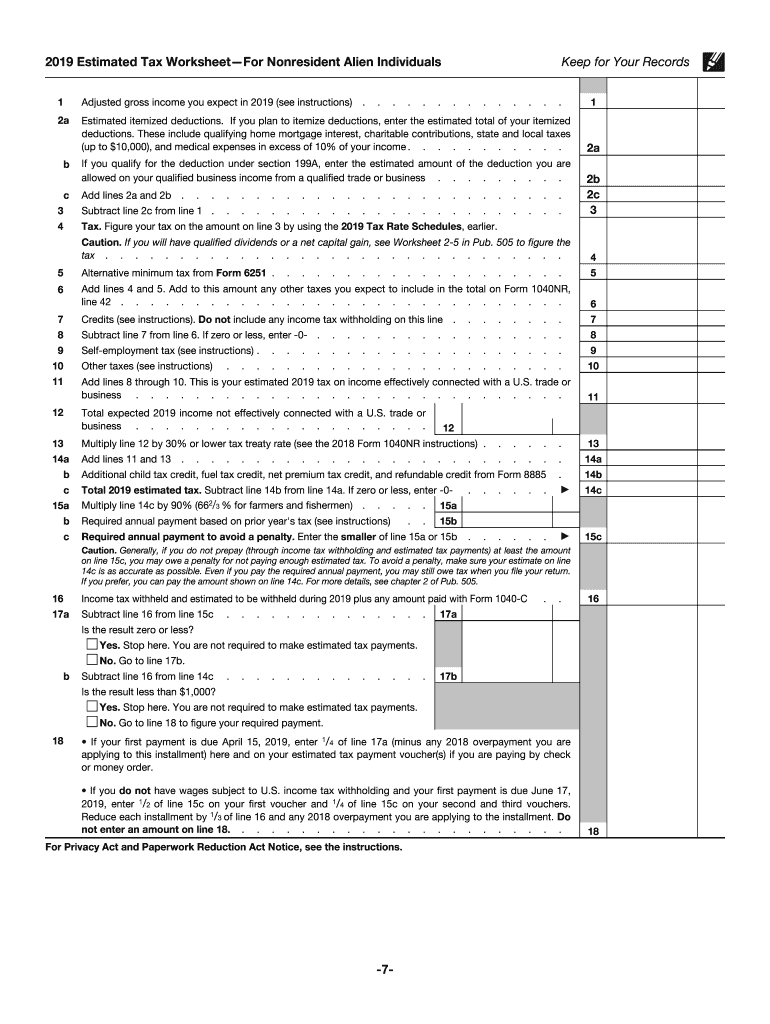

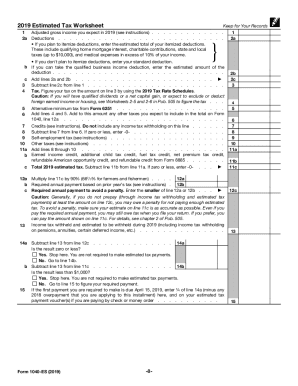

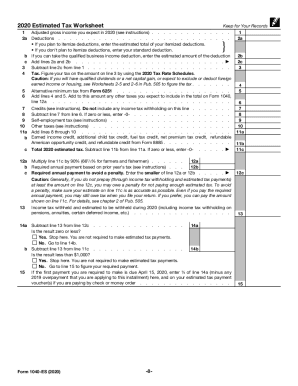

Who needs an IRS form 1040 ES (NR)?

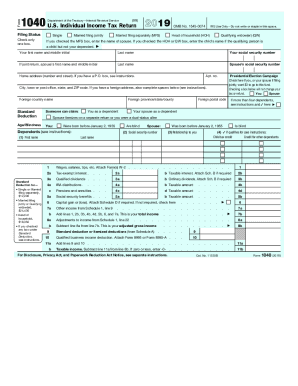

Nonresident aliens must fill out form 1040 annually to report their financial activity on the U.S. territory to the Internal Revenue Service. Farmers, fishermen, certain household employers and certain higher income taxpayers must read about special rules for filling out 1040 ES (NR) on the IRS website.

What is form 1040 ES (NR) for?

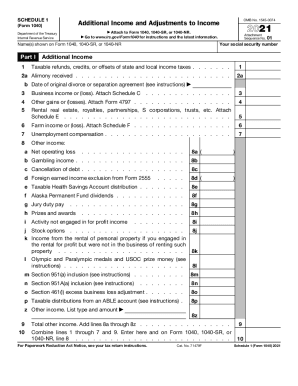

This form is also called Estimated Tax for Nonresident Alien Individuals. As stated in the Instruction to this form, estimated tax is the method used to pay tax for income that is not subject to withholding. This could include income derived from self-employment, pension/annuity income, prize winnings, capital gains, interest income, dividend income, lottery and horse racing proceeds, rental income etc.

Is it accompanied by other forms?

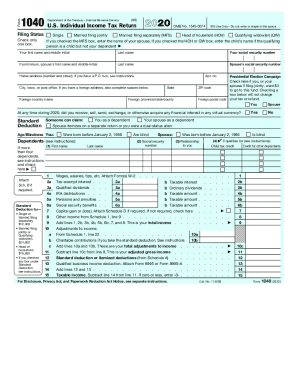

Nonresidents are also required to file forms 1040 NR, U.S. Nonresident Income Tax Return, or 1040 NR-EZ, U.S. Income Tax Return for Certain Nonresident Aliens with No Dependents.

When is form 1040 ES (NR) due?

You can pay all of your estimated tax by April 18, 2016, or in four equal amounts by the following dates: 1st payment — April 18, 2016; 2nd payment — June 15, 2016; 3rd payment — September 15, 2016; 4th payment — January 17, 2017.

How do I fill out form 1040 ES (NR)?

Apart from detailed instructions for every section inside this form, there are a few changes in 2016 edition also mentioned in this file. Learn the amounts of increased personal exemption, limitation on itemized deductions, new standard mileage rate and the social security page. Use blank pages to make your calculations, if necessary.

Where do I send it?

Send it to the IRS electronically via the official IRS website.