NY IT-201-V 2021 free printable template

Show details

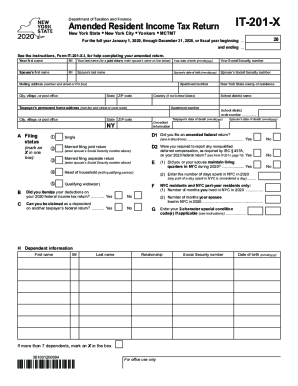

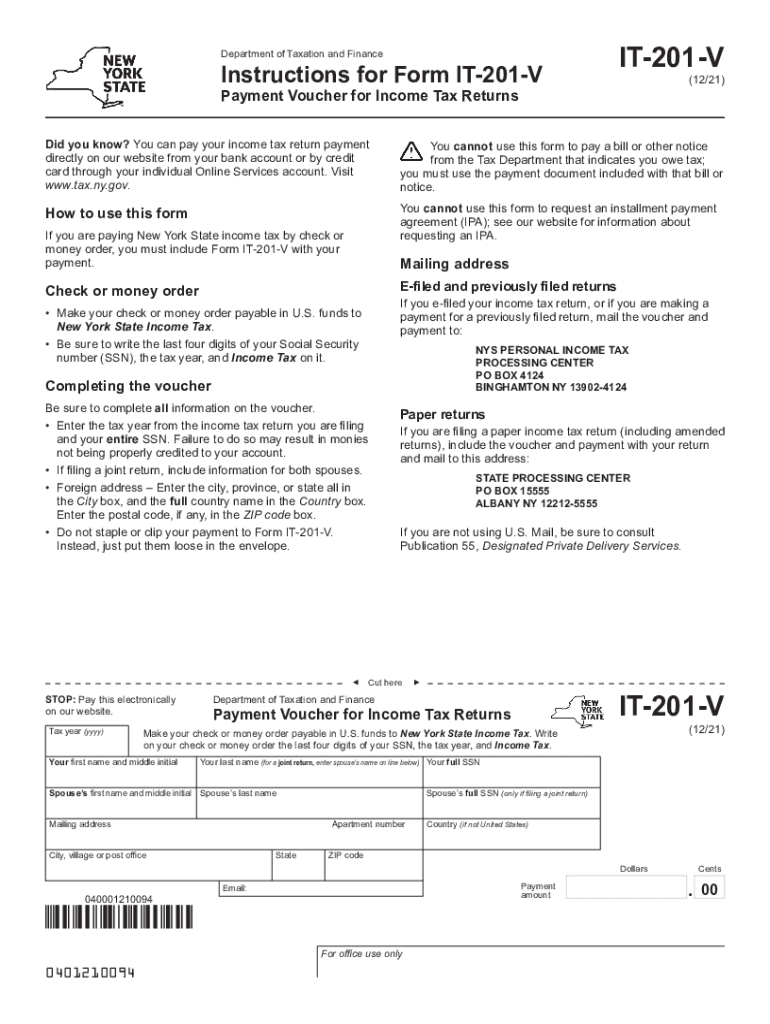

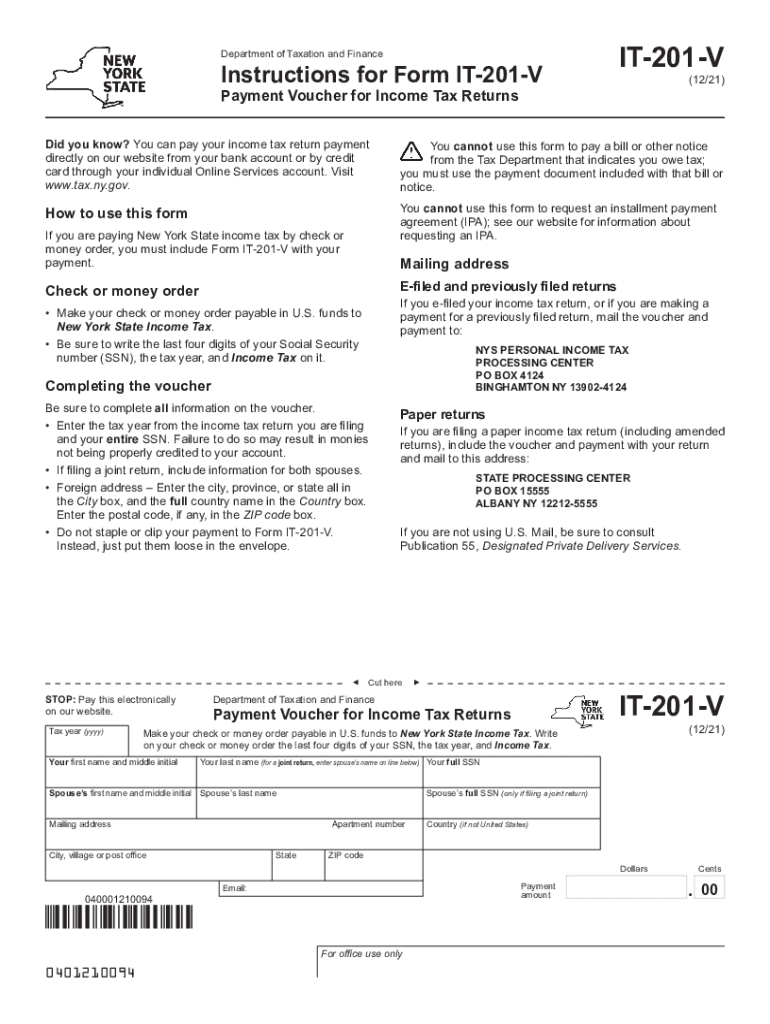

IT201VDepartment of Taxation and FinanceInstructions for Form IT201V(12/21)Payment Voucher for Income Tax Returns

Did you know? You can pay your income tax return payment

directly on our website from

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY IT-201-V

Edit your NY IT-201-V form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY IT-201-V form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY IT-201-V online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NY IT-201-V. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY IT-201-V Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY IT-201-V

How to fill out NY IT-201-V

01

Gather all necessary tax documents including your completed NY IT-201 tax return.

02

Locate the NY IT-201-V form; it can be downloaded from the New York State Department of Taxation and Finance website.

03

Fill out your personal information, including your name, address, and Social Security number.

04

Indicate the amount of payment you're submitting with the form.

05

Write your NYS identification number, which can be found on your tax return.

06

If you're filing for a previous year, make sure to indicate the tax year on the form.

07

Check the form for any errors or omissions before submitting it.

08

Prepare the payment for mailing; ensure it's a check or money order made out to 'New York State Department of Taxation and Finance.'

09

Mail the completed NY IT-201-V and payment to the address specified in the form instructions.

Who needs NY IT-201-V?

01

Individuals who are residents of New York State and are submitting their taxes using the NY IT-201 form for personal income must fill out the NY IT-201-V if they owe state income tax.

02

Taxpayers who are making a payment with their New York State income tax return, rather than through electronic means.

Fill

form

: Try Risk Free

People Also Ask about

How do I pay my estimated tax payments 2022?

The IRS provides various methods for making 2022 quarterly estimated tax payments: You may credit an overpayment on your 2021 tax return to your 2022 estimated tax; You may mail your payment with payment voucher, Form 1040-ES; You may pay by phone or online (refer to Form 1040-ES instructions);

How do I pay NY state income tax?

You can pay directly from your preferred account or by credit card through your Individual Online Services account.Pay from account with a bank or banking services provider (free) schedule payments in advance, save your bank account information, and. receive instant confirmation from the New York State Tax Department.

When can I pay 2022 estimated taxes?

So, for example, if you didn't have any taxable income in 2022 until August, you don't have to make an estimated tax payment until September 15. At that point, you can either pay your entire estimated tax by the September 15 due date or pay it in two installments by September 15 and January 17.

How do I check if I owe NYS taxes?

