NY IT-201-V 2020 free printable template

Show details

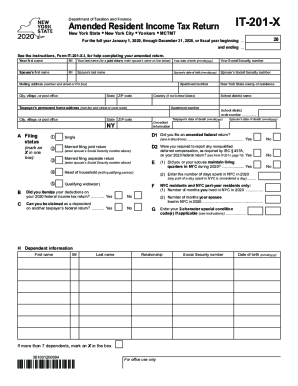

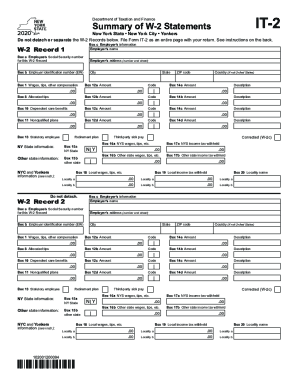

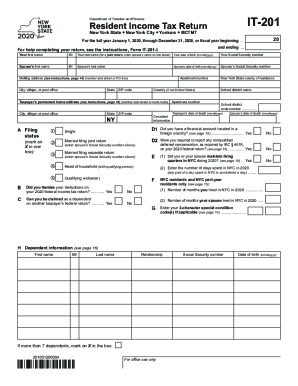

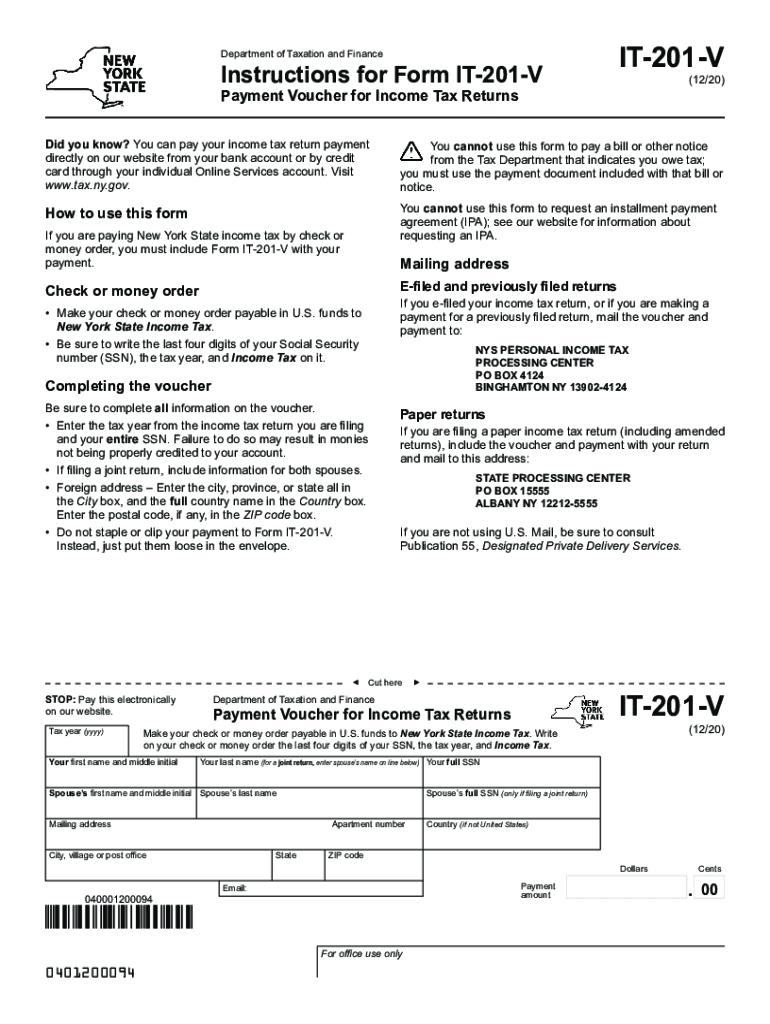

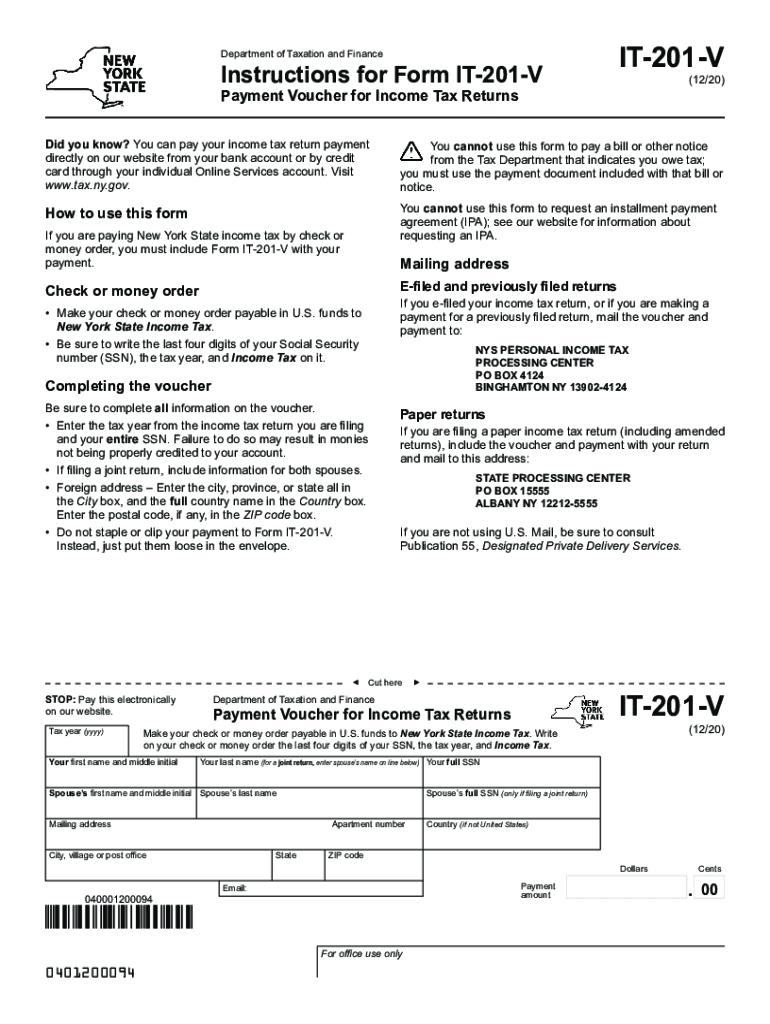

Enter the postal code if any in the ZIP code box. Do not staple or clip your payment to Form IT-201-V. IT-201-V Department of Taxation and Finance Instructions for Form IT-201-V 12/18 Payment Voucher for Income Tax Returns Did you know You can pay your income tax return payment directly on our website from your bank account or by credit card through your individual Online Services account. How to use this form agreement IPA see our website for information about requesting an IPA. If you are...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY IT-201-V

Edit your NY IT-201-V form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY IT-201-V form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY IT-201-V online

Follow the steps down below to benefit from a competent PDF editor:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NY IT-201-V. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY IT-201-V Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY IT-201-V

How to fill out NY IT-201-V

01

Download the NY IT-201-V form from the New York State Department of Taxation and Finance website.

02

Fill in your name, address, and Social Security number at the top of the form.

03

Indicate the tax year for which the payment is being made.

04

Specify the amount you are submitting for payment.

05

If applicable, include any interest or penalties owed.

06

Sign and date the form at the bottom.

07

Mail the form along with your payment to the address specified in the instructions.

Who needs NY IT-201-V?

01

Individuals who are making a payment on their New York State income tax return (IT-201) using the IT-201-V form.

Fill

form

: Try Risk Free

People Also Ask about

How do I pay my estimated tax payments 2022?

The IRS provides various methods for making 2022 quarterly estimated tax payments: You may credit an overpayment on your 2021 tax return to your 2022 estimated tax; You may mail your payment with payment voucher, Form 1040-ES; You may pay by phone or online (refer to Form 1040-ES instructions);

How do I pay NY state income tax?

You can pay directly from your preferred account or by credit card through your Individual Online Services account.Pay from account with a bank or banking services provider (free) schedule payments in advance, save your bank account information, and. receive instant confirmation from the New York State Tax Department.

When can I pay 2022 estimated taxes?

So, for example, if you didn't have any taxable income in 2022 until August, you don't have to make an estimated tax payment until September 15. At that point, you can either pay your entire estimated tax by the September 15 due date or pay it in two installments by September 15 and January 17.

