AZ TPT-2 2015 free printable template

Show details

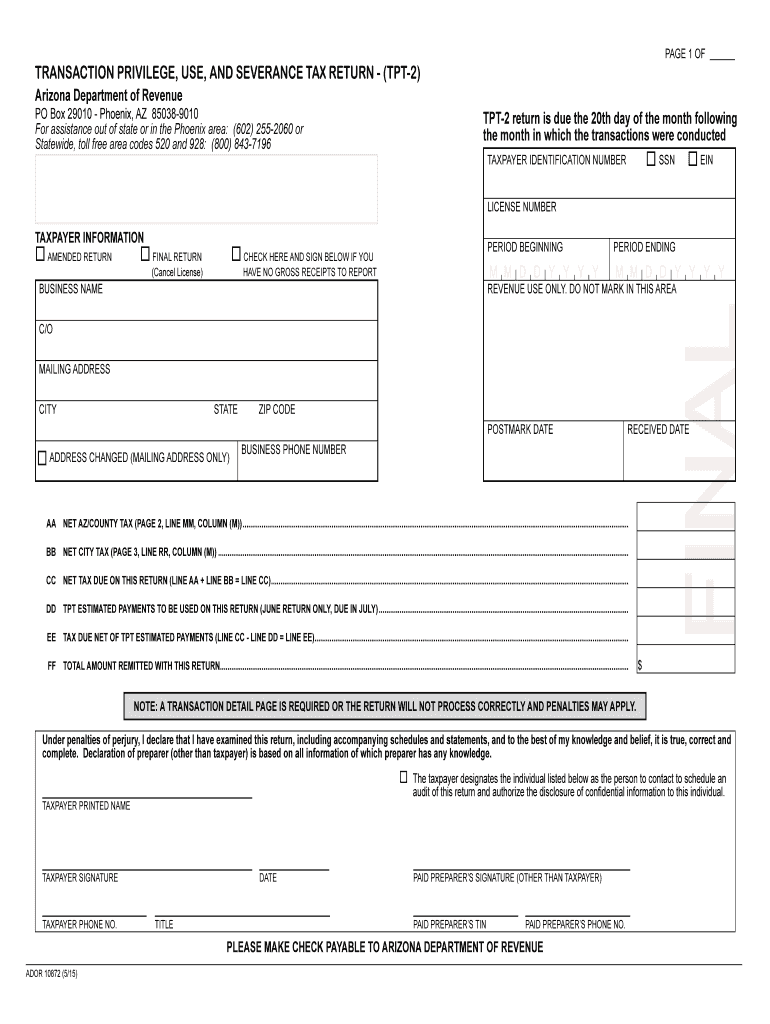

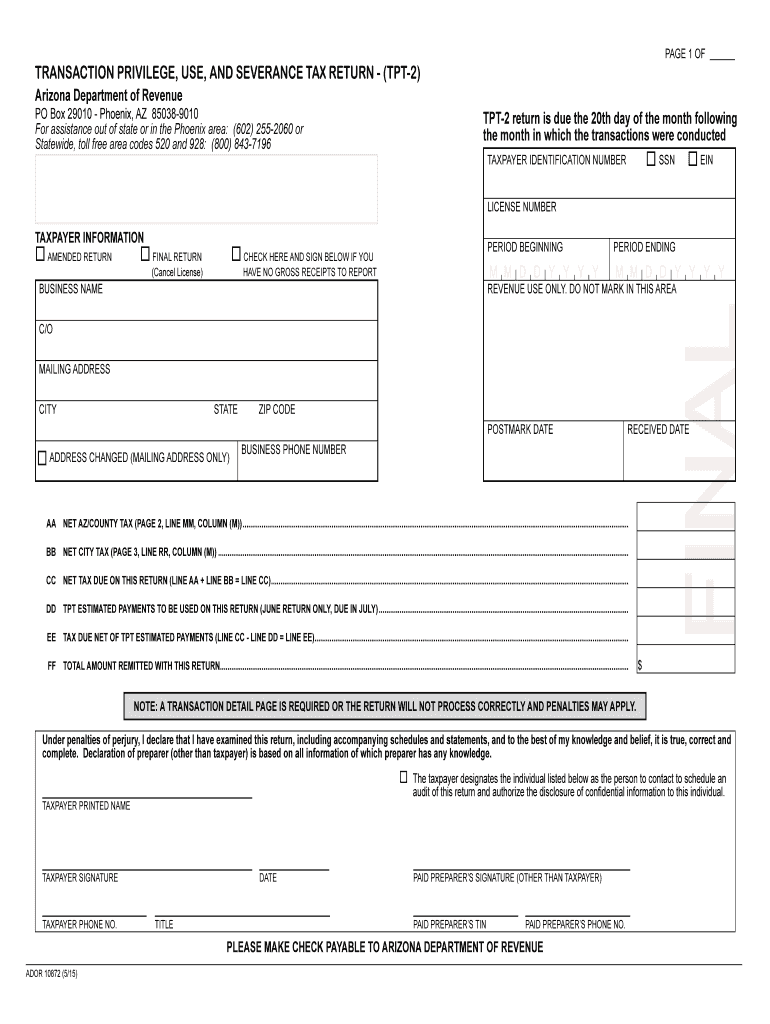

PAGE 1 OF TRANSACTION PRIVILEGE, USE, AND SEVERANCE TAX RETURN (TPT2) Arizona Department of Revenue PO Box 29010 Phoenix, AZ 850389010 For assistance out of state or in the Phoenix area: (602) 2552060

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AZ TPT-2

Edit your AZ TPT-2 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AZ TPT-2 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AZ TPT-2 online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit AZ TPT-2. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AZ TPT-2 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AZ TPT-2

How to fill out AZ TPT-2

01

Obtain a blank AZ TPT-2 form from the Arizona Department of Revenue website or your local tax office.

02

Fill in your legal business name and the trade name if applicable.

03

Provide your business address, including city, state, and ZIP code.

04

Enter your EIN (Employer Identification Number) or SSN (Social Security Number) if you are a sole proprietor.

05

Indicate your business activity type in the relevant section.

06

Complete the sales and use tax information sections accurately by including total sales and tax collected.

07

Review all entries for accuracy and completeness.

08

Sign and date the form where indicated.

09

Submit the completed AZ TPT-2 form to the Arizona Department of Revenue by the due date.

Who needs AZ TPT-2?

01

Any business operating in Arizona that is required to collect transaction privilege tax (TPT).

02

Retailers selling tangible personal property.

03

Service providers engaging in businesses that involve taxable services.

04

Businesses leasing or renting items, including equipment and vehicles.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between TPT and use tax in Arizona?

While a buyer might experience it similarly, Arizona's Transaction Privilege Tax (TPT) is different from most other states' sales and use tax. Rather than a tax on a sale paid by the buyer, TPT is a tax for “the privilege of doing business” in the state of Arizona and levied on the seller.

What is the Arizona TPT tax penalty?

How are fees assessed for TPT on an AZTaxes account? A late filed return is assessed a late filing penalty of 4.5% (four and one-half percent) of the tax required to be shown on the return for each month or a fraction of a month the return is late.

