Canada SST-NOA-GD-IS 2019 free printable template

Show details

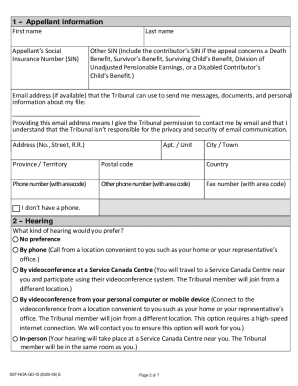

NOTICE OF APPEAL INCOME SECURITY GENERAL DIVISION element disposable en Francis Complete and sign this form if you want to appeal a Canada Pension Plan (CPP) or Old Age Security (OAS) reconsideration

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada SST-NOA-GD-IS

Edit your Canada SST-NOA-GD-IS form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada SST-NOA-GD-IS form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada SST-NOA-GD-IS online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit Canada SST-NOA-GD-IS. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada SST-NOA-GD-IS Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada SST-NOA-GD-IS

How to fill out Canada SST-NOA-GD-IS

01

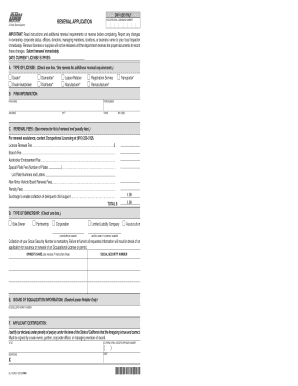

Obtain the SST-NOA-GD-IS form from the official Canada Revenue Agency website or a relevant office.

02

Read the instructions provided with the form carefully to understand the requirements.

03

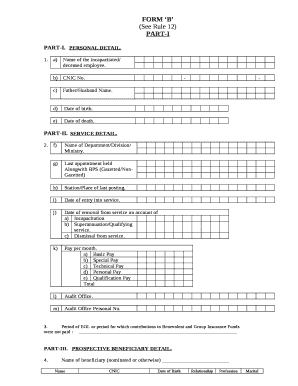

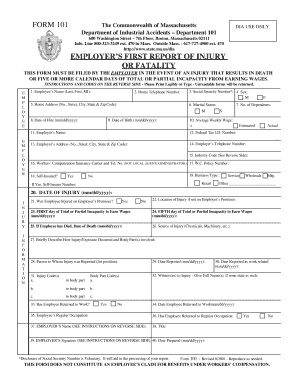

Fill in your personal information including your name, address, and tax identification number in the designated sections.

04

Provide details about your business, including the business number and type of business activities.

05

Complete the financial information section, including revenue and expenses as required.

06

Check all the sections for accuracy and completeness before submitting.

07

Sign and date the form in the designated area.

08

Submit the completed form either online, by mail, or in person, following the instructions provided.

Who needs Canada SST-NOA-GD-IS?

01

Businesses and individuals who are registered for the Goods and Services Tax/Harmonized Sales Tax (GST/HST) in Canada.

02

Taxpayers claiming input tax credits or refunds associated with the GST/HST.

03

A business operating in industries where tax collection and remittance is required.

Fill

form

: Try Risk Free

People Also Ask about

How do I contact OAS in Canada?

For information about the OAS program, visit Canada.ca/OAS or call Service Canada at 1-800-277-9914.

How long does it take to process OAS in Canada?

The application process can take some time so you should apply at least 6 months before you think you will be eligible to start receiving a benefit. If your application is denied, you can request a reconsideration of the decision within 90 days but you should get legal advice right away (see Getting Legal Help below).

Can I collect OAS outside Canada?

Receiving your OAS pension outside of Canada You can qualify to receive Old Age Security pension payments while living outside of Canada if one if these reasons applies to you: you lived in Canada for at least 20 years after turning 18. you lived and worked in a country that has a social security agreement with Canada.

How much is a pension in Canada at 65?

The average monthly amount paid for a new retirement pension (at age 65) in January 2023 is $811.21. Your situation will determine how much you'll receive up to the maximum. You can get an estimate of your monthly CPP retirement pension payments by signing in to your My Service Canada Account.

How much is Canada old age pension 2019?

As a result of quarterly indexation, on July 1, 2019, the maximum OAS pension amount will increase to $607.46, and the maximum Guaranteed Income Supplement (GIS) amount will increase to $907.30 for single seniors and to $546.17 for each member of a couple.

Can you collect CPP if you live outside Canada?

Canadian Government Income Security Programs As a non-resident of Canada, you may be entitled to apply for Canada Pension Plan (CPP) payments and Old Age Security Pension (OAS) payments. Canada also has agreements with a number of other countries that offer comparable pension programs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit Canada SST-NOA-GD-IS in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your Canada SST-NOA-GD-IS, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I sign the Canada SST-NOA-GD-IS electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your Canada SST-NOA-GD-IS.

How do I complete Canada SST-NOA-GD-IS on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your Canada SST-NOA-GD-IS. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is Canada SST-NOA-GD-IS?

Canada SST-NOA-GD-IS refers to the 'Securities Settlement Transaction – No Objection' form, which is used in Canada's securities regulatory framework to report certain transactions.

Who is required to file Canada SST-NOA-GD-IS?

Entities involved in the securities settlement process, including brokers, dealers, and registered firms, are typically required to file the Canada SST-NOA-GD-IS.

How to fill out Canada SST-NOA-GD-IS?

To fill out the Canada SST-NOA-GD-IS, submit the required information accurately, including transaction details, parties involved, and any relevant compliance data as stipulated by the regulatory guidelines.

What is the purpose of Canada SST-NOA-GD-IS?

The purpose of the Canada SST-NOA-GD-IS is to ensure transparency in securities settlements and to allow regulatory bodies to monitor compliance with securities laws.

What information must be reported on Canada SST-NOA-GD-IS?

Information that must be reported includes transaction dates, security identifiers, quantities involved, parties to the transaction, and any fees or charges associated with the settlement.

Fill out your Canada SST-NOA-GD-IS online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada SST-NOA-GD-IS is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.