AZ DoR 140 Instructions 2022 free printable template

Show details

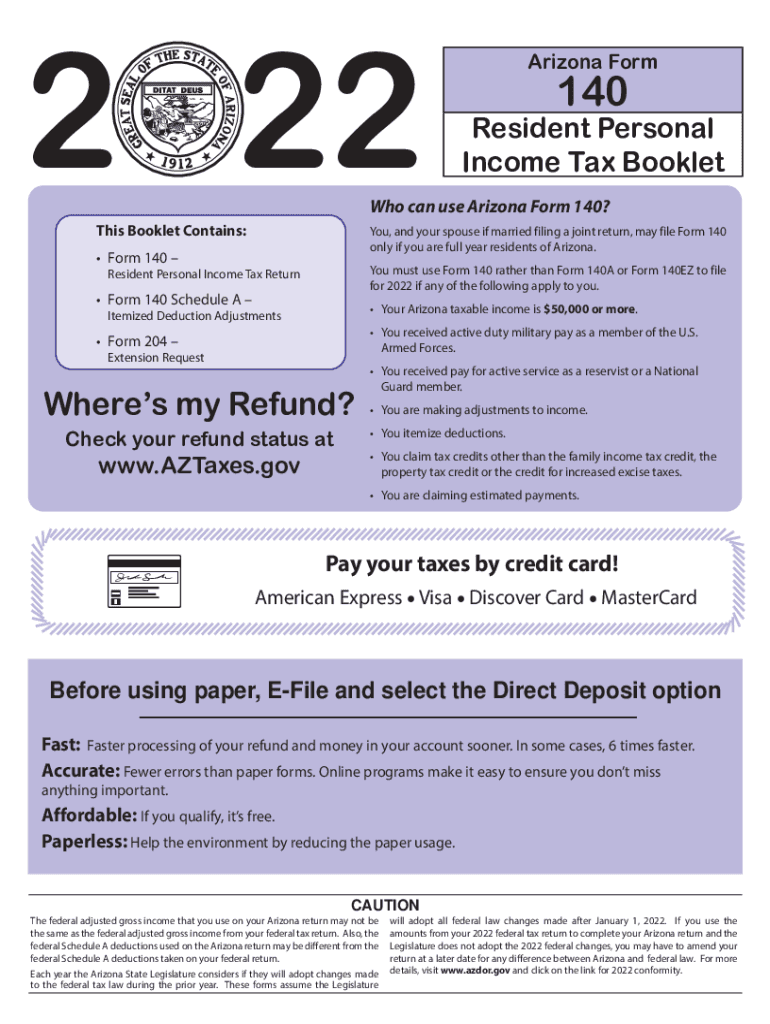

2 22Arizona Form140Resident Personal Income Tax Booklet can use Arizona Form 140? This Booklet Contains:You, and your spouse if married filing a joint return, may file Form 140 only if you are full

