MA 355-7004 2010 free printable template

Show details

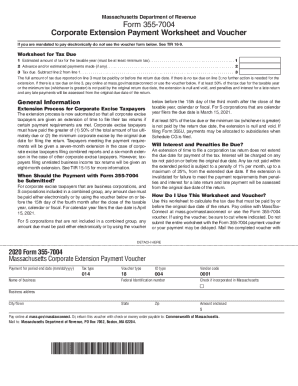

Rev. 10/02 Massachusetts Form 355-7004 Corporate Extension Worksheet Department of Revenue Tentative Return 1 Estimated amount of tax for the taxable year must be at least minimum tax. For further information see TIR 04-30. DETACH HERE Federal Identification number Application for Corporate Extension 2010 Is the corporation incorporated in Massachusetts Yes Period end date Amount enclosed No Business name Type of extension being applied for Mailing address City/Town b. 1 2 Advance and/or...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign massachusetts corporate extension 2010

Edit your massachusetts corporate extension 2010 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your massachusetts corporate extension 2010 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit massachusetts corporate extension 2010 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit massachusetts corporate extension 2010. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MA 355-7004 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out massachusetts corporate extension 2010

How to fill out MA 355-7004

01

Gather all necessary personal and financial information before starting the form.

02

Begin by filling out your name and contact information at the top of the form.

03

Provide your Social Security Number in the designated section.

04

Complete the sections for your income sources, including employment, benefits, and other earnings.

05

List any deductions or expenses that apply to your situation in the appropriate fields.

06

Review the instructions for any additional documentation required to accompany the form.

07

Double-check all entries for accuracy and completeness.

08

Sign and date the form before submission.

Who needs MA 355-7004?

01

Individuals or households in need of financial assistance or public benefits may need to fill out MA 355-7004.

02

People applying for programs such as Medicaid or other social support services typically require this form.

Instructions and Help about massachusetts corporate extension 2010

Fill

form

: Try Risk Free

People Also Ask about

What is taxable income Malaysia?

ing to LHDN, Malaysian employees are required to pay taxes if they earn an annual income of at least RM34,000 (after EPF* deduction).

How do I find my tax income?

Your adjusted gross income (AGI) consists of the total amount of income and earnings you made for the tax year minus certain adjustments to income. For tax year 2022, your AGI is on Line 11 on Form 1040, 1040-SR, and 1040NR. It is located on different lines on forms from earlier years.

How much is taxable in the Philippines 2022?

Income of residents in Philippines is taxed progressively up to 32%. Resident citizens are taxed on all their net income derived from sources within and without the Philippines.

What are the three main types of taxes income?

Individual and Consumption Taxes Individual Income Taxes. Excise Taxes. Estate & Gift Taxes.

What are the three types of taxable income?

Types of Taxable Income Employee compensation and benefits. These are the most common types of taxable income and include wages and salaries, as well as fringe benefits. Investment and business income. Miscellaneous taxable income.

How do I know what my tax income is?

To calculate your taxable income, first determine your filing status. Next, collect documents for all sources of income. After that, calculate your adjusted gross income. Finally, subtract your deductions from your adjusted gross income to determine your taxable income.

How much income is tax exempt in Philippines?

You are not obliged to file ITRs if you are a minimum wage earner, an individual earning purely compensation income that does not exceed PHP250, 000, or if your employer has withheld your income tax correctly.

What type of income is not taxable?

Nontaxable income won't be taxed, whether or not you enter it on your tax return. The following items are deemed nontaxable by the IRS: Inheritances, gifts and bequests. Cash rebates on items you purchase from a retailer, manufacturer or dealer.

What is considered tax income?

The term taxable income refers to any gross income earned that is used to calculate the amount of tax you owe. Put simply, it is your adjusted gross income less any deductions. This includes any wages, tips, salaries, and bonuses from employers.

How much is taxable income in Philippines?

2020 national income tax rates Taxable income band PHPTax rates1 to 250,0000%250,001 to 400,00020%400,001 to 800,00025%800,001 to 2,000,00030%2 more rows

How much salary is taxable in the Philippines?

Computing for Your Salary BIR TAX TABLESALARY RANGE (ANNUAL)INCOME TAX RATE250000 and below0%250000.01 to 40000020% of the excess over 250000400000.01 to 80000030000 + 25% of the excess over 4000003 more rows

What are 10 types of taxable income?

What is taxable income? wages, salaries, tips, bonuses, vacation pay, severance pay, commissions. interest and dividends. certain types of disability payments. unemployment compensation. jury pay and election worker pay. strike and lockout benefits. bank “gifts” for opening or adding to accounts if more than “nominal” value.

What types of income are taxable?

Taxable income includes wages, salaries, bonuses, and tips, as well as investment income and various types of unearned income.

What does not count as taxable income?

Nontaxable income won't be taxed, whether or not you enter it on your tax return. The following items are deemed nontaxable by the IRS: Inheritances, gifts and bequests. Cash rebates on items you purchase from a retailer, manufacturer or dealer.

What is considered my taxable income?

Generally, you must include in gross income everything you receive in payment for personal services. In addition to wages, salaries, commissions, fees, and tips, this includes other forms of compensation such as fringe benefits and stock options.

What income is not taxable in Malaysia?

Company special service cash or prize awards are eligible for a tax exemption of up to RM1,000. Grants for all types of approved green SRI (Socially Responsible Investing) sukuk and bonds are exempted from income tax for applications for issuance from 2021 to 2025.

What should I include in taxable income?

Taxable income is the amount you receive after you take away all your allowable deductions from your assessable or gross income. Gross income includes: Salary and wages, lump sum payments, money from business or self employment, rent, interest, investments and dividends.

Is 20000 salary taxable in the Philippines?

If you make ₱ 20,000 a year living in Philippines, you will be taxed ₱ 2,756. That means that your net pay will be ₱ 17,244 per year, or ₱ 1,437 per month. Your average tax rate is 13.8% and your marginal tax rate is 9.9%. This marginal tax rate means that your immediate additional income will be taxed at this rate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete massachusetts corporate extension 2010 online?

Easy online massachusetts corporate extension 2010 completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit massachusetts corporate extension 2010 in Chrome?

Install the pdfFiller Google Chrome Extension to edit massachusetts corporate extension 2010 and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How can I fill out massachusetts corporate extension 2010 on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your massachusetts corporate extension 2010 from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is MA 355-7004?

MA 355-7004 is a tax form used by corporations in Massachusetts to report their income and calculate their corporate excise tax liabilities.

Who is required to file MA 355-7004?

All corporations doing business in Massachusetts, including domestic and foreign corporations, are required to file MA 355-7004.

How to fill out MA 355-7004?

To fill out MA 355-7004, corporations must complete the form by providing their financial information, calculating their taxable income, and determining their excise tax due. Detailed instructions are usually provided by the Massachusetts Department of Revenue.

What is the purpose of MA 355-7004?

The purpose of MA 355-7004 is to report a corporation's income and to calculate the amount of corporate excise tax owed to the state of Massachusetts.

What information must be reported on MA 355-7004?

MA 355-7004 requires corporations to report information such as total income, deductions, net income, and any applicable credits to determine their corporate excise tax.

Fill out your massachusetts corporate extension 2010 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Massachusetts Corporate Extension 2010 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.