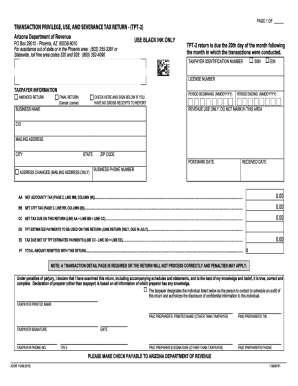

AZ TPT-2 2016 free printable template

Get, Create, Make and Sign AZ TPT-2

How to edit AZ TPT-2 online

Uncompromising security for your PDF editing and eSignature needs

AZ TPT-2 Form Versions

How to fill out AZ TPT-2

How to fill out AZ TPT-2

Who needs AZ TPT-2?

Instructions and Help about AZ TPT-2

The Arizona Department of Revenue presents a tutorial completing the TPT easy for a retail business the Arizona Department of Revenue offers free electronic filing at WWDC taxes gov for transaction privilege tax returns businesses with more than one physical location must file electronically in order to file electronically using EZ taxes gov it is necessary to first register for an AZ taxes account on the EZ taxes website email notifications are sent to the user when the registration for online filing is complete the following tutorial gives an example of completing the TPT EZ form for a retail business located in Cave Creek the TPT EZ form may be used to report transaction privilege tax in the place of the TPT to form for businesses with only one location or jurisdiction the TPT EZ is due the twentieth day of the month following the reporting period in which the tax is collected or accrued the new TPT EZ form has separate sections to report combined state and county transaction details and city transaction details the form also has separate schedule a section for the combined state and county deduction details and the City deduction details the schedule a section...

People Also Ask about

Do I need an Arizona transaction privilege tax license?

What is the Arizona TPT form 5000?

Who is subject to Arizona TPT tax?

What are the TPT requirements for Arizona?

Do I need an Arizona TPT license?

What is the difference between TPT and use tax in Arizona?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my AZ TPT-2 directly from Gmail?

Can I create an eSignature for the AZ TPT-2 in Gmail?

How do I fill out AZ TPT-2 on an Android device?

What is AZ TPT-2?

Who is required to file AZ TPT-2?

How to fill out AZ TPT-2?

What is the purpose of AZ TPT-2?

What information must be reported on AZ TPT-2?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.