pdfFiller is not affiliated with any government organization

Instructions and Help about AZ DoR 140 Instructions

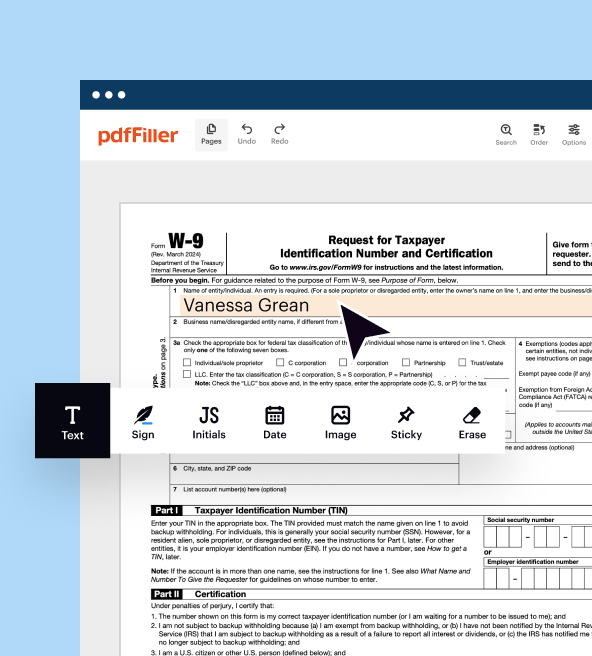

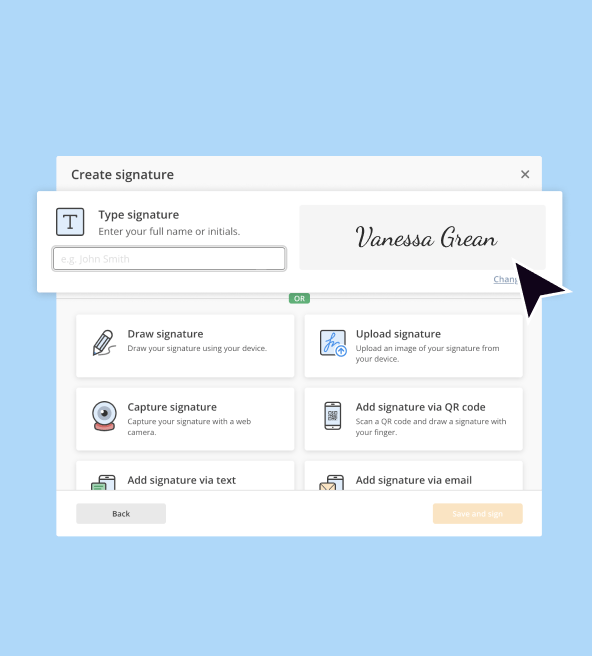

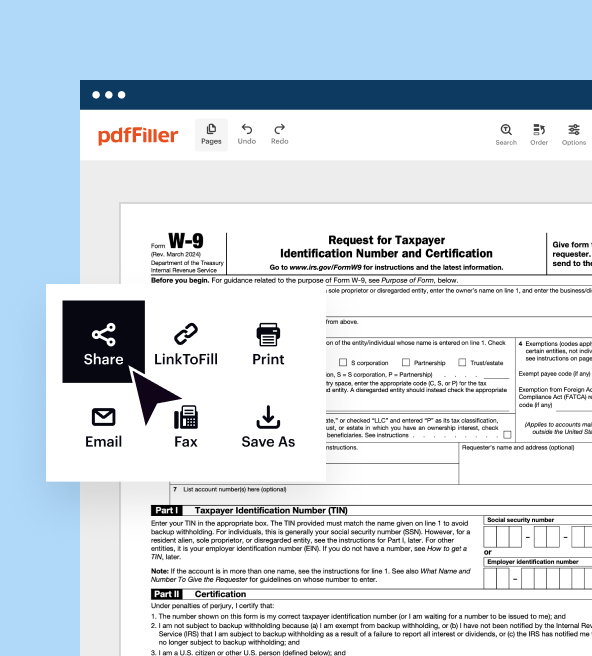

How to edit AZ DoR 140 Instructions

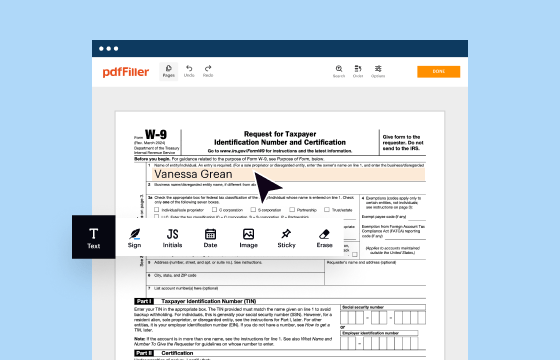

How to fill out AZ DoR 140 Instructions

Instructions and Help about AZ DoR 140 Instructions

How to edit AZ DoR 140 Instructions

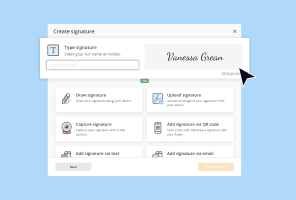

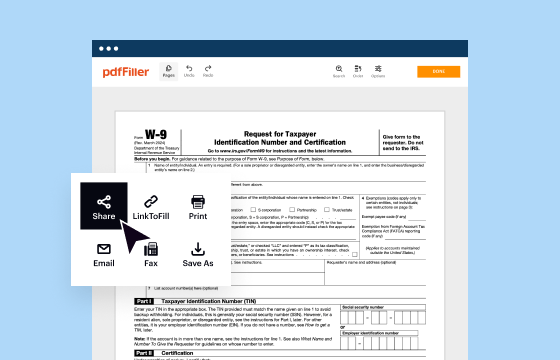

Editing the AZ DoR 140 Instructions can be done effectively using pdfFiller. Users can upload their documents to pdfFiller's platform, which enables them to make necessary changes and corrections easily. With tools provided by pdfFiller, you can adjust any sections according to your needs without the risk of detailing errors in the instructions.

How to fill out AZ DoR 140 Instructions

To fill out the AZ DoR 140 Instructions, begin by gathering all necessary personal and financial information, including identification numbers and relevant financial data. Utilize the guidelines outlined within the form for accurate completion. Each section will provide prompts to ensure that all required information is captured clearly.

About AZ DoR 140 Instructions 2022 previous version

What is AZ DoR 140 Instructions?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About AZ DoR 140 Instructions 2022 previous version

What is AZ DoR 140 Instructions?

AZ DoR 140 Instructions is a form issued by the Arizona Department of Revenue that provides guidance to taxpayers on how to report certain financial information. This form outlines the necessary steps and components required for accurate submission and compliance with state tax regulations.

What is the purpose of this form?

The purpose of the AZ DoR 140 Instructions is to ensure that taxpayers understand the reporting requirements associated with Arizona state taxes. It aids in clarifying what information needs to be submitted, along with instructions on how to properly fill in the related tax forms.

Who needs the form?

Individuals who have specific financial transactions or obligations as defined by the Arizona Department of Revenue will need the AZ DoR 140 Instructions. Typically, this includes those filing state taxes, making significant purchases, or engaging in activities that require reporting due to applicable tax laws.

