MI DoT 4567 2021 free printable template

Show details

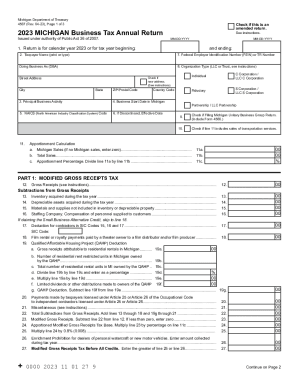

Do not staple the check to the return. Instructions for Form 4567 Michigan Business Tax MBT Annual Return Purpose To calculate the Modified Gross Receipts Tax and Business Income Tax for standard taxpayers. For each member listed in Part 1A complete Part 1B and 2A skip lines 18 through 65. See Form 4567 for instructions on completing that form. Simplified Calculation See the 2015 General Information for Standard Taxpayers in the Michigan Business Tax for Standard Taxpayers Form 4600 for...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign michigan business tax annual

Edit your michigan business tax annual form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your michigan business tax annual form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing michigan business tax annual online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit michigan business tax annual. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI DoT 4567 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out michigan business tax annual

How to fill out MI DoT 4567

01

Obtain the MI DoT 4567 form from the Michigan Department of Transportation website or your local office.

02

Read the instructions carefully to understand the requirements and what information is needed.

03

Fill out your personal information at the top of the form, including your name, address, and contact details.

04

Provide information about the vehicle, including the make, model, year, and VIN (Vehicle Identification Number).

05

Indicate the purpose of completing the form in the designated section.

06

Sign and date the form at the bottom to certify that the information provided is accurate.

07

Submit the completed form either online, by mail, or in person, depending on the submission guidelines provided.

Who needs MI DoT 4567?

01

Individuals who are registering a vehicle in Michigan.

02

People transferring vehicle ownership in Michigan.

03

Those applying for vehicle title or seeking a registration renewal.

Instructions and Help about michigan business tax annual

Fill

form

: Try Risk Free

People Also Ask about

Does an LLC have to file a tax return in Michigan?

Michigan taxes LLC profits the same way as the IRS: the LLC's owners pay taxes to the state on their personal tax returns. The LLC itself does not pay a state tax, but Michigan does require LLCs to file an annual report, due February 15 each year, with a filing fee of $25.

Who must file a Michigan partnership return?

Every partnership with business activity in the City of Detroit, whether or not an office or place of business was maintained in the city, is required to file an annual return using the City of Detroit Income Tax Partnership Return (Form 5458).

Who must file Michigan business tax?

All taxpayers other than financial institutions and insurance companies (described here as standard taxpayers) with nexus and apportioned or allocated gross receipts equal to $350,000 or more and whose CIT tax liability is greater than $100 must file a CIT Annual Return (Form 4891).

Does Michigan tax unrelated business income?

Business Income Tax The tax is imposed on the business income of all taxpayers (not just corporations) with business activity in Michigan, subject to the limitations of federal law.

Do an LLC have to file a Michigan state tax return?

Michigan taxes LLC profits the same way as the IRS: the LLC's owners pay taxes to the state on their personal tax returns. The LLC itself does not pay a state tax, but Michigan does require LLCs to file an annual report, due February 15 each year, with a filing fee of $25.

What forms must an S-corp file?

A. All California S corporations and LLCs companies treated as S corporations for federal, should file Form 100S (California S Corporation Franchise or Income Tax Return).

Does an S-corp file a 1120 or 1065?

More In Forms and Instructions Use Form 1120-S to report the income, gains, losses, deductions, credits, etc., of a domestic corporation or other entity for any tax year covered by an election to be an S corporation.

Do partnerships have to file in Michigan?

For tax purposes, partnerships in Michigan are treated as pass-through entities, meaning the income the company earns passes through to the partners' personal income. The partnership doesn't file a tax return, like a corporation would do, instead the money earned is treated like personal income for the partners.

