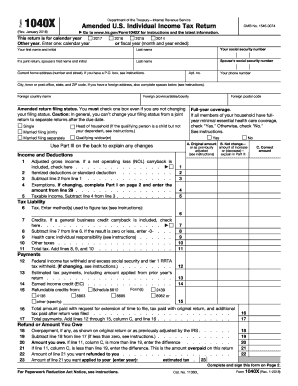

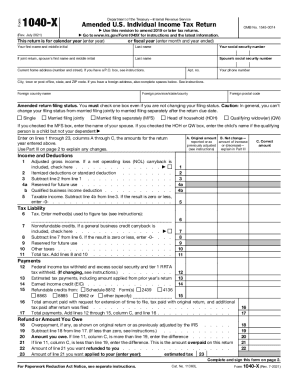

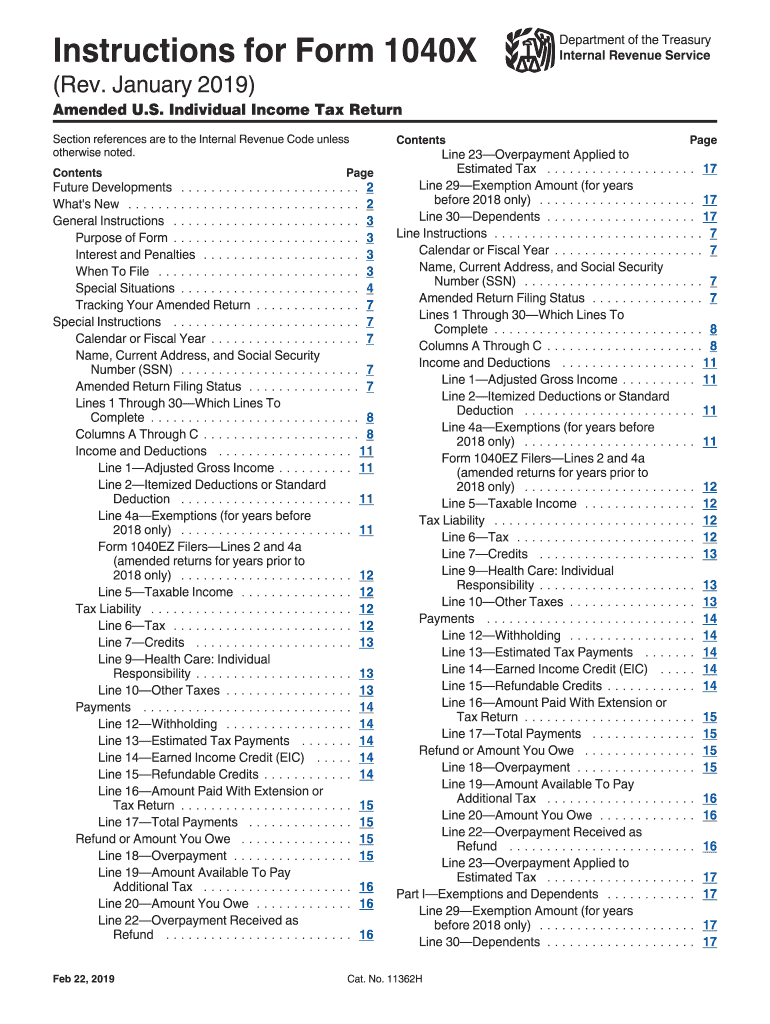

IRS Instructions 1040X 2019 free printable template

Instructions and Help about IRS Instructions 1040X

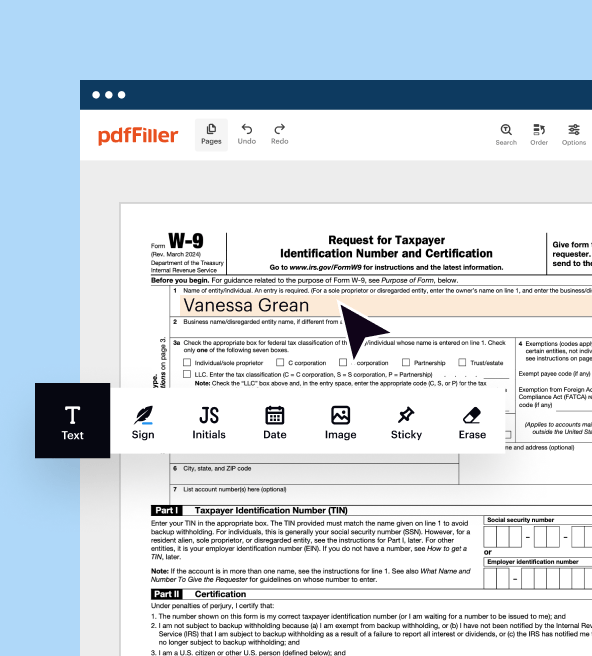

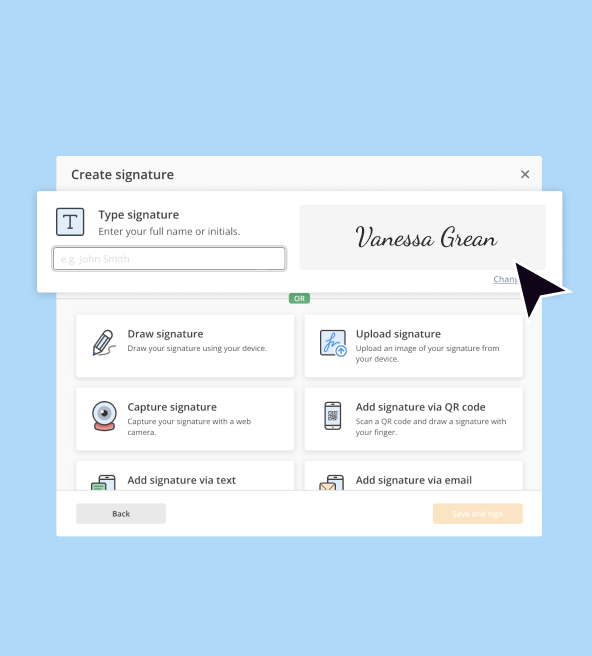

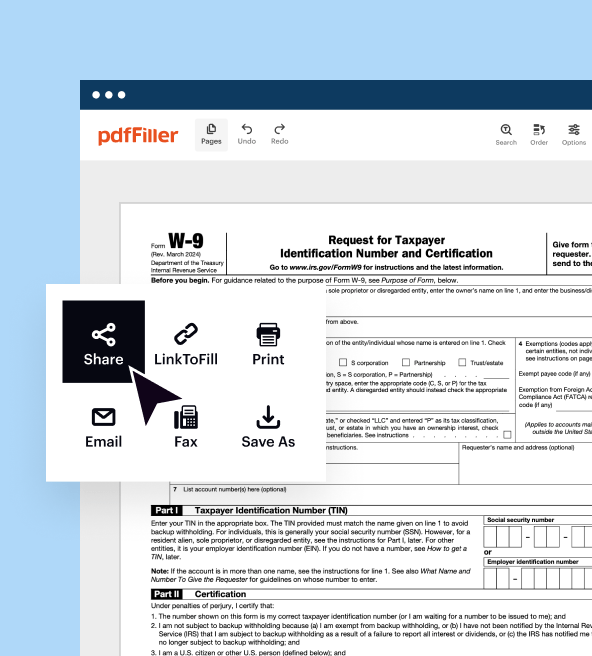

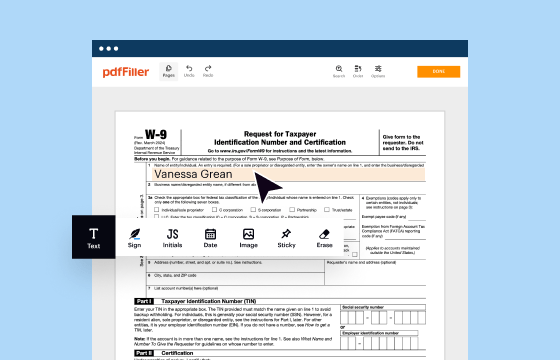

How to edit IRS Instructions 1040X

How to fill out IRS Instructions 1040X

About IRS Instructions 1040X 2019 previous version

What is IRS Instructions 1040X?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS Instructions 1040X

What should I do if I realize I've made a mistake on my IRS Instructions 1040X after submission?

If you find an error after submitting your IRS Instructions 1040X, you can correct it by filing another amended return. Ensure that you clearly indicate the changes on the new form, referencing the original return for clarity. Keep in mind to check the IRS website for any specific instructions on how to address common mistakes.

How can I check the status of my amended IRS Instructions 1040X?

To check the status of your amended IRS Instructions 1040X, visit the IRS 'Where's My Amended Return?' tool online. You will need your personal information, including Social Security number and the ZIP code associated with your latest tax return. Typically, it can take up to 16 weeks for the IRS to process amended returns, so patience may be required.

What common errors should I avoid when filing my IRS Instructions 1040X?

When filing your IRS Instructions 1040X, avoid common errors such as incorrect personal information, failing to sign the form, and not including all necessary documentation. It's advisable to double-check your calculations and ensure that you're using the correct version of the form relevant to the tax year in question for a smoother process.

Are there any special considerations for filing IRS Instructions 1040X as a nonresident?

Nonresidents have unique considerations when filing IRS Instructions 1040X, including eligibility for certain deductions and credits. If you are a nonresident, confirm that you are filing the correct tax form type and check if any specific guidelines apply to your particular situation, as IRS rules can differ based on residency status.

What should I do if I receive an IRS notice after submitting my 1040X?

If you receive an IRS notice after filing your 1040X, carefully read the contents of the notice to understand what action is required. You may need to gather additional documentation, respond by a specific deadline, or correct additional issues. Keeping a copy of all correspondence is essential in case of further inquiries or disputes.