What is Form 1040 ES 2019?

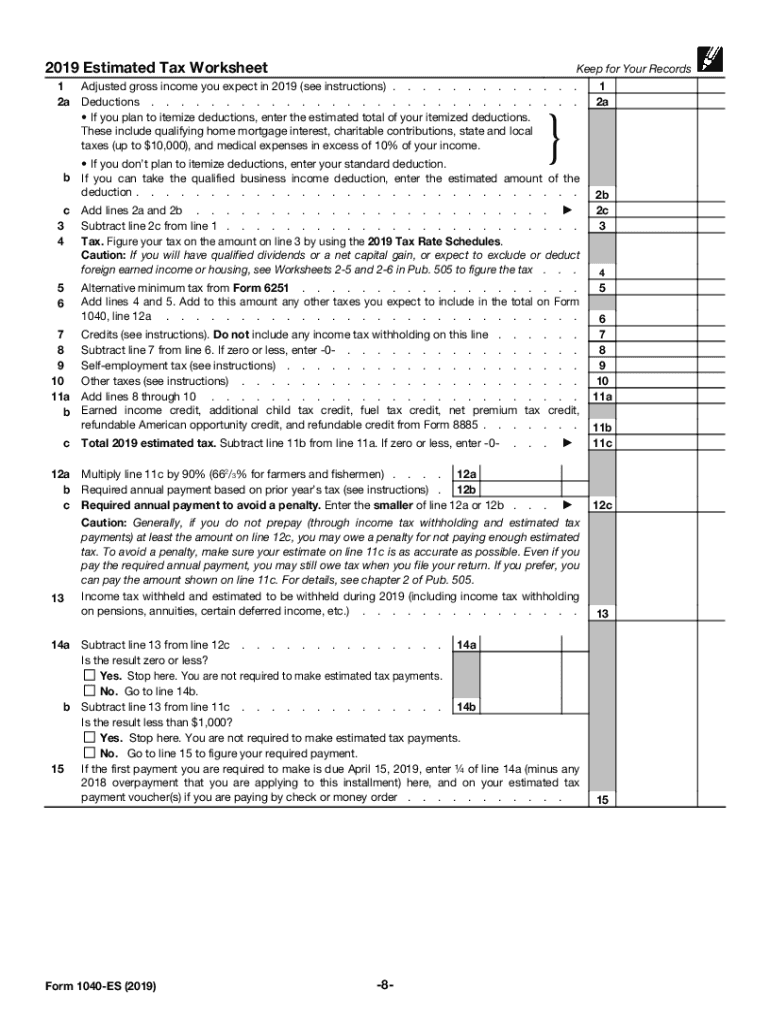

Form 1040 ES reports estimated tax payments, broken into four installments, paid to the IRS for the current year. This form covers income earned from freelance work and other income categories requiring estimated tax payments. They are as follows: dividends, rent, retirement benefits, unemployment compensation, etc. Since estimated tax must be calculated for the current year, it is easy to make mistakes and enter wrong numbers. Such errors may eventually result in underpayment and penalty. To avoid confusion when calculating estimated tax, taxpayers can follow the previous year’s taxes. Also, make sure to check out the Form 1040 ES instructions as a guide for calculating the estimated tax.

Who should file the IRS Form 1040 ES 2019?

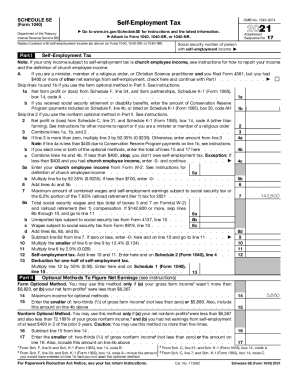

The Tax Form 1040 ES is an Estimated Tax Form. It is created for self-employed individuals, small business owners, freelancers, and independent contractors. These are individuals who rarely have income tax withheld from their earnings and those who satisfy the following criteria:

- You’re expected at least $1,000 in tax for the current year

- The estimated withholding and credits are less than 90% of the expected tax or 100% of the entire tax liability recorded in return for the previous year.

A taxpayer doesn’t have to pay estimated taxes if:

- They were not asked to pay taxes for the previous year

- They were US citizens or residents in the previous tax year

- The previous tax year was no less than 12-month long.

What information do you need when you file the Tax Form 1040 ES?

In your 2019 Form 1040-ES, include your personal information and the estimated amount of payment you owe for the quarter. Underestimating your income while calculating your estimated taxes for IRS Form 1040-ES 2019 may result in underpayment and penalty. To make your filing as accurate as possible and avoid fines, use your previous year’s tax return and compare it against the current year’s numbers.

How do I fill out Form 1040-ES 2019 in 2020?

Form 1040 ES consists of twelve pages, including instructions and worksheets that aren’t sent anywhere. A filer must keep them for the records. The main information about the estimated tax is provided in the payment voucher. A filer must enter their name, address, SSN, and a spouse’s SSN.

Here’s how to fill out Form 1040 ES with pdfFiller:

- Go to the form page and click the Get Form button.

- Follow the green pointer to fill out the required fields in the document.

- Click DONE once you’ve finished completing the form.

- Next, download or save the form to your computer.

- Select to send the form via USPS to the local IRS office if needed.

Is Form 1040-ES 2019 accompanied by other forms?

Form 1040 ES must be accompanied by the estimated tax payment voucher in case the payment is made by the money order or paycheck.

When is Form 1040 ES due?

The Tax Form 1040 ES must be filed quarterly throughout the calendar year according to the following schedule:

- 15th of April for the income earned from the 1st of January till the 31st of March

- 15th of June for the income earned from the 1st of April till the 31st of May

- 15th of September for the income earned from the 1st of June till the 31st of August

- 15th of January for the income earned from the 1st of September till the 31st of December.

Where to mail Form 1040 ES?

First, enter the name of the 1040 ES Form and the current year on the money order or paycheck. Then mail the payment voucher to the address corresponding to the place you live.