AZ DoR 140 Instructions 2018 free printable template

Show details

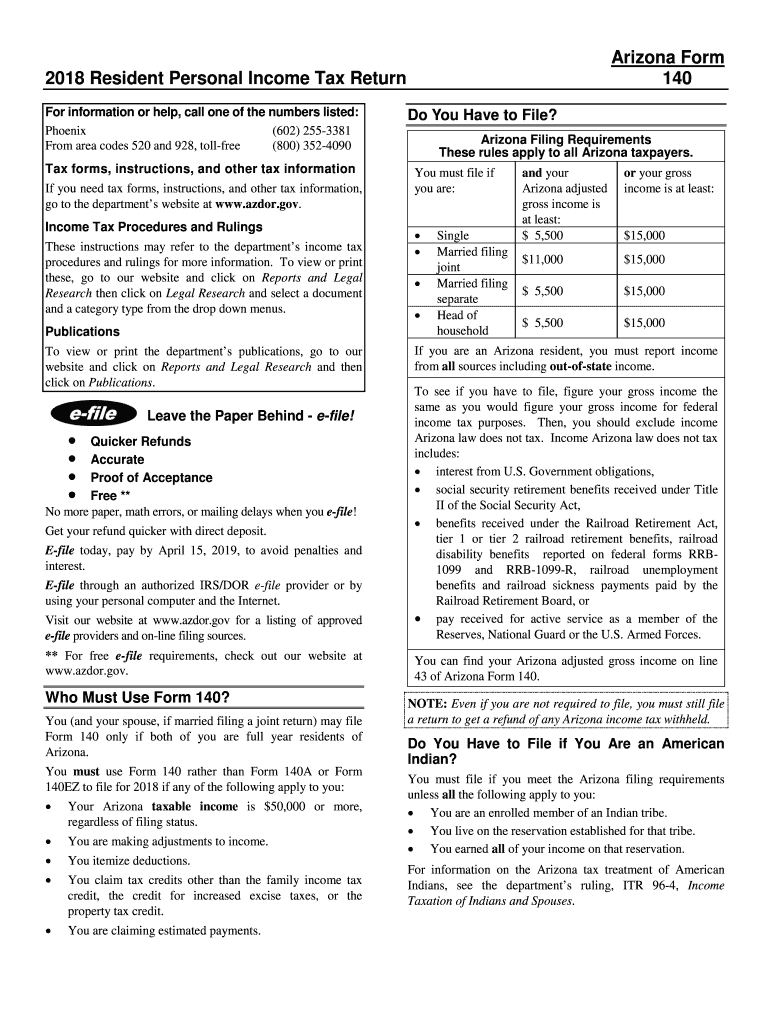

Arizona Form

1402018 Resident Personal Income Tax Return

For information or help, call one of the numbers listed:

Phoenix

(602) 2553381

From area codes 520 and 928, toll-free

(800) 3524090

Tax forms,

pdfFiller is not affiliated with any government organization

Instructions and Help about AZ DoR 140 Instructions

How to edit AZ DoR 140 Instructions

How to fill out AZ DoR 140 Instructions

Instructions and Help about AZ DoR 140 Instructions

How to edit AZ DoR 140 Instructions

To edit the AZ DoR 140 Instructions, you can use the tools provided by pdfFiller. This platform allows you to make necessary amendments before submission. After uploading the form, select the fields you want to modify, ensuring all information is accurate and up to date.

How to fill out AZ DoR 140 Instructions

Filling out the AZ DoR 140 Instructions requires careful attention to detail. Begin by gathering all required financial information and documentation. Follow these steps to properly complete the form:

01

Review the instructions carefully to understand each section.

02

Input personal and tax information as prompted.

03

Double-check for any errors or omissions.

Ensure you follow any additional instructions regarding signatures or dates relevant to your situation.

About AZ DoR 140 Instructions 2018 previous version

What is AZ DoR 140 Instructions?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About AZ DoR 140 Instructions 2018 previous version

What is AZ DoR 140 Instructions?

The AZ DoR 140 Instructions is a form issued by the Arizona Department of Revenue for specific tax-related purposes. This document is utilized by individuals and businesses for reporting state income taxes, ensuring compliance with Arizona tax laws. The instructions provide guidance on how to accurately complete the form and what information is required.

What is the purpose of this form?

The purpose of the AZ DoR 140 Instructions is to assist taxpayers in accurately filing their Arizona income tax returns. This form outlines the necessary requirements for accomplishing this task, ensuring that taxpayers provide all relevant information to the state. Properly following these instructions helps avoid penalties and ensures compliance with state regulations.

Who needs the form?

The AZ DoR 140 Instructions is required for residents and part-year residents of Arizona who need to file state income tax returns. This includes individuals who have income sourced in Arizona or who meet certain income thresholds as determined by state law. Specific exclusions may apply based on residency status or income type.

When am I exempt from filling out this form?

Taxpayers may be exempt from filling out the AZ DoR 140 Instructions if their income falls below a certain threshold or if they qualify for specific exemptions outlined by the Arizona Department of Revenue. Additionally, non-residents with no Arizona-sourced income are also typically exempt. It is important to review eligibility criteria and any changes annually.

Components of the form

The AZ DoR 140 Instructions consist of several key components, including personal identification details, income reporting sections, and tax credits applicable to Arizona residents. Each section must be completed accurately, as the information compiled will determine the overall tax obligation.

Due date

The due date for submitting the AZ DoR 140 Instructions aligns with the federal income tax return deadlines, typically falling on April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Be aware of any extensions or changes announced by the Arizona Department of Revenue.

What payments and purchases are reported?

The AZ DoR 140 Instructions require the reporting of all forms of income, including wages, interest, dividends, and business income. Taxpayers must also report any purchases subject to sales tax as determined by state regulations. This information helps establish the comprehensive tax liability of the taxpayer.

How many copies of the form should I complete?

Typically, taxpayers are required to complete one copy of the AZ DoR 140 Instructions for submission to the Arizona Department of Revenue. However, it is advisable to keep an additional copy for personal records. This ensures you have documentation in case of inquiries or audits in the future.

What are the penalties for not issuing the form?

Failure to submit the AZ DoR 140 Instructions can result in penalties, including fines and interest on any owed tax liabilities. The Arizona Department of Revenue may impose additional penalties for late submissions, which may escalate the longer the form is overdue. Understanding these consequences can motivate timely compliance.

What information do you need when you file the form?

When filing the AZ DoR 140 Instructions, you will need a variety of information, including your Social Security number, details of any income received, and documentation for applicable deductions and credits. Having tax identification numbers from your employers or business entities is also necessary to complete the filing process.

Is the form accompanied by other forms?

The AZ DoR 140 Instructions may require accompanying forms depending on your financial situation. Taxpayers often need to include supporting documents related to income and deductions, such as W-2 forms or 1099s. It is crucial to verify which additional forms are required to avoid processing delays.

Where do I send the form?

Completed AZ DoR 140 Instructions should be sent to the appropriate address as designated by the Arizona Department of Revenue. The submission might differ based on whether you are filing electronically or by mail. Always check the latest guidance issued by the Department of Revenue to ensure correct delivery.

See what our users say