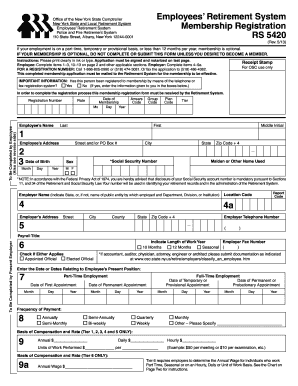

NY RS 5420 2018-2025 free printable template

Show details

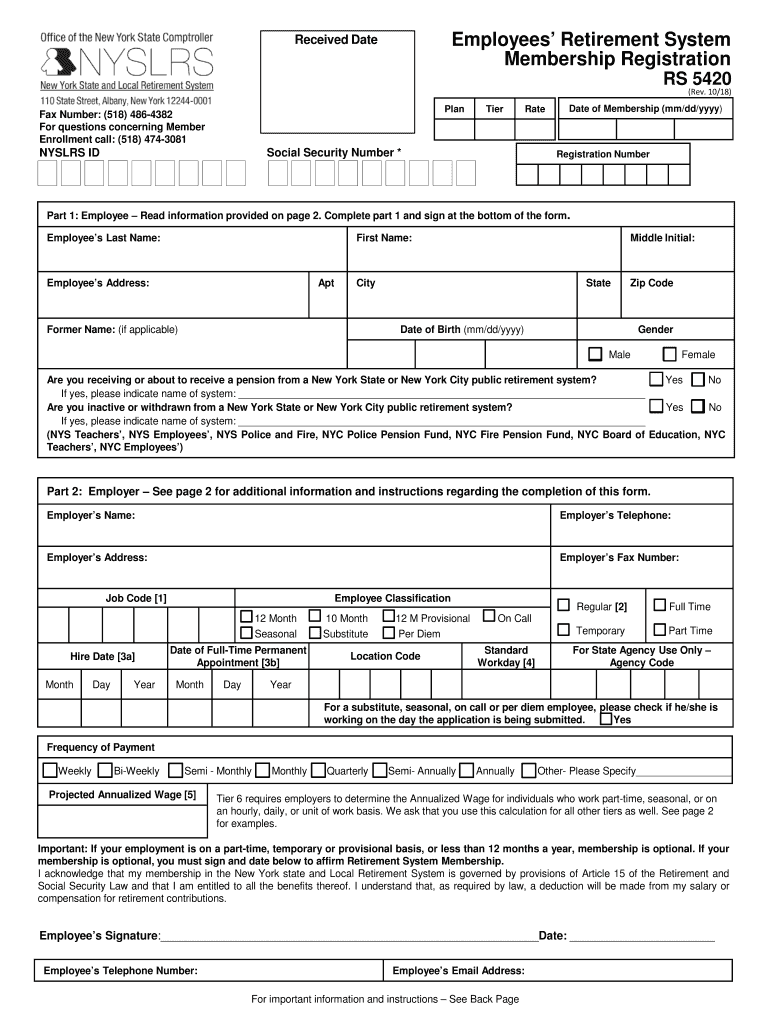

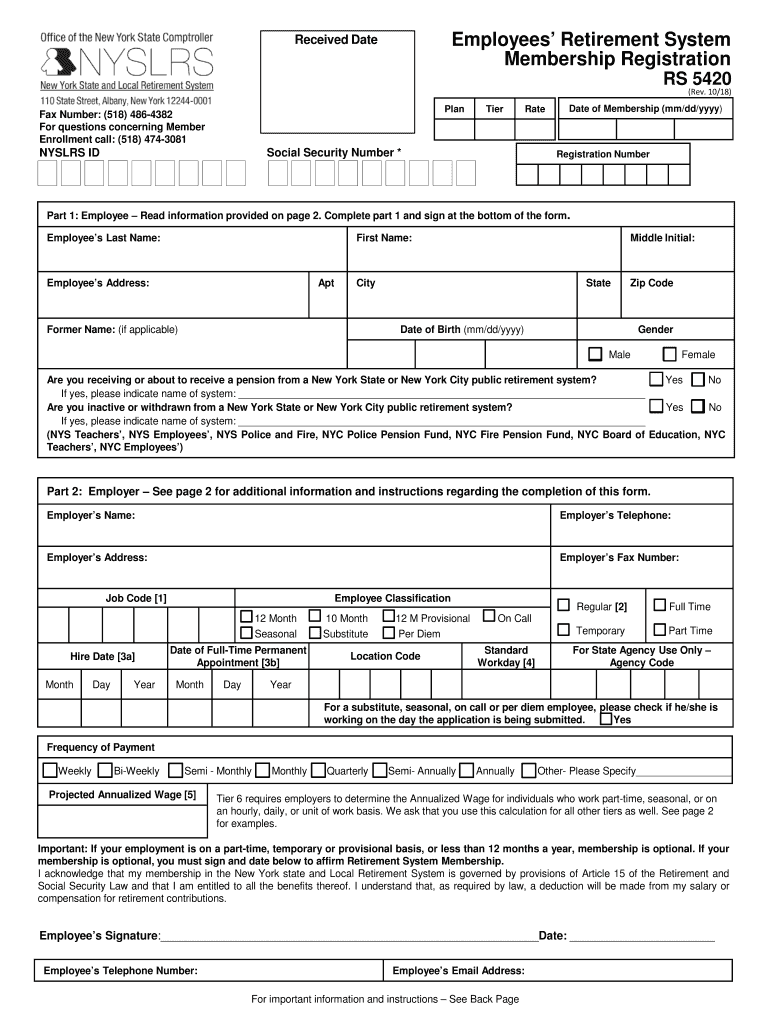

Employees Retirement System Membership RegistrationReceived Daters 5420 (Rev. 10/18)Planar Number: (518) 4864382 For questions concerning Member Enrollment call: (518) 4743081TierRateSocial Security

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign nys retirement forms

Edit your rs 5420 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY RS 5420 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY RS 5420 online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit NY RS 5420. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY RS 5420 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY RS 5420

How to fill out employees retirement system membership:

01

Obtain the necessary forms from your employer or the retirement system's website.

02

Fill in your personal information, such as name, address, and social security number.

03

Provide employment details, including the name and address of your employer, your job title, and dates of employment.

04

Indicate your desired retirement plan, such as a defined benefit or defined contribution plan.

05

Specify your contribution amount, if applicable, and any additional voluntary contributions you wish to make.

06

Review and sign the completed form, ensuring that all information is accurate and legible.

Who needs employees retirement system membership:

01

Employees who want to contribute towards their retirement savings.

02

Individuals who are employed by an organization that offers a retirement system membership.

03

Those who are interested in receiving retirement benefits from the system upon reaching a certain age or meeting specific criteria.

Fill

form

: Try Risk Free

People Also Ask about

What forms are needed for NYS retirement?

Applications for Retirement. Application for Service Retirement (RS-6037) Beneficiaries. Eligibility of Retired Employee for Survivor's Benefit (RS-6355) Change of Address. Change of Address Form for Active Members (RS-5512) Health Benefits. Health Insurance Transaction Form (PS-404) M/C Life Insurance. Sign Up / Decline.

Can I collect NYS pension and still work?

A Message from Comptroller Thomas P. NYSLRS retirees can work after retirement and still receive a pension.

Can I cash out my NYS retirement?

You may choose to: Terminate your membership and withdraw your accumulated contributions plus interest; or. Leave your contributions in your account and qualify for a retirement benefit when you are age 55.

