Get the free vehicle donation receipt template

Show details

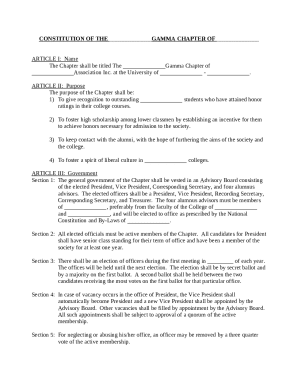

CAR DONATION RECEIPT Note Please review IRS guidelines and consult with your tax advisor to learn how the changes may affect your deduction. DATE NAME ADDRESS CITY State ZIP FAX PHONE E-MAIL VEHICLE DESCRIPTION YEAR/MAKE/MODEL LICENSE VIN ODOMETER REGISTERED YES NO TITLE YES NO DRIVABLE YES NO MECHANICAL INFORMATION I understand that the Conservatory will advise me of the amount of the sale price of the vehicle at auction and that this sale price is the amount I can state for a...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign act of donation form for vehicle

Edit your writing a receipt for a private car sale form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your how to fill out a nc title form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit vehicle donation receipt online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit refund receipt sample form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out vehicle donation receipt template

How to fill out car donation receipt:

01

Begin by gathering all necessary information, including the donor's name, contact information, and the vehicle's make, model, and identification number.

02

Include the date of donation and the fair market value of the vehicle at the time of donation. It is advisable to consult a trusted source such as the Kelley Blue Book to determine the value.

03

Indicate whether the donor received any goods or services in exchange for the donation. If so, provide a description of the items or services along with their fair market value.

04

If the vehicle's value exceeds $500, attach Form 1098-C to the receipt and provide the appropriate acknowledgment language to the donor.

05

Sign and date the receipt, as well as include the organization's official contact information.

06

Keep a copy of the receipt for your records and provide a copy to the donor for their tax purposes.

Who needs car donation receipt:

01

Non-profit organizations that accept car donations usually require a car donation receipt for their own records and to fulfill legal requirements.

02

Donors who intend to claim a tax deduction for their vehicle donation will typically need a car donation receipt as supporting documentation for their tax return.

03

Individuals or organizations that facilitate car donations, such as car donation programs or third-party brokers, may also request a car donation receipt to ensure transparency and accountability in the donation process.

Fill

form

: Try Risk Free

People Also Ask about

What is a 1098?

Use Form 1098, Mortgage Interest Statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or business from an individual, including a sole proprietor.

What is the carryover for Form 8283?

The IRS requires non-cash charitable contributions carried over from prior years to be shown on the Form 8283 in the current year if the total allowed amount of those carryovers exceeds $5000.

Is a car donation an itemized deduction?

You'll need to report your deduction on Schedule A of your federal income tax return. If your car donation is more than $500, you must also fill out IRS Form 8283. If your deduction for the car is between $501 and $5,000, fill out Part A of the form.

How much of a tax write off is donating a car?

How much can I deduct? Once your vehicle is sold, the selling price determines the amount of your donation. If your vehicle sells for more than $500, you may deduct the full selling price. If your vehicle sells for $500 or less, you can deduct the “fair market value” of your vehicle, up to $500.

Is donating a car a good tax write off?

Donating your car to charity can result in significant tax savings if you include it in your charitable contribution deduction. However, doing a little planning will ensure that you maximize the tax savings of your donation.

Do I need to notify my local motor vehicle division when I donate my vehicle?

State notification should be completed BEFORE cancelling your insurance. Do I have to notify my local Motor Vehicle Division or DMV when I donate my vehicle? If state notification is required, you should notify your local Motor Vehicle Division or DMV to complete the donation process.

Does an act of donation need to be notarized in Louisiana?

ACT OF DONATIONS Louisiana residents, who want to donate vehicles, real estate, stock, or other property to charities, family members, or other individuals, usually need to fill out an Act of Donation form and have it notarized and witnessed.

Do both parties have to be present to transfer a car title in Louisiana?

Yes. However, the person giving and receiving the vehicle, must execute a document in the presence of a Notary and two witnesses. Call us and we can walk you through the process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete vehicle donation receipt template online?

Completing and signing vehicle donation receipt template online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I sign the vehicle donation receipt template electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your vehicle donation receipt template in seconds.

How do I complete vehicle donation receipt template on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your vehicle donation receipt template. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is vehicle donation receipt template?

A vehicle donation receipt template is a standardized form used by charities to provide a written acknowledgment of a vehicle donation made by an individual or organization. The template typically includes details about the donor, the donated vehicle, and the charity.

Who is required to file vehicle donation receipt template?

Donors who wish to claim a tax deduction for their vehicle donation are required to keep a vehicle donation receipt provided by the charity. The charity is responsible for filling out and giving this receipt to the donor.

How to fill out vehicle donation receipt template?

To fill out a vehicle donation receipt template, include the donor's name, address, date of the donation, a description of the vehicle, the Vehicle Identification Number (VIN), the charity's name, and the charity's acknowledgment of the donation. If applicable, also include the fair market value of the vehicle.

What is the purpose of vehicle donation receipt template?

The purpose of a vehicle donation receipt template is to provide a formal record of the vehicle donation for both the donor and the charity. It is also used to substantiate the donor's tax deductions when filing tax returns.

What information must be reported on vehicle donation receipt template?

The information that must be reported on a vehicle donation receipt template includes the donor's name and address, the vehicle's make, model, year, VIN, the date of the donation, the charity's name and address, and a statement that the donor did not receive anything in return for the donation.

Fill out your vehicle donation receipt template online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Vehicle Donation Receipt Template is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.