NY DTF IT-201 2018 free printable template

Show details

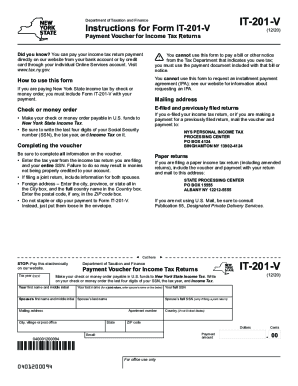

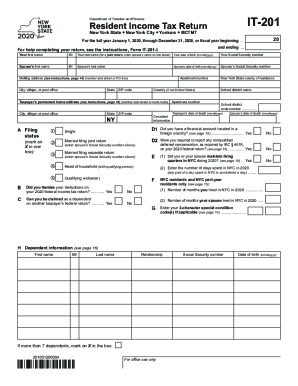

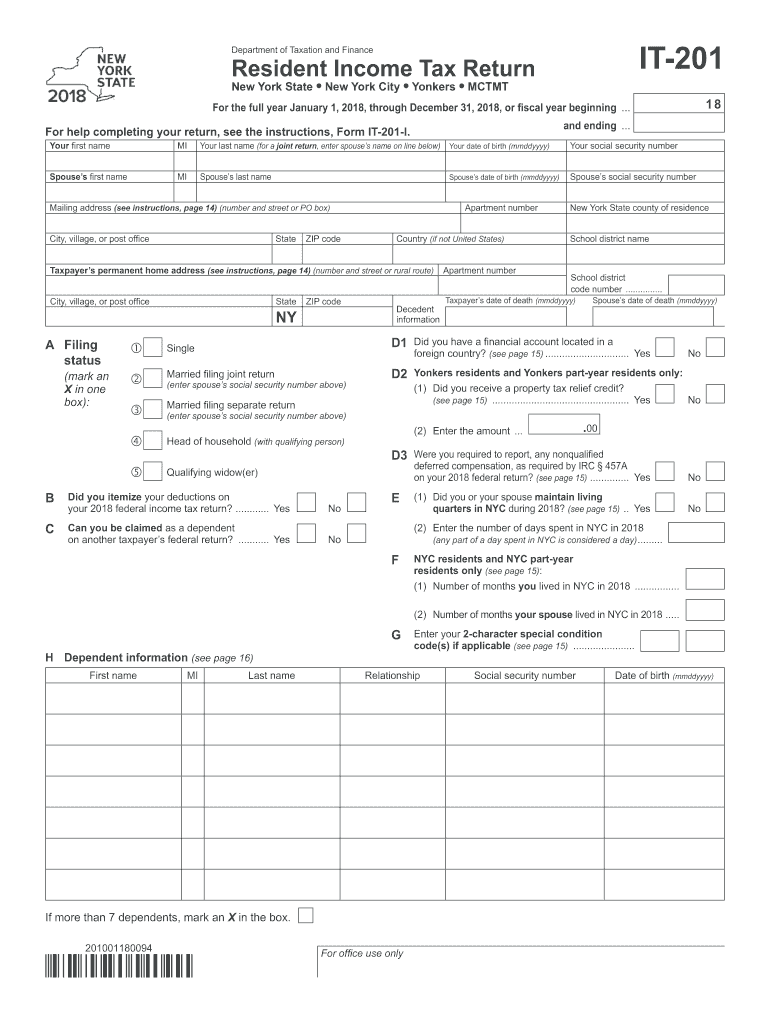

49 surcharges and MCTMT. 50 Part-year NYC resident tax Form IT-360. 1. 50 51 Other NYC taxes Form IT-201-ATT line 34. 44 45 Net other NYS taxes Form IT-201-ATT line 30. 45 46 Total New York State taxes add lines 44 and 45. 51 52 Add lines 49 50 and 51. 52 53 NYC nonrefundable credits Form IT-201-ATT line 10. 53 line 52 leave blank. 37 Name s as shown on page 1 IT-201 2018 Page 3 of 4 Tax computation credits and other taxes NYS tax on line 38 amount see page 22. 39 NYS household credit page 21...table 1 2 or 3. 40 Resident credit see page 23. 41 Other NYS nonrefundable credits Form IT-201-ATT line 7. 70a Other refundable credits Form IT-201-ATT line 18. 71 74 Total Yonkers tax withheld. 75 Total estimated tax payments and amount paid with Form IT-370 76 Total payments add lines 63 through 75. If you pay by check or money order you must complete Form IT-201-V and mail it with your return.. 80 81 Estimated tax penalty include this amount in line 80 or reduce the overpayment on line 77...see page 34. 39 NYS household credit page 21 table 1 2 or 3. 40 Resident credit see page 23. 41 Other NYS nonrefundable credits Form IT-201-ATT line 7. 42 Add lines 40 41 and 42. 43 44 Subtract line 43 from line 39 if line 43 is more than line 39 leave blank. IT-201 Department of Taxation and Finance Resident Income Tax Return New York State New York City Yonkers MCTMT For the full year January 1 2018 through December 31 2018 or fiscal year beginning. Taxpayer s date of death mmddyyyy D1 Did...you have a financial account located in a Single Married filing joint return D2 Yonkers residents and Yonkers part-year residents only 1 Did you receive a property tax relief credit see page 15. Yes No Head of household with qualifying person Qualifying widow er enter spouse s social security number above B Did you itemize your deductions on your 2018 federal income tax return. Yes C Can you be claimed as a dependent on another taxpayer s federal return. Yes H Dependent information see page 16...First name Last name 2 Enter the amount. D3 Were you required to report any nonqualified deferred compensation as required by IRC 457A E 1 Did you or your spouse maintain living quarters in NYC during 2018 see page 15. Yes 2 Enter the number of days spent in NYC in 2018 any part of a day spent in NYC is considered a day. F NYC residents and NYC part-year residents only see page 15 1 Number of months you lived in NYC in 2018. G Enter your 2 character special condition code s if applicable see...page 15. Relationship If more than 7 dependents mark an X in the box. 2 Ordinary dividends. 3 Taxable refunds credits or offsets of state and local income taxes also enter on line 25. 4 Alimony received. 5 Business income or loss submit a copy of federal Schedule C or C-EZ Form 1040. 6 Capital gain or loss if required submit a copy of federal Schedule D Form 1040. 7 Other gains or losses submit a copy of federal Form 4797. 8 Taxable amount of IRA distributions. If received as a beneficiary mark...an X in the box. Rental real estate royalties partnerships S corporations trusts etc* submit copy of federal Schedule E Form 1040 11 Farm income or loss submit a copy of federal Schedule F Form 1040.

pdfFiller is not affiliated with any government organization

Instructions and Help about NY DTF IT-201

How to edit NY DTF IT-201

How to fill out NY DTF IT-201

Instructions and Help about NY DTF IT-201

How to edit NY DTF IT-201

