IRS 1040-ES 2023 free printable template

Show details

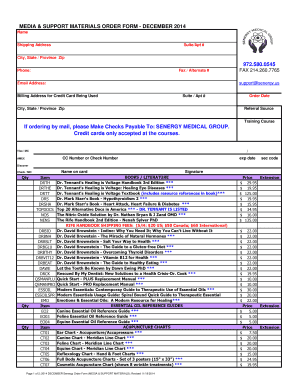

Changing your estimated tax. To amend or correct your estimated tax see How To Amend Estimated Tax Payments later. You would be required to make estimated tax payments to avoid a penalty even if you didn t include household employment taxes when figuring your estimated tax. April 18 2023 June 15 2023 Sept. 15 2023 Jan. 16 2024 You don t have to make the payment due January 16 2024 if you file your 2023 tax return by January 31 2024 and pay the entire balance due with your return. How To Amend...Estimated Tax To change or amend your estimated tax payments refigure your total estimated tax payments due see the 2023 Estimated Tax Worksheet. 12b 12c c Total 2023 estimated tax. Subtract line 11b from line 11a. If zero or less enter -0- Caution Generally if you do not prepay through income tax withholding and estimated tax payments at least the amount on line 12c you may owe a penalty for not paying enough estimated tax. Pay all of your estimated tax by January 16 2024. File your 2023 Form...1040 or 1040-SR by March 1 2024 and pay the total tax due. Do not mail your tax return to this address or send an estimated tax payment without a payment voucher. Schedule 1 Form 1040 line 15. Subtract this amount when figuring your expected AGI on line 1 of your 2023 Estimated Tax Worksheet. 505 Tax Withholding and Estimated Tax and in the instructions for the 2022 Form 1040 and 1040-SR. For details on how to get forms and publications see the 2022 Instructions for Form 1040. Household...employers. When estimating the tax on your 2023 tax return include your household employment taxes if either of the following applies. You will have federal income tax withheld from wages pensions annuities gambling winnings or other income. 2. You expect your withholding and refundable credits to be less than the smaller of a* 90 of the tax to be shown on your 2023 tax return or b. 100 of the tax shown on your 2022 tax return* Your 2022 tax return must cover all 12 months. Note. These...percentages may be different if you are a farmer fisherman or higher income taxpayer. You had no tax liability for 2022 if your total tax was zero or you didn t have to file an income tax return* There are special rules for farmers fishermen certain taxpayers. Higher income taxpayers. If your adjusted gross income AGI for 2022 was more than 150 000 75 000 if your filing status for 2023 is married filing separately substitute 110 for 100 in 2b under General Rule earlier. You can use the Tax...Withholding Estimator at TIP IRS*gov/W4App to determine whether you need to have your withholding increased or decreased* Additional Information You May Need You can find most of the information you will need in Pub. If you don t itemize your deductions you can take the 2023 standard deduction listed in the following chart Cat* No* 11340T IF your 2023 filing status is. affect your refund or balance due. Promptly report changes in your income or family size to your Marketplace. View the amount...you owe and a breakdown by tax year. See payment plan details or apply for a new payment plan* Make a payment view 5 years of payment history and any pending or scheduled payments.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1040-ES

How to edit IRS 1040-ES

How to fill out IRS 1040-ES

Instructions and Help about IRS 1040-ES

How to edit IRS 1040-ES

To edit IRS 1040-ES, use a PDF editor like pdfFiller. Open your PDF document in the application, and utilize the editing tools to input or modify data as necessary. Ensure all information is accurate and up to date before finalizing your form.

How to fill out IRS 1040-ES

Filling out IRS 1040-ES requires specific information about your estimated taxes. Begin by gathering your income sources, deductions, and previous year’s tax return as a reference. Follow these steps to correctly complete the form:

01

Enter your personal information, including your name, address, and Social Security number.

02

Calculate your estimated tax liability for the current year based on your income sources.

03

Divide your estimated tax into quarterly payments, as specified on the form.

04

Sign and date the form before submitting it along with your payment, if applicable.

About IRS 1040-ES 2023 previous version

What is IRS 1040-ES?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1040-ES 2023 previous version

What is IRS 1040-ES?

IRS 1040-ES is the Estimated Tax for Individuals form used by U.S. taxpayers to calculate and pay estimated quarterly taxes. This form is essential for individuals who expect to owe tax on income not subject to withholding, such as self-employment income, dividends, interest, or capital gains.

What is the purpose of this form?

The purpose of IRS 1040-ES is to help taxpayers determine their estimated tax liability and facilitate the payment of taxes in a timely manner throughout the year. This helps avoid penalties for underpayment, ensuring compliance with IRS regulations.

Who needs the form?

Taxpayers who are self-employed or receive income from sources that do not withhold taxes may need to file IRS 1040-ES. This includes freelancers, independent contractors, and individuals with investment income. If you expect to owe at least $1,000 in taxes after subtracting withholding and refundable credits, you are generally required to file this form.

When am I exempt from filling out this form?

You may be exempt from filing IRS 1040-ES if your tax liability for the previous year was zero or you were not required to file a federal tax return. Additionally, if you had income tax withheld and it covers your estimated tax payments, then you do not need to file this form.

Components of the form

IRS 1040-ES consists of several key components including:

01

Personal information section for the taxpayer’s name, address, and Social Security number.

02

Calculation worksheet to determine your estimated tax for the current year.

03

Payment vouchers for submitting quarterly payments.

Each section must be accurately filled out to avoid issues with the IRS.

What are the penalties for not issuing the form?

Failing to file IRS 1040-ES or making insufficient estimated tax payments can result in penalties and interest charges. Generally, if you do not pay enough tax throughout the year, you may face a penalty of 0.5% of the unpaid tax for each month the tax remains unpaid, up to a maximum of 25%.

What information do you need when you file the form?

When filing IRS 1040-ES, gather the following information:

01

Your projected income for the year.

02

Details of any tax deductions and credits you anticipate claiming.

03

Your total tax liability from the previous year.

This information will assist in accurately calculating your estimated tax payments.

Is the form accompanied by other forms?

IRS 1040-ES itself does not require additional forms for filing; however, if you have other income types or deductions, you might need to file supplementary forms with your annual tax return, such as Schedule C or Schedule D, for self-employment or capital gains, respectively.

Where do I send the form?

Where you send IRS 1040-ES depends on your location and whether you are making a payment. Most taxpayers will mail their completed forms and any payments to the address specified in the form instructions. If filing electronically, the process will differ based on the electronic filing method chosen.

See what our users say