How do I check if I owe NYS taxes?

To review your tax account balance, use your Individual Online Services account with the Tax Department. Your account also gives you access to your tax-related information and activity. Married filing a joint return? You will both need your own Online Services account to view each spouse's separate tax account balance.

What is the deadline to pay NY state taxes?

The latest deadline for e-filing New York State Tax Returns is April 18, 2023. New York State Income Tax Return forms for Tax Year 2022 (Jan. 1 - Dec. 31, 2022) can be e-Filed in conjunction with an IRS Income Tax Return by April 18, 2023.

How do I pay my NY income tax online?

You can pay directly from your preferred account or by credit card through your Individual Online Services account.Pay from account with a bank or banking services provider (free) schedule payments in advance, save your bank account information, and. receive instant confirmation from the New York State Tax Department.

How long do you have to pay taxes after due date?

If after 5 months you still haven't paid, the Failure to File Penalty will max out, but the Failure to Pay Penalty continues until the tax is paid, up to its maximum of 25% of the unpaid tax as of the due date.

How do I automatically pay estimated taxes?

To make estimated tax payments online, first establish an account with the IRS at the EFTPS website. Once you have an EFTPS account established, you can schedule automatic withdrawals for your quarterly estimated taxes, specifying the amounts and the dates of the payments.

How do I pay my New York income tax?

Payment Options If you received a bill or notice and need to pay, you have options: use your Online Services account to pay directly from your bank account for free or by credit card for a fee. Don't have an Online Services account? Pay directly from your bank account for free using Quick Pay (individuals only).

What is the NYS tax deadline for 2022?

FilerReturn2021 Filing deadline for calendar-year filersIndividualForm IT-201, IT-203, or IT-203-GRApril 18, 2022PartnershipForm IT-204March 15, 2022FiduciariesForm IT-205April 18, 2022 Apr 25, 2022

Can I pay my New York State income tax online?

Pay income tax through Online Services, regardless of how you file your return. You can pay, or schedule a payment for, any day up to and including the due date. If you apply for an extension of time to file and owe tax, you need to make your extension payment by the due date.

Do you have to pay owed taxes by April 15?

Individual income tax returns are typically due April 15, unless the date falls on a weekend or holiday or you file Form 4868 seeking an extension until October 15. Independent contractors, gig workers, and self-employed people usually have to make quarterly estimated tax payments are pre-set dates throughout the year.

Can I pay my estimated tax all at once?

The answer is no. Because the U.S. tax system is pay as you go, you need to pay and file on a quarterly basis or you'll be charged a penalty.

How long do I have to pay my taxes after April 18th?

File and Pay Extension Taxpayers will have until April 18, 2022 to file and pay income taxes. California grants you an automatic extension to file your state tax return. No form is required. You must file by October 17, 2022.

How do I pay my NY state tax by check?

If you are paying New York State income tax by check or money order, you must include Form IT-201-V with your payment. Make your check or money order payable in U.S. funds to New York State Income Tax. Be sure to write the last four digits of your Social Security number (SSN), the tax year, and Income Tax on it.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit NY IT-201-V from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your NY IT-201-V into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I execute NY IT-201-V online?

With pdfFiller, you may easily complete and sign NY IT-201-V online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit NY IT-201-V online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your NY IT-201-V to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

What is NY IT-201-V?

NY IT-201-V is a payment voucher used for making tax payments in New York State for personal income tax. It is typically utilized by taxpayers who need to pay their tax balance due for the year.

Who is required to file NY IT-201-V?

Taxpayers who owe taxes and are filing their New York State personal income tax returns using Form IT-201 are required to file NY IT-201-V to submit their payment.

How to fill out NY IT-201-V?

To fill out NY IT-201-V, you must provide your name, address, and Social Security number, along with the amount of payment you are submitting and the tax year for which the payment is being made.

What is the purpose of NY IT-201-V?

The purpose of NY IT-201-V is to facilitate the payment of New York State personal income taxes by allowing taxpayers to submit their payments securely and efficiently.

What information must be reported on NY IT-201-V?

The information that must be reported on NY IT-201-V includes the taxpayer's name, address, Social Security number, payment amount, and tax year.

Fill out your NY IT-201-V online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY IT-201-V is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.