Where can I get tax forms in my area?

Get federal tax forms Get the current filing year's forms, instructions, and publications for free from the IRS. You can also find printed versions of many forms, instructions, and publications in your community for free at: Libraries. IRS Taxpayer Assistance Centers.

Is there an Arizona state tax form?

Form 140 - Resident Personal Income Tax Form -- Calculating You may file Form 140 only if you (and your spouse, if married filing a joint return) are full year residents of Arizona. You must use Form 140 if any of the following apply: Your Arizona taxable income is $50,000 or more, regardless of filing status.

What is tpt2 form?

Transaction privilege tax is filed with the State of Arizona Department of Revenue using a Transaction Privilege, Use, and Severance Tax Return (TPT-2). In order to file the TPT-2 form, a business must register with the State of Arizona Department of Revenue using a Joint Tax Application Form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get AZ TPT-2?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the AZ TPT-2 in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit AZ TPT-2 in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your AZ TPT-2, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I sign the AZ TPT-2 electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your AZ TPT-2.

What is AZ TPT-2?

AZ TPT-2 is a tax form used in Arizona for reporting transaction privilege tax (TPT), which is a tax imposed on businesses for the privilege of conducting business in the state.

Who is required to file AZ TPT-2?

Businesses that engage in retail sales, rental of tangible personal property, or certain services in Arizona are required to file AZ TPT-2.

How to fill out AZ TPT-2?

To fill out AZ TPT-2, businesses must provide their transaction privilege tax account number, report gross receipts by category, calculate the tax due, and include any applicable deductions.

What is the purpose of AZ TPT-2?

The purpose of AZ TPT-2 is to collect the transaction privilege tax from businesses operating in Arizona and to ensure compliance with state tax laws.

What information must be reported on AZ TPT-2?

AZ TPT-2 must report information including the business's gross sales, deductions, tax rate, tax collected, and the total amount of transaction privilege tax owed.

Fill out your AZ TPT-2 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AZ TPT-2 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.