MA 355-7004 2018 free printable template

Get, Create, Make and Sign ma form 355

Editing ma form 355 online

Uncompromising security for your PDF editing and eSignature needs

MA 355-7004 Form Versions

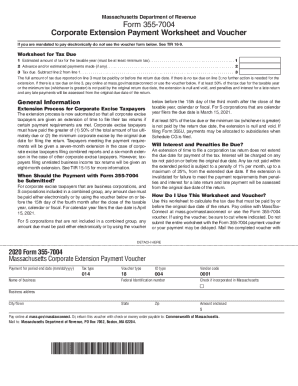

How to fill out ma form 355

How to fill out MA 355-7004

Who needs MA 355-7004?

Instructions and Help about ma form 355

Hi IN×39’m Zoe with Express extension command IN×39’d like to take a few minute to explaining some of the most common questions regarding IRS tax extensions the tax extensions extension amount of time to prepare and file your tax returns with the IRS does not extend the amount of time to pay your taxes the deadline to file a tax extension depend son which form you need to file business extension can be filed with Reform seven zero four formulti-member LLC C corporation Corporations partnerships trust and estates to name a few the federal tax deadline for these types of businesses is March 16 and the 7 0 0 more can extend that filing deadline by 5 to 6months depending on the business type toe-file your tax extension now go express extension Daresay to get started if you have any questions toucan contact us at 803 504 51 55 or emails at support Express extension

People Also Ask about

What address do I send my tax forms to?

Who needs to file a Massachusetts tax return?

What is Massachusetts Form 355S?

Does Massachusetts accept federal extension for corporations?

What is MA Form 355?

What is IRS Form 7004?

Do I need to file a corporation tax return?

When must a corporation file a tax return?

Who Must file MA nonresident return?

What is a 355 7004 form?

Who has to file a corporate tax return?

Who needs to file MA state tax return?

Who must file a Massachusetts corporate tax return?

Do I need to file a ma return?

How do I send my tax return by mail?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

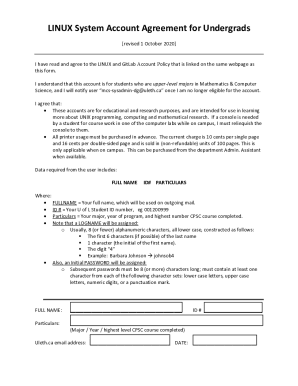

How can I send ma form 355 to be eSigned by others?

How do I edit ma form 355 online?

How can I edit ma form 355 on a smartphone?

