Get the free SBA 7 a Loan Guaranty Program - Office of the Comptroller of ...

Show details

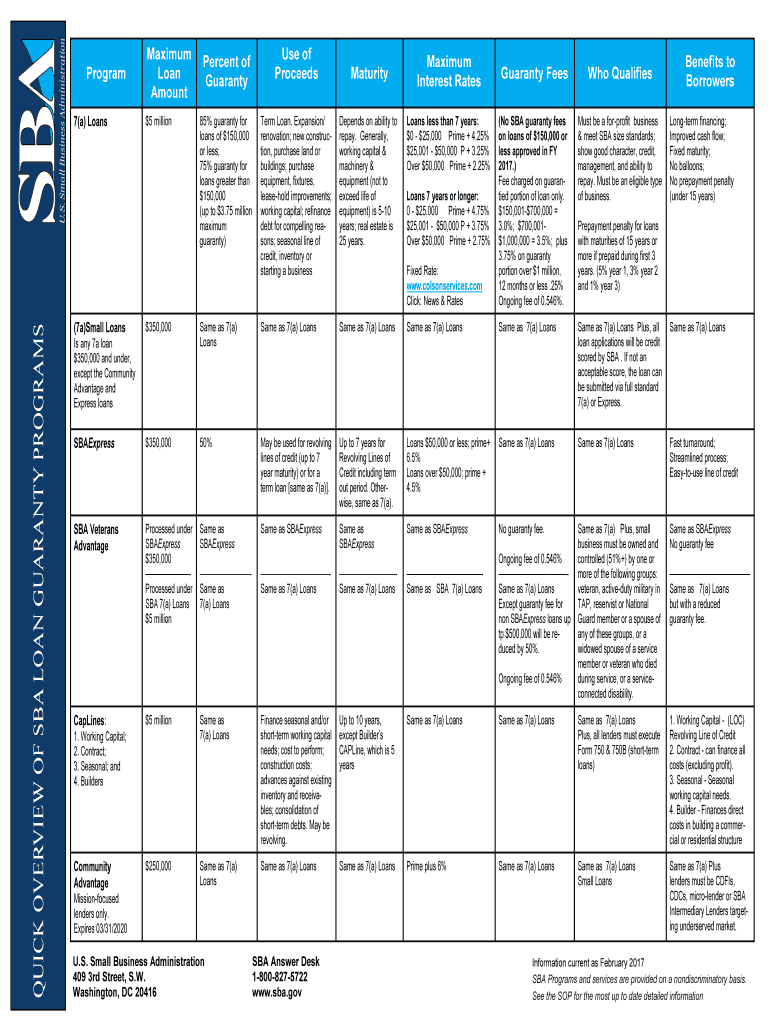

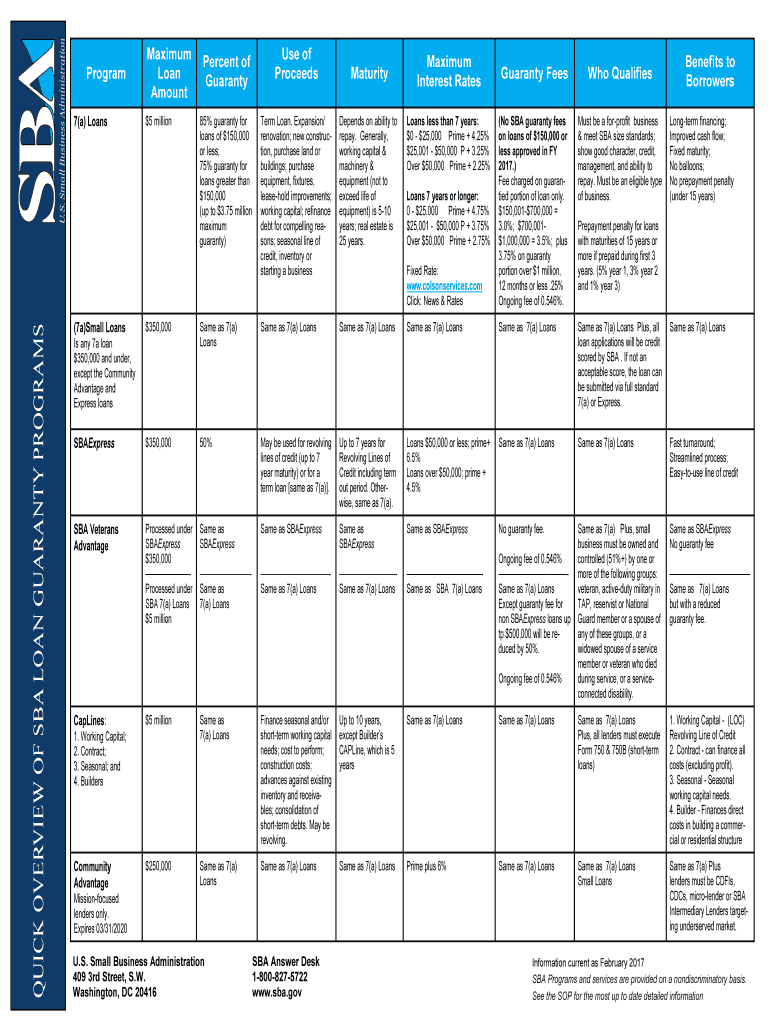

ProgramQUICK OVERVIEW OF SBA LOAN GUARANTY PROGRAMS7(a) Loans(7a)Small LoansMaximum

Loan

Amount

$5 millionPercent of

Guaranty

85% guaranty for

loans of $150,000

or less;

75% guaranty for

loans greater

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sba 7 a loan

Edit your sba 7 a loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sba 7 a loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sba 7 a loan online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit sba 7 a loan. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sba 7 a loan

How to fill out sba 7 a loan

01

Gather all required documents such as personal financial statements, business financial statements, tax returns, and business plan.

02

Complete the SBA 7(a) Loan Application form, providing accurate and detailed information about your business, its financial performance, and your personal financial situation.

03

Submit the completed application along with all required documents to an SBA-approved lender.

04

Await the lender's decision on your loan application. This process may involve a thorough review of your application, financial statements, credit history, and business plan.

05

If approved, work with the lender to finalize the loan terms and conditions, including interest rate, repayment period, and collateral requirements.

06

Carefully review and sign the loan agreement, acknowledging your responsibility to repay the loan according to the agreed-upon terms.

07

Once the loan agreement is signed, funds will be disbursed to your business bank account.

08

Ensure that you use the loan proceeds for the approved purposes and manage your business finances responsibly.

09

Make timely loan repayments as per the agreed-upon repayment schedule.

Who needs sba 7 a loan?

01

