Treasury FS 1522 2019 free printable template

Show details

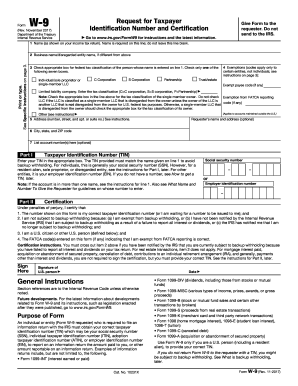

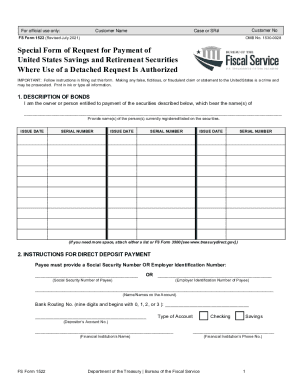

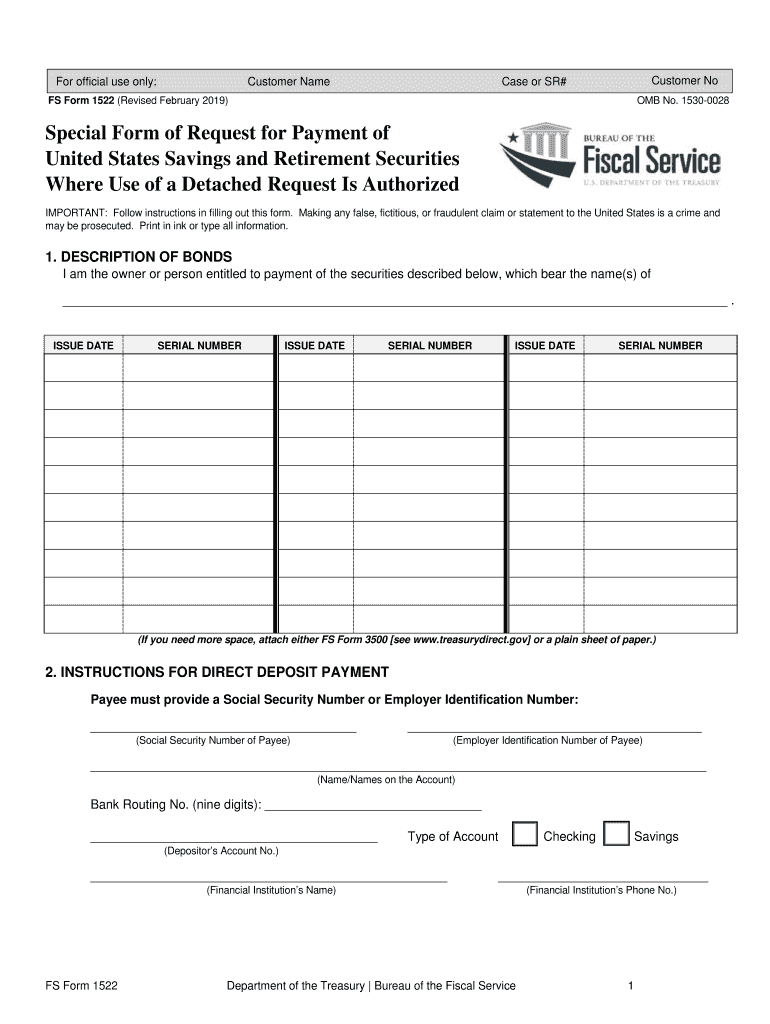

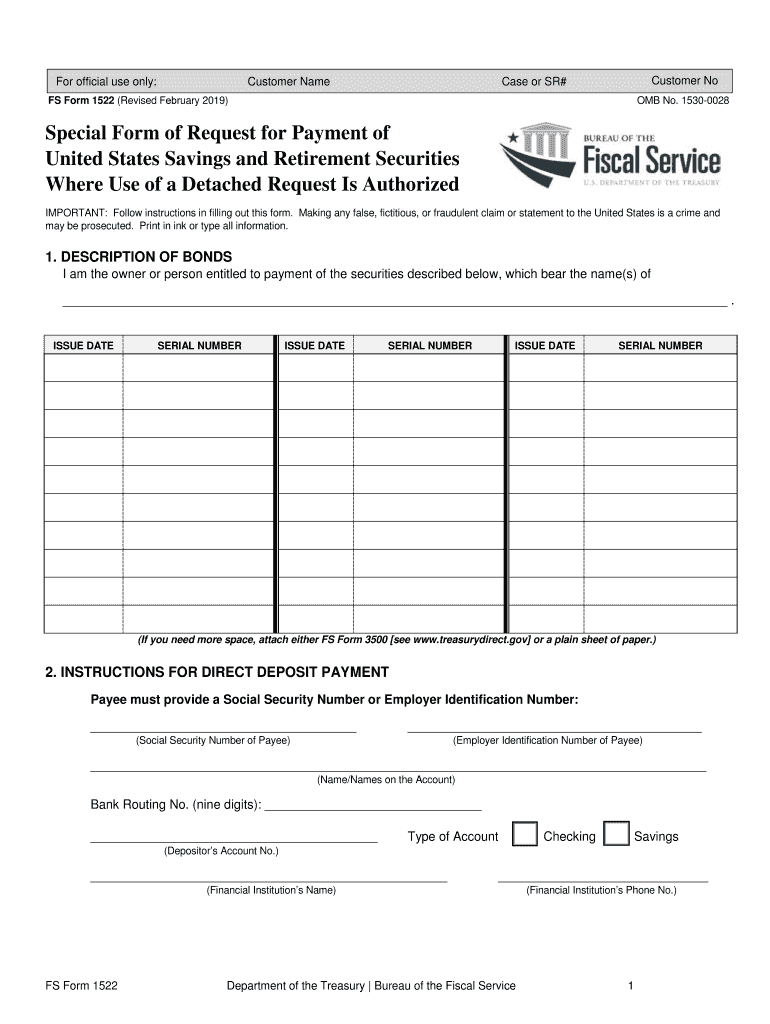

RESET For official use only Customer No Case or SR FS Form 1522 Revised February 2019 OMB No. 1530-0028 Special Form of Request for Payment of United States Savings and Retirement Securities Where Use of a Detached Request Is Authorized IMPORTANT Follow instructions in filling out this form. Making any false fictitious or fraudulent claim or statement to the United States is a crime and may be prosecuted. Print in ink or type all information. 1. Gov or a plain sheet of paper. 2. INSTRUCTIONS...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Treasury FS 1522

Edit your Treasury FS 1522 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Treasury FS 1522 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Treasury FS 1522 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit Treasury FS 1522. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Treasury FS 1522 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Treasury FS 1522

How to fill out Treasury FS 1522

01

Obtain the Treasury FS 1522 form from the official website or your local financial institution.

02

Fill in the 'Claimant's Name' section with the full name of the individual or entity making the claim.

03

Enter the 'Claimant's Address' where the claimant resides or does business.

04

Provide the 'Social Security Number' or 'Employer Identification Number' for tax purposes.

05

Complete the section titled 'Type of Claim' by indicating the specific reason for the claim.

06

Include the 'Amount of Claim' that is being requested, ensuring it matches supporting documentation.

07

Sign and date the form, certifying that all provided information is accurate and complete.

08

Attach any required documentation that supports the claim.

09

Submit the completed form to the appropriate Treasury office as indicated in the instructions.

Who needs Treasury FS 1522?

01

Individuals or businesses claiming amounts owed by the U.S. Treasury, such as unclaimed payments or compensation.

02

Beneficiaries or heirs of deceased individuals who are claiming funds.

03

Parties involved in legal settlements that require proof of claim to receive payment.

Fill

form

: Try Risk Free

People Also Ask about

Why do I need Form 5444?

They're required to file additional paperwork to prove their identity before they can open a TreasuryDirect account. To do so, you must fill out Form 5444 , which is designed to prevent fraud when opening the online TreasuryDirect account.

What is a Form 1522?

