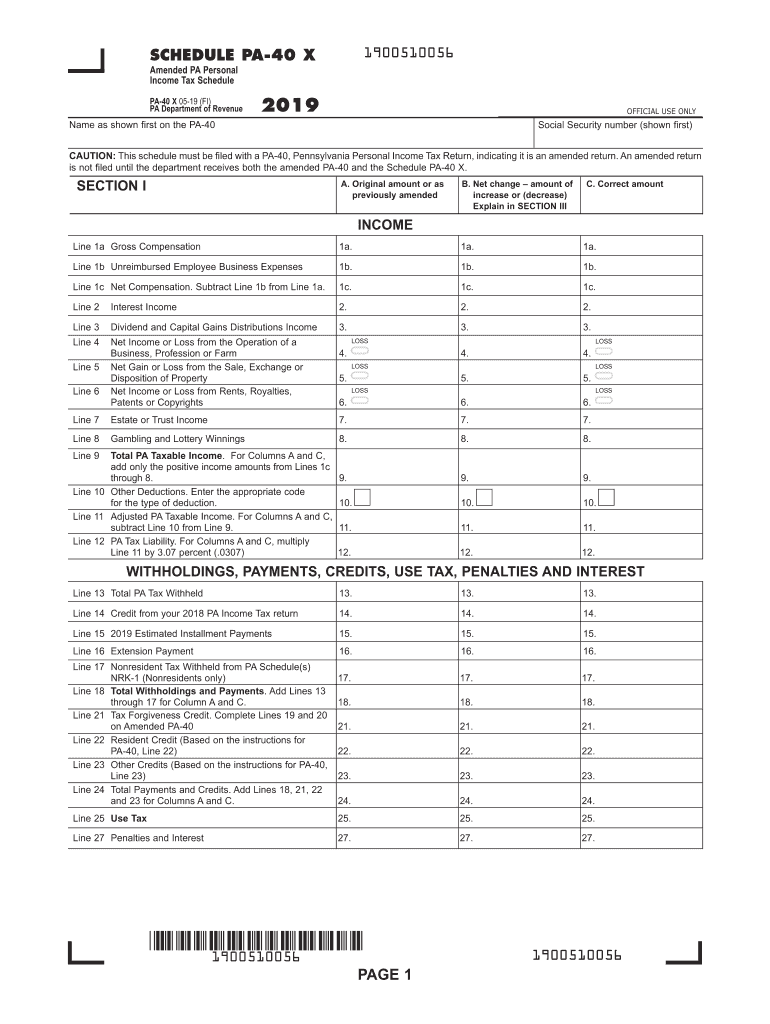

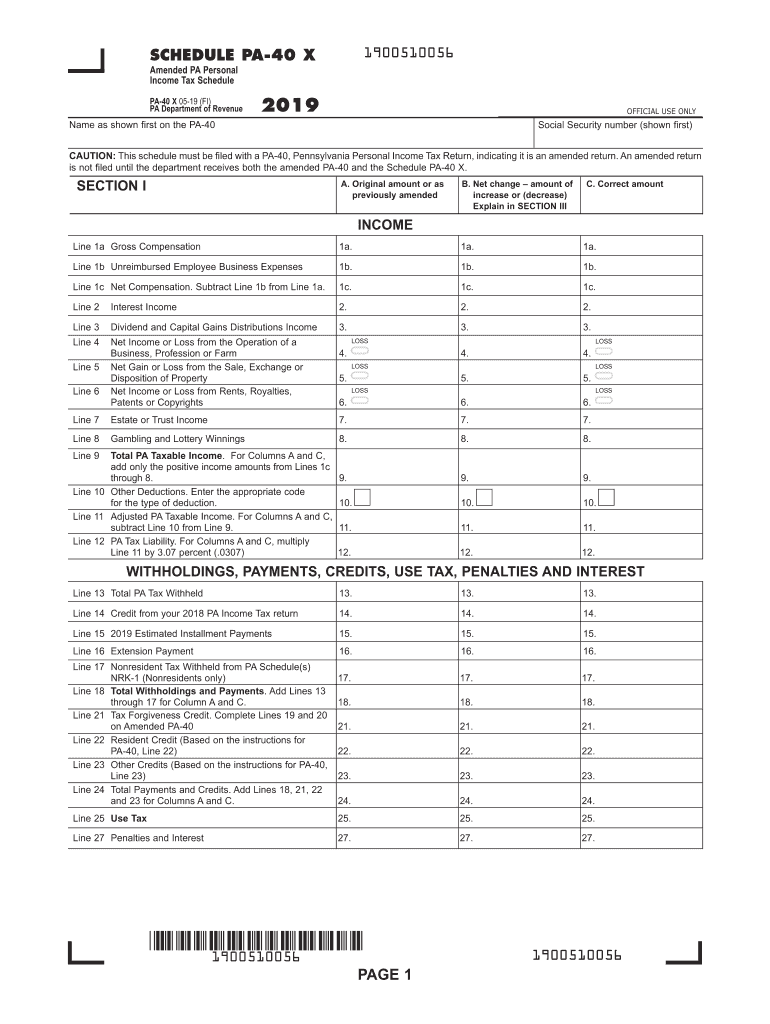

PA Schedule PA-40X 2019 free printable template

Get, Create, Make and Sign PA Schedule PA-40X

How to edit PA Schedule PA-40X online

Uncompromising security for your PDF editing and eSignature needs

PA Schedule PA-40X Form Versions

How to fill out PA Schedule PA-40X

How to fill out PA Schedule PA-40X

Who needs PA Schedule PA-40X?

Instructions and Help about PA Schedule PA-40X

Hello and welcome to this video presentation not sure how to claim unemployment benefits in Pennsylvania no problem watch this video to know how to file an initial claim file for biweekly benefits and reopen a claim before we start lets make a few things clear one we are not associated with the state unemployment agency — while we have made our best attempt to make it accurate and useful we are not liable for any inaccuracy or dated information the information contained is meant to be accurate as of March 2013 once you are eligible to claim unemployment compensation benefits you have to gather some information before contacting the unemployment office do not delay while applying as there is a waiting period of one week during which you will not receive any benefit amount use this checklist to know if all your documents are in place before starting the filing process please provide your complete mailing address as you will receive unemployment handbook and other documents through the mail check if you have gathered all the employer information required you're joining date is the date you started working or the day you resumed working in the company after a previous layoff it is helpful if you can furnish employer you see account number your employment history along with the total gross wages earned in the past 18 months is required while filing take some time to gather this information carefully as it will be verified for your initial claim you need to furnish all the documents mentioned earlier to the unemployment office they will require a week to process your application to claim unemployment benefits during this week you will not receive any benefit amount once your application is verified and approved based on your earnings in the past 18 months your weekly benefit amount will be