Can I withdraw from my pension account?

You can leave your money in your pension pot and take lump sums from it as and when you need, until your money runs out or you choose another option. You can decide when you make withdrawals and how much to you take out.

Is my NYS retirement loan taxable?

Your loan will be taxable if: You do not make the required payments on your loan at least once every three months or do not complete payment within five years from the date the loan was issued. You retire or withdraw from the Retirement System and have one or more outstanding loan balances when you retire or withdraw.

How long do you have to work for NYS to be vested?

You are eligible for a vested retirement benefit if you leave public employment before age 55 and you have five or more years of credited service. This means that when you reach age 55, you will be entitled to a retirement benefit based on your service and your earnings when you were an active member.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send NY RS 5420 to be eSigned by others?

Once your NY RS 5420 is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How can I edit NY RS 5420 on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit NY RS 5420.

How can I fill out NY RS 5420 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your NY RS 5420. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is NY RS 5420?

NY RS 5420 is a form used in New York State to report certain financial information and disclosures related to the governance and ethical conduct of public officials.

Who is required to file NY RS 5420?

Public officials, including elected officials and certain appointed officials in New York State, are required to file NY RS 5420.

How to fill out NY RS 5420?

To fill out NY RS 5420, individuals must provide personal information, disclose financial interests, describe relevant positions held, and declare any potential conflicts of interest as required by the form's guidelines.

What is the purpose of NY RS 5420?

The purpose of NY RS 5420 is to promote transparency, accountability, and ethical governance among public officials by ensuring that they disclose their financial interests and potential conflicts of interest.

What information must be reported on NY RS 5420?

NY RS 5420 requires reporting information such as income sources, property interests, business ownership, positions held in organizations, and any relationships that may pose a conflict of interest.

Fill out your NY RS 5420 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY RS 5420 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.