FS Form 1522. Special Form of Request for Payment of United States Savings and Retirement Securities Where Use of a Detached Request Is Authorized. Request payment when use of a detached request is authorized. Sign this form in the presence of a certifying individual.

What form for replacing lost savings bonds?

To file a claim for a savings bond that is lost, stolen, or destroyed, complete a Claim for Lost, Stolen, or Destroyed United States Savings Bonds (FS Form 1048). Please sign the form in the presence of an authorized certifying officer (available at a bank, trust company, or credit union).

Where can I get TreasuryDirect form signed?

Any Bank Works If you use an online bank in TreasuryDirect, you can go to a different bank with a brick-and-mortar branch for the signature guarantee. If one bank refuses you, you can go to another bank. If you go to a bank or a credit union, talk to someone working at a desk, not a teller.

How long does it take to get a TreasuryDirect authorization form?

Cases you send by mail may take us as long as 13 weeks to process. Processing of FS Form 5444, for account authorization, currently takes about eight weeks."

What is FS Form 1522 used for?

USE OF FORM – Use this form to request payment of United States Savings Bonds, Savings Notes, Retirement Plan Bonds, and Individual Retirement Bonds.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my Treasury FS 1522 directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your Treasury FS 1522 and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I send Treasury FS 1522 to be eSigned by others?

Once your Treasury FS 1522 is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I complete Treasury FS 1522 online?

pdfFiller has made it simple to fill out and eSign Treasury FS 1522. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

What is Treasury FS 1522?

Treasury FS 1522 is a form used by the U.S. Department of the Treasury for reporting information related to the payment of federal taxes.

Who is required to file Treasury FS 1522?

Individuals, businesses, or entities that have tax obligations to the federal government may be required to file Treasury FS 1522.

How to fill out Treasury FS 1522?

To fill out Treasury FS 1522, you must provide accurate information regarding your tax obligations, including identification details, payment amounts, and other relevant financial data.

What is the purpose of Treasury FS 1522?

The purpose of Treasury FS 1522 is to help the U.S. Treasury monitor and collect federal tax payments efficiently.

What information must be reported on Treasury FS 1522?

The information that must be reported on Treasury FS 1522 includes taxpayer identification, amount of tax owed, payment details, and any relevant correspondence dates.

Fill out your Treasury FS 1522 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Treasury FS 1522 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.