Small business owners looking to start a new business or expand their existing business.

02

Entrepreneurs who are unable to obtain traditional bank loans due to lack of collateral or credit history.

03

Business owners facing temporary cash flow issues and needing working capital to cover expenses.

04

Businesses involved in industries that have been significantly impacted by COVID-19 and need financial assistance to survive.

05

Minority-owned, women-owned, and veteran-owned businesses that require financial support to grow and thrive.

06

Companies looking to finance commercial real estate purchases or major equipment acquisitions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send sba 7 a loan for eSignature?

To distribute your sba 7 a loan, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How can I get sba 7 a loan?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the sba 7 a loan in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I sign the sba 7 a loan electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

What is sba 7 a loan?

SBA 7(a) loan is a type of loan provided by the Small Business Administration to help small businesses start, grow, and expand.

Who is required to file sba 7 a loan?

Small business owners who need financial assistance for their business may be required to file for an SBA 7(a) loan.

How to fill out sba 7 a loan?

To fill out an SBA 7(a) loan, you need to contact a participating lender and submit the required documentation and information.

What is the purpose of sba 7 a loan?

The purpose of an SBA 7(a) loan is to provide financial assistance to small businesses for starting, expanding, or growing their business.

What information must be reported on sba 7 a loan?

Information such as business financials, business plan, personal financial information, and collateral may need to be reported on an SBA 7(a) loan application.

Fill out your sba 7 a loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sba 7 A Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.