To review your tax account balance, use your Individual Online Services account with the Tax Department. Your account also gives you access to your tax-related information and activity. Married filing a joint return? You will both need your own Online Services account to view each spouse's separate tax account balance.

What is the deadline to pay NY state taxes?

The latest deadline for e-filing New York State Tax Returns is April 18, 2023. New York State Income Tax Return forms for Tax Year 2022 (Jan. 1 - Dec. 31, 2022) can be e-Filed in conjunction with an IRS Income Tax Return by April 18, 2023.

How do I pay my NY income tax online?

You can pay directly from your preferred account or by credit card through your Individual Online Services account.Pay from account with a bank or banking services provider (free) schedule payments in advance, save your bank account information, and. receive instant confirmation from the New York State Tax Department.

How long do you have to pay taxes after due date?

If after 5 months you still haven't paid, the Failure to File Penalty will max out, but the Failure to Pay Penalty continues until the tax is paid, up to its maximum of 25% of the unpaid tax as of the due date.

How do I automatically pay estimated taxes?

To make estimated tax payments online, first establish an account with the IRS at the EFTPS website. Once you have an EFTPS account established, you can schedule automatic withdrawals for your quarterly estimated taxes, specifying the amounts and the dates of the payments.

How do I pay my New York income tax?

Payment Options If you received a bill or notice and need to pay, you have options: use your Online Services account to pay directly from your bank account for free or by credit card for a fee. Don't have an Online Services account? Pay directly from your bank account for free using Quick Pay (individuals only).

What is the NYS tax deadline for 2022?

FilerReturn2021 Filing deadline for calendar-year filersIndividualForm IT-201, IT-203, or IT-203-GRApril 18, 2022PartnershipForm IT-204March 15, 2022FiduciariesForm IT-205April 18, 2022 Apr 25, 2022

Can I pay my New York State income tax online?

Pay income tax through Online Services, regardless of how you file your return. You can pay, or schedule a payment for, any day up to and including the due date. If you apply for an extension of time to file and owe tax, you need to make your extension payment by the due date.

Do you have to pay owed taxes by April 15?

Individual income tax returns are typically due April 15, unless the date falls on a weekend or holiday or you file Form 4868 seeking an extension until October 15. Independent contractors, gig workers, and self-employed people usually have to make quarterly estimated tax payments are pre-set dates throughout the year.

Can I pay my estimated tax all at once?

The answer is no. Because the U.S. tax system is pay as you go, you need to pay and file on a quarterly basis or you'll be charged a penalty.

How long do I have to pay my taxes after April 18th?

File and Pay Extension Taxpayers will have until April 18, 2022 to file and pay income taxes. California grants you an automatic extension to file your state tax return. No form is required. You must file by October 17, 2022.

How do I pay my NY state tax by check?

If you are paying New York State income tax by check or money order, you must include Form IT-201-V with your payment. Make your check or money order payable in U.S. funds to New York State Income Tax. Be sure to write the last four digits of your Social Security number (SSN), the tax year, and Income Tax on it.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit NY IT-201-V in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing NY IT-201-V and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I sign the NY IT-201-V electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your NY IT-201-V in seconds.

How do I fill out the NY IT-201-V form on my smartphone?

Use the pdfFiller mobile app to complete and sign NY IT-201-V on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is NY IT-201-V?

NY IT-201-V is a payment voucher used for submitting a payment for New York State personal income tax.

Who is required to file NY IT-201-V?

Individuals who owe New York State personal income tax and are submitting a payment along with their tax return are required to file NY IT-201-V.

How to fill out NY IT-201-V?

To fill out NY IT-201-V, you need to provide your name, address, Social Security number or employer identification number, the amount of the payment, and the tax year.

What is the purpose of NY IT-201-V?

The purpose of NY IT-201-V is to ensure that payments for New York State personal income tax are submitted correctly and efficiently.

What information must be reported on NY IT-201-V?

The information that must be reported on NY IT-201-V includes the taxpayer's name, address, Social Security number or employer identification number, tax year, and the payment amount.

Fill out your NY IT-201-V online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY IT-201-V is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.