MI DoT 4567 2018 free printable template

Show details

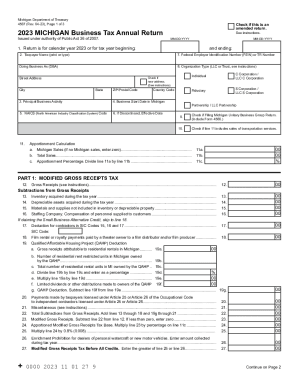

Do not staple the check to the return. Instructions for Form 4567 Michigan Business Tax MBT Annual Return Purpose To calculate the Modified Gross Receipts Tax and Business Income Tax for standard taxpayers. For each member listed in Part 1A complete Part 1B and 2A skip lines 18 through 65. See Form 4567 for instructions on completing that form. Simplified Calculation See the 2015 General Information for Standard Taxpayers in the Michigan Business Tax for Standard Taxpayers Form 4600 for...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign michigan sales tax 5080

Edit your michigan sales tax 5080 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your michigan sales tax 5080 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit michigan sales tax 5080 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit michigan sales tax 5080. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI DoT 4567 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out michigan sales tax 5080

How to fill out MI DoT 4567

01

Obtain the MI DoT 4567 form from the Michigan Department of Transportation website or office.

02

Fill in the applicant's name and contact information in the designated sections.

03

Provide details about the vehicle, including make, model, year, and VIN (Vehicle Identification Number).

04

Indicate the purpose of the form and any specific requests you may have.

05

Attach any necessary documentation, such as proof of ownership or identification.

06

Review the form for accuracy and completeness before submitting.

07

Submit the completed form to the appropriate MI DoT office, either in person or by mail.

Who needs MI DoT 4567?

01

Individuals or businesses registering a vehicle in Michigan.

02

Those applying for certain vehicle permits or licenses.

03

Anyone needing to update vehicle information in the state records.

Instructions and Help about michigan sales tax 5080

Fill

form

: Try Risk Free

People Also Ask about

Does an LLC have to file a tax return in Michigan?

Michigan taxes LLC profits the same way as the IRS: the LLC's owners pay taxes to the state on their personal tax returns. The LLC itself does not pay a state tax, but Michigan does require LLCs to file an annual report, due February 15 each year, with a filing fee of $25.

Who must file a Michigan partnership return?

Every partnership with business activity in the City of Detroit, whether or not an office or place of business was maintained in the city, is required to file an annual return using the City of Detroit Income Tax Partnership Return (Form 5458).

Who must file Michigan business tax?

All taxpayers other than financial institutions and insurance companies (described here as standard taxpayers) with nexus and apportioned or allocated gross receipts equal to $350,000 or more and whose CIT tax liability is greater than $100 must file a CIT Annual Return (Form 4891).

Does Michigan tax unrelated business income?

Business Income Tax The tax is imposed on the business income of all taxpayers (not just corporations) with business activity in Michigan, subject to the limitations of federal law.

Do an LLC have to file a Michigan state tax return?

Michigan taxes LLC profits the same way as the IRS: the LLC's owners pay taxes to the state on their personal tax returns. The LLC itself does not pay a state tax, but Michigan does require LLCs to file an annual report, due February 15 each year, with a filing fee of $25.

What forms must an S-corp file?

A. All California S corporations and LLCs companies treated as S corporations for federal, should file Form 100S (California S Corporation Franchise or Income Tax Return).

Does an S-corp file a 1120 or 1065?

More In Forms and Instructions Use Form 1120-S to report the income, gains, losses, deductions, credits, etc., of a domestic corporation or other entity for any tax year covered by an election to be an S corporation.

Do partnerships have to file in Michigan?

For tax purposes, partnerships in Michigan are treated as pass-through entities, meaning the income the company earns passes through to the partners' personal income. The partnership doesn't file a tax return, like a corporation would do, instead the money earned is treated like personal income for the partners.

What form does an S Corp file in Michigan?

File form to apply for S corp status Once your Michigan LLC is approved by the state, you need to file Form 2553, Election by a Small Business Corporation, to get S corp status.

Who must file Michigan Form 4567?

In Michigan, a UBG with standard members must file Form 4567. A Designated Member (DM) must file the return on behalf of the standard members of the group. In a parent- subsidiary controlled group, the controlling member must serve as DM if it has nexus with Michigan.

Do I need to file an S-corp return in Michigan?

You must file all the formation documents with the state and pay the state filing fees. There may be some restrictions on the types of business allowed to be conducted by Michigan S-corporations.

Do I need to file a Michigan tax return as a non resident?

You must file a Michigan Individual Income Tax return. Required forms include (not limited to): MI-1040, Schedule 1, Schedule NR, and Schedule W. You were a non-resident of Michigan.

Do I have to file a Michigan partnership return?

Yes. Every partnership with business activity in the City of Detroit, whether or not an office or place of business was maintained in the city, is required to file an annual return using the City of Detroit Income Tax Partnership Return (Form 5458).

Who is required to file Michigan business tax?

All taxpayers other than financial institutions and insurance companies (described here as standard taxpayers) with nexus and apportioned or allocated gross receipts equal to $350,000 or more and whose CIT tax liability is greater than $100 must file a CIT Annual Return (Form 4891).

Do I need to file a Michigan income tax return?

Yes. You must file a Michigan Individual Income Tax Return MI-1040 and pay tax on income you earned, received, or accrued while living in Michigan. Required forms include (not limited to): MI-1040, Schedule 1, Schedule NR and Schedule W.

How much can a small business make before paying taxes in Michigan?

FAQs. How much can a Michigan small business make before paying taxes? Michigan doesn't require a business that owes less than $100 to file or pay CIT.

Who must file a Michigan business tax return?

All taxpayers other than financial institutions and insurance companies (described here as standard taxpayers) with nexus and apportioned or allocated gross receipts equal to $350,000 or more and whose CIT tax liability is greater than $100 must file a CIT Annual Return (Form 4891).

Who must file a partnership return?

You must file a Partnership Return of Income (Form 565) if you're: Engaged in a trade or business in California. Have income from California sources. Use a Pass-Through Entity Ownership (Schedule EO 568) to report any ownership interest in other partnerships or limited liability companies.

Should I file S-corp or Schedule C?

If you're a small business that is just starting out i.e., low income, high expenses, Schedule C is a great way to file tax returns. However, as you begin to make some 'real' money, Schedule C might not be the best way to continue filing. That's when you might want to think about S-Corporations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete michigan sales tax 5080 online?

pdfFiller has made it simple to fill out and eSign michigan sales tax 5080. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit michigan sales tax 5080 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign michigan sales tax 5080 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How can I fill out michigan sales tax 5080 on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your michigan sales tax 5080 by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is MI DoT 4567?

MI DoT 4567 is a document related to the Department of Transportation in the state of Michigan, used for reporting specific transportation-related information.

Who is required to file MI DoT 4567?

Individuals or entities engaged in transportation activities that fall under Michigan's jurisdiction are typically required to file MI DoT 4567.

How to fill out MI DoT 4567?

To fill out MI DoT 4567, first gather all necessary information related to transportation activities, follow the provided instructions on the form, and submit it as directed by the Michigan Department of Transportation.

What is the purpose of MI DoT 4567?

The purpose of MI DoT 4567 is to collect data related to transportation activities to help improve planning, safety, and efficiency in Michigan's transportation system.

What information must be reported on MI DoT 4567?

Information that must be reported on MI DoT 4567 includes details about the transportation activity, such as origin and destination, type of cargo, and any relevant dates and times.

Fill out your michigan sales tax 5080 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Michigan Sales Tax 5080 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.