When am I exempt from filling out this form?

Exemptions from filling out the AZ DoR 140 Instructions include specific scenarios such as individuals with income below the filing threshold, certain retirement income, or military personnel under specific conditions. Always verify with the Arizona Department of Revenue for complete exemption guidelines.

Components of the form

The AZ DoR 140 Instructions consist of several key components, including sections for personal identification, income reporting, tax credits, and deductions. Each section guides the user through what information is required, ensuring that taxpayers submit a comprehensive and accurate document.

Due date

The due date for submitting the AZ DoR 140 Instructions typically aligns with the general tax return deadline established by the Arizona Department of Revenue. Generally, for most filers, this is April 15, but it can vary depending on specific circumstances or holidays. Always refer to the latest state guidelines for exact dates.

What are the penalties for not issuing the form?

Failing to issue the AZ DoR 140 Instructions may result in penalties imposed by the Arizona Department of Revenue. These penalties can include fines, interest on unpaid taxes, and potential legal action for non-compliance. It is crucial to adhere to all state tax obligations to avoid these consequences.

What information do you need when you file the form?

When filing the AZ DoR 140 Instructions, gather essential information including Social Security numbers, income statements, details of exemptions, deductions, and credits. Having this information readily available will streamline the filing process and help ensure accuracy in your submission.

Is the form accompanied by other forms?

The AZ DoR 140 Instructions may be accompanied by additional forms depending on the individual's financial activities or specific tax situations. Often, supporting documents such as W-2s, 1099s, or schedules for itemized deductions will be required to complete the submission process.

Where do I send the form?

The AZ DoR 140 Instructions should be sent to the address specified by the Arizona Department of Revenue. Typically, this is determined by the taxpayer's geographical location or the nature of the tax return being filed. Ensure to check the latest guidelines to obtain the correct mailing address for your submission.

See what our users say