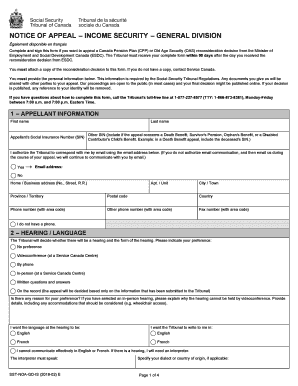

Canada SST-NOA-GD-IS 2020-2025 free printable template

Show details

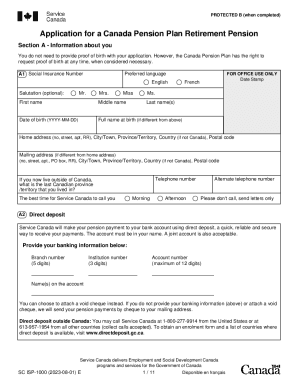

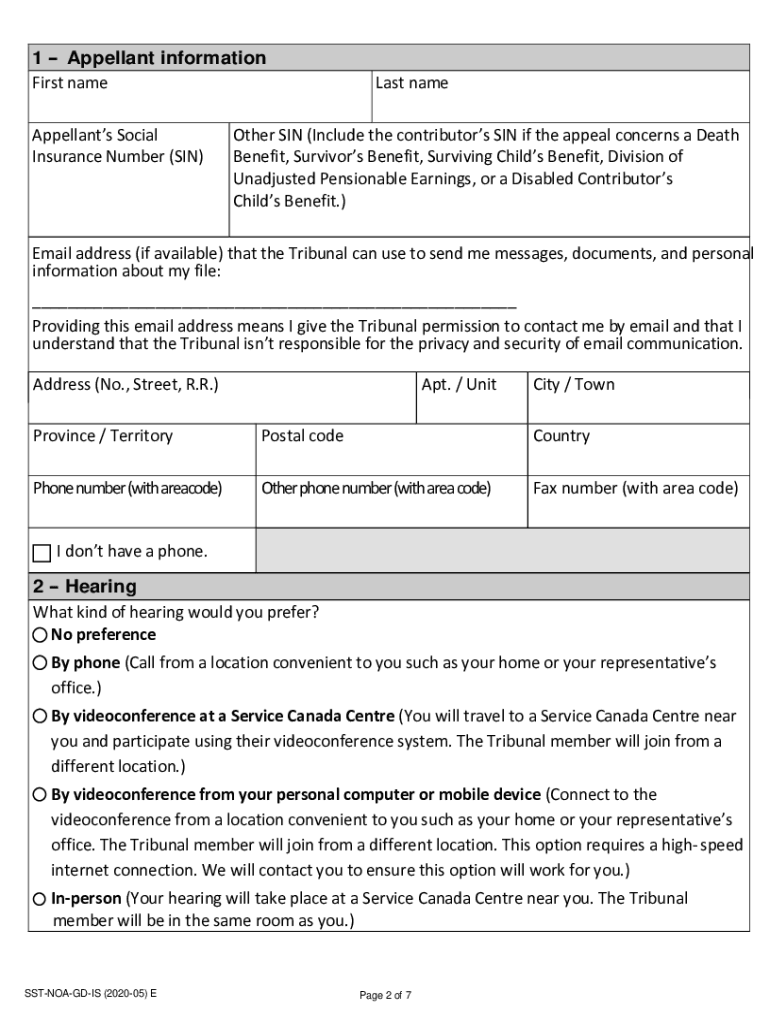

Notice of Appeal Income Security General Division element disposable en Francis Fill out and sign this form if you want to appeal a Canada Pension Plan or Old Age Security reconsideration decision

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada SST-NOA-GD-IS

Edit your Canada SST-NOA-GD-IS form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada SST-NOA-GD-IS form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada SST-NOA-GD-IS online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit Canada SST-NOA-GD-IS. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada SST-NOA-GD-IS Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada SST-NOA-GD-IS

How to fill out Canada SST-NOA-GD-IS

01

Obtain the Canada SST-NOA-GD-IS form from the official website or local office.

02

Fill in your personal information including your name, address, and contact details in the designated sections.

03

Provide the relevant identification numbers, such as Social Insurance Number (SIN) or other applicable IDs.

04

Indicate the reason for submitting the SST-NOA-GD-IS form, selecting from the options provided.

05

Review all entries for accuracy and completeness before signing the form.

06

Submit the completed form to the appropriate government office, either through mail or in-person.

Who needs Canada SST-NOA-GD-IS?

01

Individuals or organizations applying for specific government programs or benefits in Canada.

02

Anyone needing to correct or update information related to their social services.

03

Participants in government-funded programs who need to confirm their eligibility or provide necessary updates.

Fill

form

: Try Risk Free

People Also Ask about

How do I contact OAS in Canada?

For information about the OAS program, visit Canada.ca/OAS or call Service Canada at 1-800-277-9914.

How long does it take to process OAS in Canada?

The application process can take some time so you should apply at least 6 months before you think you will be eligible to start receiving a benefit. If your application is denied, you can request a reconsideration of the decision within 90 days but you should get legal advice right away (see Getting Legal Help below).

Can I collect OAS outside Canada?

Receiving your OAS pension outside of Canada You can qualify to receive Old Age Security pension payments while living outside of Canada if one if these reasons applies to you: you lived in Canada for at least 20 years after turning 18. you lived and worked in a country that has a social security agreement with Canada.

How much is a pension in Canada at 65?

The average monthly amount paid for a new retirement pension (at age 65) in January 2023 is $811.21. Your situation will determine how much you'll receive up to the maximum. You can get an estimate of your monthly CPP retirement pension payments by signing in to your My Service Canada Account.

How much is Canada old age pension 2019?

As a result of quarterly indexation, on July 1, 2019, the maximum OAS pension amount will increase to $607.46, and the maximum Guaranteed Income Supplement (GIS) amount will increase to $907.30 for single seniors and to $546.17 for each member of a couple.

Can you collect CPP if you live outside Canada?

Canadian Government Income Security Programs As a non-resident of Canada, you may be entitled to apply for Canada Pension Plan (CPP) payments and Old Age Security Pension (OAS) payments. Canada also has agreements with a number of other countries that offer comparable pension programs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in Canada SST-NOA-GD-IS?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your Canada SST-NOA-GD-IS to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I sign the Canada SST-NOA-GD-IS electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your Canada SST-NOA-GD-IS in minutes.

Can I edit Canada SST-NOA-GD-IS on an iOS device?

Create, modify, and share Canada SST-NOA-GD-IS using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is Canada SST-NOA-GD-IS?

Canada SST-NOA-GD-IS stands for 'Canada Specific Sales Tax - Notice of Assessment - General Declaration - Information Sheet'. It is a document used for reporting sales tax information in Canada.

Who is required to file Canada SST-NOA-GD-IS?

Businesses and individuals who are required to report their sales tax obligations under Canadian tax laws must file the Canada SST-NOA-GD-IS.

How to fill out Canada SST-NOA-GD-IS?

To fill out Canada SST-NOA-GD-IS, you need to provide accurate sales figures, applicable tax rates, and other relevant financial information as specified in the form's instructions.

What is the purpose of Canada SST-NOA-GD-IS?

The purpose of the Canada SST-NOA-GD-IS is to facilitate the reporting and assessment of sales tax liabilities for compliance with Canadian tax regulations.

What information must be reported on Canada SST-NOA-GD-IS?

The information that must be reported includes total sales, taxable sales, exempt sales, applicable sales tax collected, and any deductions or credits claimed.

Fill out your Canada SST-NOA-GD-IS online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada SST-NOA-GD-IS is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.