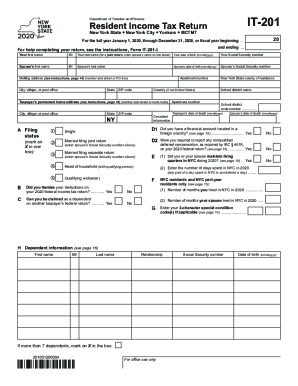

NY IT-201-V 2018 free printable template

Show details

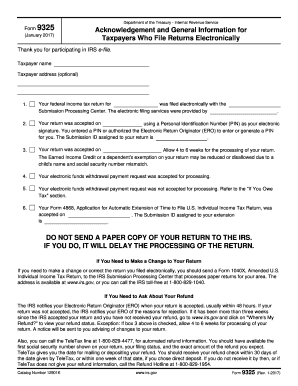

Enter the postal code if any in the ZIP code box. Do not staple or clip your payment to Form IT-201-V. IT-201-V Department of Taxation and Finance Instructions for Form IT-201-V 12/18 Payment Voucher for Income Tax Returns Did you know You can pay your income tax return payment directly on our website from your bank account or by credit card through your individual Online Services account. How to use this form agreement IPA see our website for information about requesting an IPA. If you are...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY IT-201-V

Edit your NY IT-201-V form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY IT-201-V form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY IT-201-V online

Use the instructions below to start using our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit NY IT-201-V. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY IT-201-V Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY IT-201-V

How to fill out NY IT-201-V

01

Download the NY IT-201-V form from the NYS Department of Taxation and Finance website.

02

Fill in your personal information at the top of the form, including your name, address, and social security number.

03

Enter the tax year for which you are filing in the designated space.

04

Complete the payment amount section by indicating the total amount of tax being submitted.

05

Include any necessary details about your filing status, if applicable.

06

Review all entered information for accuracy.

07

Sign and date the form before submitting it.

08

Mail the completed form along with your payment to the address specified in the instructions.

Who needs NY IT-201-V?

01

Individuals who are filing their New York State personal income tax return.

02

Taxpayers who owe taxes and are making a payment with their tax return.

03

Residents and non-residents of New York State who are required to file a tax return.

Fill

form

: Try Risk Free

People Also Ask about

Can I still file an amended tax return for 2018?

You typically must file an amended return within three years from the original filing deadline, or within two years of paying the tax due for that year, if that date is later.

What is form IT-201 used for?

Form IT-201 is the standard New York income tax return for state residents. Nonresidents and part-time residents must use must use Form IT-203 instead. Form IT-201 requires you to list multiple forms of income, such as wages, interest, or alimony .

How many years later can you amend a tax return?

If you are within three years from the date you filed your original return, you can amend your taxes by filing Form 1040X.

Can you amend a tax return after 5 years?

The Internal Revenue Service limits the amount of time you have to file a 1040-X to the later of three years from the date you file the original tax return, or two years from the time you pay the tax for that year.

What does IT-201-V mean?

0402210094. IT-201-V (12/21) (back) Fee for payments returned by banks – The law allows the Tax Department to charge a $50 fee when a check, money order, or electronic payment is returned by a bank for nonpayment.

Can I pay my New York State income tax online?

Pay income tax through Online Services, regardless of how you file your return. You can pay, or schedule a payment for, any day up to and including the due date. If you apply for an extension of time to file and owe tax, you need to make your extension payment by the due date.

What is the difference between it-201 and 1040?

The IT-201 is the main income tax form for New York State residents. It is analogous to the US Form 1040, but it is four pages long, instead of two pages. The first page of IT-201 is mostly a recap of information that flows directly from the federal tax forms.

On what line of the IT-201 is the taxable income?

Net taxable income is the income reported on line 37 of your 2015 IT-201 Tax Form.

Can I amend my 2018 tax return in 2022?

For example, if you file your 2018 tax return on March 15, 2019, then you have until April 18, 2022 to get your amended tax return to the IRS. For a 2021 tax return filed in 2022, the deadline was April 18, 2022 and therefore 2021 amended returns have to be filed prior to April 18, 2025.

Do you need to attach federal return to New York return?

State Only Return Requirements – New York returns can be transmitted with the Federal return or as a State Only return unlinked from the Federal return. Amended Returns - Amended returns are required to be e-filed.

What is the difference between IT-201 and IT-203?

Form IT-201 can be used only by resident New York taxpayers who want to file their New York income tax returns. If you are a part-year resident or a nonresident, you may use Form IT-203 instead to file your income tax return.

Can you amend a tax return more than 3 years old?

Generally, for a credit or refund, you must file Form 1040-X within 3 years after the date you timely filed your original return or within 2 years after the date you paid the tax, whichever is later. Allow the IRS up to 16 weeks to process the amended return.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in NY IT-201-V?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your NY IT-201-V and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I edit NY IT-201-V on an iOS device?

Use the pdfFiller mobile app to create, edit, and share NY IT-201-V from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How do I edit NY IT-201-V on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute NY IT-201-V from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is NY IT-201-V?

NY IT-201-V is a payment voucher used for submitting personal income tax payments to the New York State Department of Taxation and Finance.

Who is required to file NY IT-201-V?

Individuals who owe personal income tax in New York State and are making an estimated payment or filing an extension are required to file NY IT-201-V.

How to fill out NY IT-201-V?

To fill out NY IT-201-V, provide your name, address, social security number, the tax year, and the amount of your payment. Ensure the information is accurate and complete.

What is the purpose of NY IT-201-V?

The purpose of NY IT-201-V is to facilitate the payment of personal income tax owed to New York State in a structured and organized manner.

What information must be reported on NY IT-201-V?

The information that must be reported on NY IT-201-V includes your name, address, social security number, tax year, and payment amount.

Fill out your NY IT-201-V online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY IT-201-V is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.