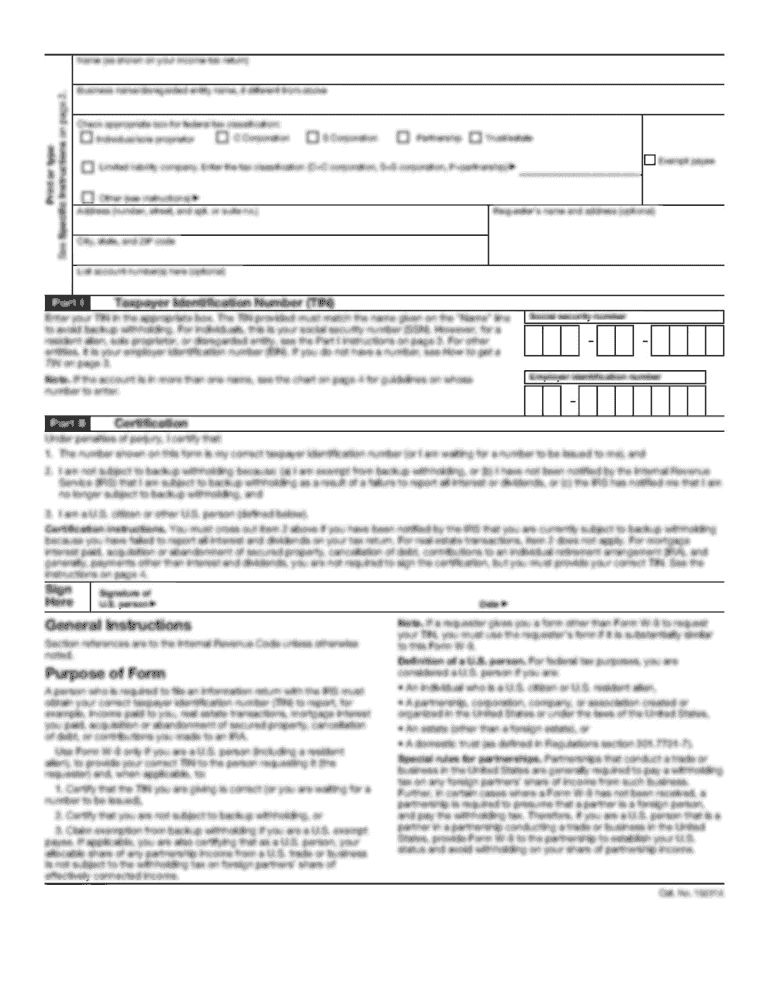

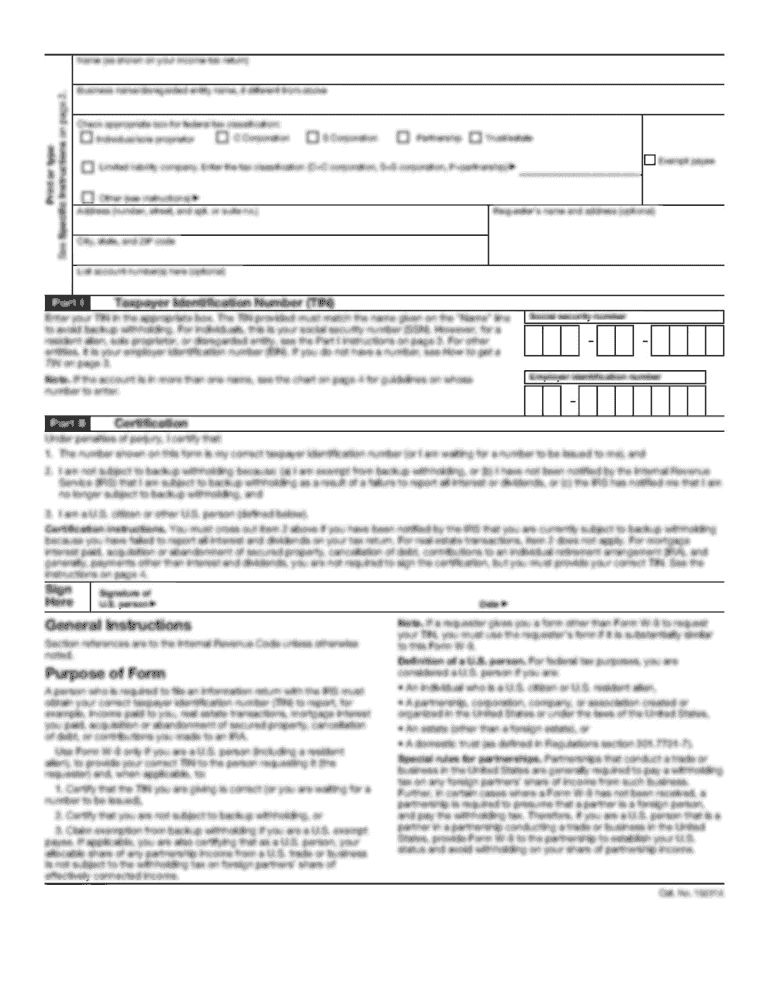

What is MA 355-7004?

Who is required to file MA 355-7004?

How to fill out MA 355-7004?

What is the purpose of MA 355-7004?

What information must be reported on MA 355-7004?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.