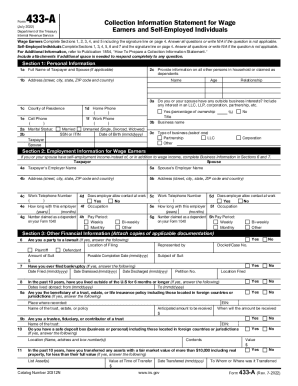

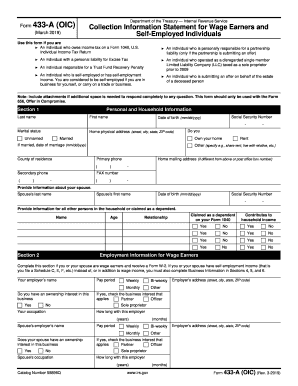

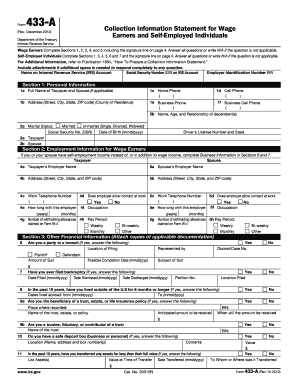

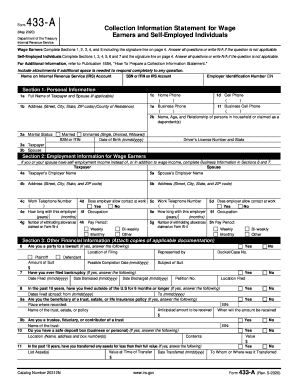

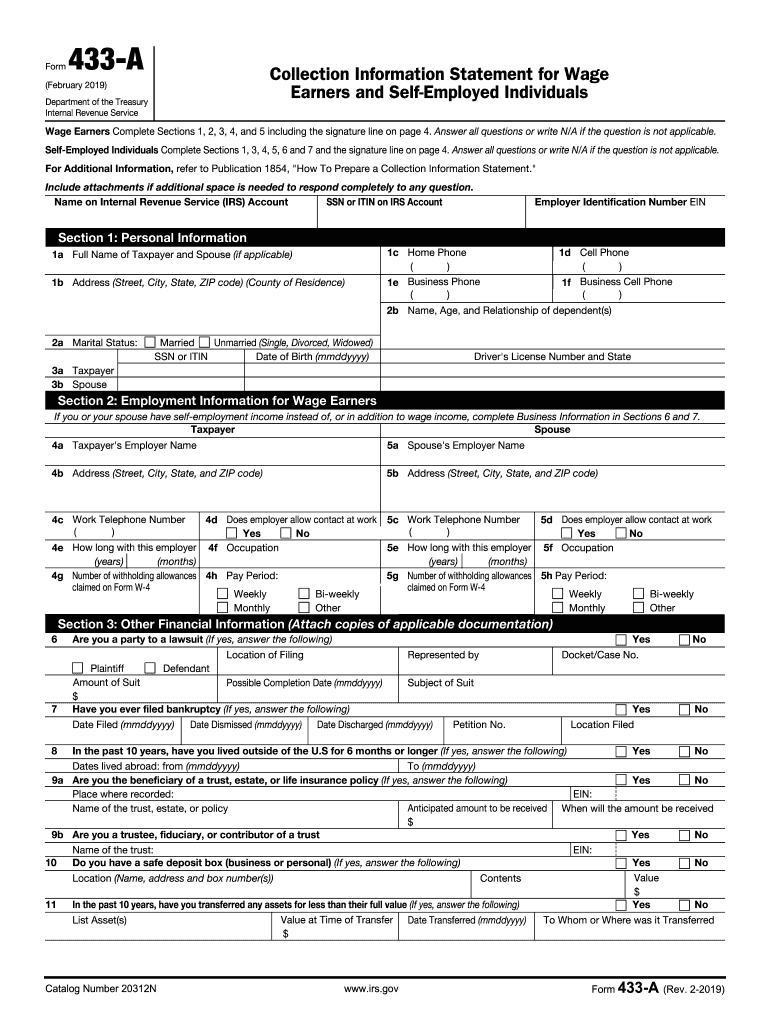

IRS 433-A 2019 free printable template

Instructions and Help about IRS 433-A

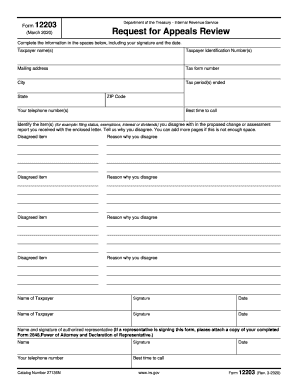

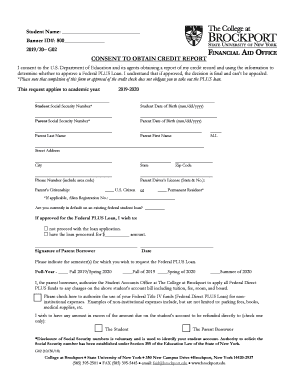

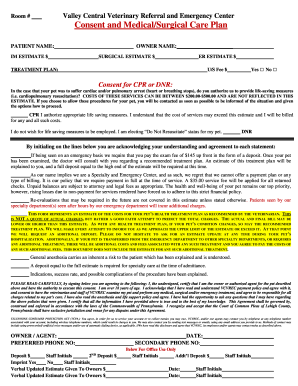

How to edit IRS 433-A

How to fill out IRS 433-A

About IRS 433-A 2019 previous version

What is IRS 433-A?

Who needs the form?

Components of the form

How many copies of the form should I complete?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What payments and purchases are reported?

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 433-A

What should I do if I notice an error after submitting my IRS 433-A?

If you find an error after filing your IRS 433-A, you can submit an amended form to correct it. Ensure that the amendment clearly states the changes, and include a brief explanation of the reason for the correction. It's essential to keep a copy of both the original and amended submissions for your records.

How can I verify if my IRS 433-A has been received and processed?

To check the status of your filed IRS 433-A, you can contact the IRS directly or use online tools provided on their website. Keep in mind that processing times may vary, so allow a reasonable period before making inquiries. Ensure you have your personal information handy to expedite the tracking process.

What should I do if my IRS 433-A submission is rejected when e-filing?

If your IRS 433-A is rejected during e-filing, review the rejection code provided by the IRS to identify the specific issue. Common reasons for rejection include incorrect personal information or format issues. Make the necessary corrections and resubmit the form promptly to avoid delays in processing.

Are there any privacy concerns I should be aware of when filing IRS 433-A?

When filing IRS 433-A, ensure that your personal and financial information is securely submitted. Use encrypted communication channels if filing electronically, and confirm that the software or service you use complies with data security standards to protect your information from unauthorized access.

What should I prepare if I receive a notice from the IRS regarding my IRS 433-A?

If you receive a notice or letter from the IRS about your IRS 433-A, carefully review the document to understand the request or issue. Prepare any requested documentation and respond promptly, keeping copies for your records. If you are unsure about how to respond, consider seeking professional assistance to ensure compliance.

See what our users say