calculated you will receive your benefit amount weekly provided you file for bi-weekly claims initial claim only certifies your eligibility to receive unemployment compensation in order to receive your benefit check every week you have to file every two week once and satisfy weekly requirements file your bi-weekly claims from Sunday through Friday of the week immediately following the two weeks you are claiming for any earnings in the week in which you are claiming unemployment benefits must be reported to the office you have certain job search duties for each week you claim benefits maintain a work search record and retain it for at least two years from the first week of claiming benefits do not send your work search records to the unemployment office until asked choose to file online as this is the easiest and fastest way to file calling on Mondays is not a good idea as these toll-free numbers suffer high call volumes in the beginning of a week you can reopen a claim if you are laid off again or when your working hours have been reduced a week-long waiting period is inevitable, and again you will not receive benefit amount for this week you can choose to reopen a...

People Also Ask about

What is Schedule O on PA tax return?

Who has to file a PA tax return?

Who must file PA Schedule A?

Who Must File Pa Schedule A?

Who is subject to PA income tax withholding?

What is PA Schedule J?

Who must file a PA partnership Return?

What is the tax rate schedule?

Who must file a PA nonresident return?

What is schedule GL PA?

Do all tax returns have a schedule A?

What is a Schedule C in PA?

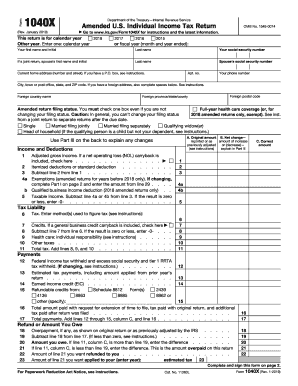

Is schedule 1 the same as 1040?

What is PA Schedule D?

What deductions can I claim on PA state taxes?

What is a PA Schedule SP form?

What is Schedule O for PA taxes?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit PA Schedule PA-40X from Google Drive?

How do I make changes in PA Schedule PA-40X?

How do I complete PA Schedule PA-40X on an iOS device?

What is PA Schedule PA-40X?

Who is required to file PA Schedule PA-40X?

How to fill out PA Schedule PA-40X?

What is the purpose of PA Schedule PA-40X?

What information must be reported on PA Schedule PA-40X?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.