Using pdfFiller, you can easily edit the NY DTF IT-201 form. Simply upload the form to the platform, where you can add or modify information as needed. This tool allows for straightforward text editing and ensures that your entries are legible and neatly formatted.

How to fill out NY DTF IT-201

Filling out the NY DTF IT-201 requires attention to detail. Start by entering personal identification information, such as your Social Security number or Employer Identification Number (EIN). Follow this by providing income details and claiming any applicable credits or deductions. Review each section carefully to ensure accuracy.

About NY DTF IT previous version

What is NY DTF IT-201?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About NY DTF IT previous version

What is NY DTF IT-201?

The NY DTF IT-201 form is the New York State Personal Income Tax Return for resident individuals. This form is used to report income, calculate tax liabilities, claim credits, and determine what refunds may be owed.

What is the purpose of this form?

The purpose of the NY DTF IT-201 is to provide the New York State Department of Taxation and Finance with a comprehensive overview of an individual's income and tax obligations. It allows the state to assess how much tax is owed based on the income reported and to process any potential refunds or credits.

Who needs the form?

Individuals who are residents of New York State and have earned income during the tax year are required to file the NY DTF IT-201 form. This typically includes wages from employment, self-employment income, and other income sources such as dividends and interest.

When am I exempt from filling out this form?

You may be exempt from filing the NY DTF IT-201 if your income falls below the state’s minimum threshold, you have no taxable income for the year, or if you are not a resident of New York. Additionally, certain categories, such as dependents, may also be exempt.

Components of the form

The NY DTF IT-201 consists of several key components: personal information fields, income sections where you report different types of income, tax calculation sections, schedules for credits and deductions, and signature lines. Each component must be completed accurately to ensure proper processing.

What are the penalties for not issuing the form?

Failure to file the NY DTF IT-201 by the deadline can result in penalties ranging from late fees to interest on unpaid taxes. For fraudulent or intentional misstatements, more severe penalties and legal consequences may apply. It is essential to file on time to avoid such repercussions.

What information do you need when you file the form?

When filing the NY DTF IT-201, gather essential information including your Social Security number, any W-2 or 1099 tax forms, documentation of deductions and credits, and bank account information for direct deposits if expecting a refund. This information streamlines the filing process and ensures accuracy.

Is the form accompanied by other forms?

Depending on your individual tax situation, the NY DTF IT-201 may be accompanied by additional schedules or forms, especially if you are claiming specific deductions, credits, or if you have complex income sources. It's crucial to check New York State tax guidelines to ensure all related forms are submitted.

Where do I send the form?

The completed NY DTF IT-201 should be sent to the address specified by the New York State Department of Taxation and Finance, based on your residence and whether you are filing electronically or by mail. Confirm the latest mailing address on the official state tax website.

See what our users say