What form does an S Corp file in Michigan?

File form to apply for S corp status Once your Michigan LLC is approved by the state, you need to file Form 2553, Election by a Small Business Corporation, to get S corp status.

Who must file Michigan Form 4567?

In Michigan, a UBG with standard members must file Form 4567. A Designated Member (DM) must file the return on behalf of the standard members of the group. In a parent- subsidiary controlled group, the controlling member must serve as DM if it has nexus with Michigan.

Do I need to file an S-corp return in Michigan?

You must file all the formation documents with the state and pay the state filing fees. There may be some restrictions on the types of business allowed to be conducted by Michigan S-corporations.

Do I need to file a Michigan tax return as a non resident?

You must file a Michigan Individual Income Tax return. Required forms include (not limited to): MI-1040, Schedule 1, Schedule NR, and Schedule W. You were a non-resident of Michigan.

Do I have to file a Michigan partnership return?

Yes. Every partnership with business activity in the City of Detroit, whether or not an office or place of business was maintained in the city, is required to file an annual return using the City of Detroit Income Tax Partnership Return (Form 5458).

Who is required to file Michigan business tax?

All taxpayers other than financial institutions and insurance companies (described here as standard taxpayers) with nexus and apportioned or allocated gross receipts equal to $350,000 or more and whose CIT tax liability is greater than $100 must file a CIT Annual Return (Form 4891).

Do I need to file a Michigan income tax return?

Yes. You must file a Michigan Individual Income Tax Return MI-1040 and pay tax on income you earned, received, or accrued while living in Michigan. Required forms include (not limited to): MI-1040, Schedule 1, Schedule NR and Schedule W.

How much can a small business make before paying taxes in Michigan?

FAQs. How much can a Michigan small business make before paying taxes? Michigan doesn't require a business that owes less than $100 to file or pay CIT.

Who must file a Michigan business tax return?

All taxpayers other than financial institutions and insurance companies (described here as standard taxpayers) with nexus and apportioned or allocated gross receipts equal to $350,000 or more and whose CIT tax liability is greater than $100 must file a CIT Annual Return (Form 4891).

Who must file a partnership return?

You must file a Partnership Return of Income (Form 565) if you're: Engaged in a trade or business in California. Have income from California sources. Use a Pass-Through Entity Ownership (Schedule EO 568) to report any ownership interest in other partnerships or limited liability companies.

Should I file S-corp or Schedule C?

If you're a small business that is just starting out i.e., low income, high expenses, Schedule C is a great way to file tax returns. However, as you begin to make some 'real' money, Schedule C might not be the best way to continue filing. That's when you might want to think about S-Corporations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the michigan business tax annual form on my smartphone?

Use the pdfFiller mobile app to fill out and sign michigan business tax annual. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Can I edit michigan business tax annual on an iOS device?

Create, modify, and share michigan business tax annual using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How do I fill out michigan business tax annual on an Android device?

Use the pdfFiller Android app to finish your michigan business tax annual and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is MI DoT 4567?

MI DoT 4567 is a form used for reporting specific data related to transportation, logistics, or environmental compliance within a regulatory framework.

Who is required to file MI DoT 4567?

Individuals and entities involved in transportation or logistics operations that meet certain regulatory criteria are required to file MI DoT 4567.

How to fill out MI DoT 4567?

To fill out MI DoT 4567, gather the necessary information as specified in the form's instructions and complete each section accurately before submitting it to the relevant authority.

What is the purpose of MI DoT 4567?

The purpose of MI DoT 4567 is to ensure compliance with transportation regulations, track logistics data, and support environmental protection efforts.

What information must be reported on MI DoT 4567?

The information that must be reported on MI DoT 4567 includes details such as the nature of the transportation activity, dates, vehicle information, and any relevant environmental impact data.

Fill out your michigan business tax annual online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Michigan Business Tax Annual is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.